Answered step by step

Verified Expert Solution

Question

1 Approved Answer

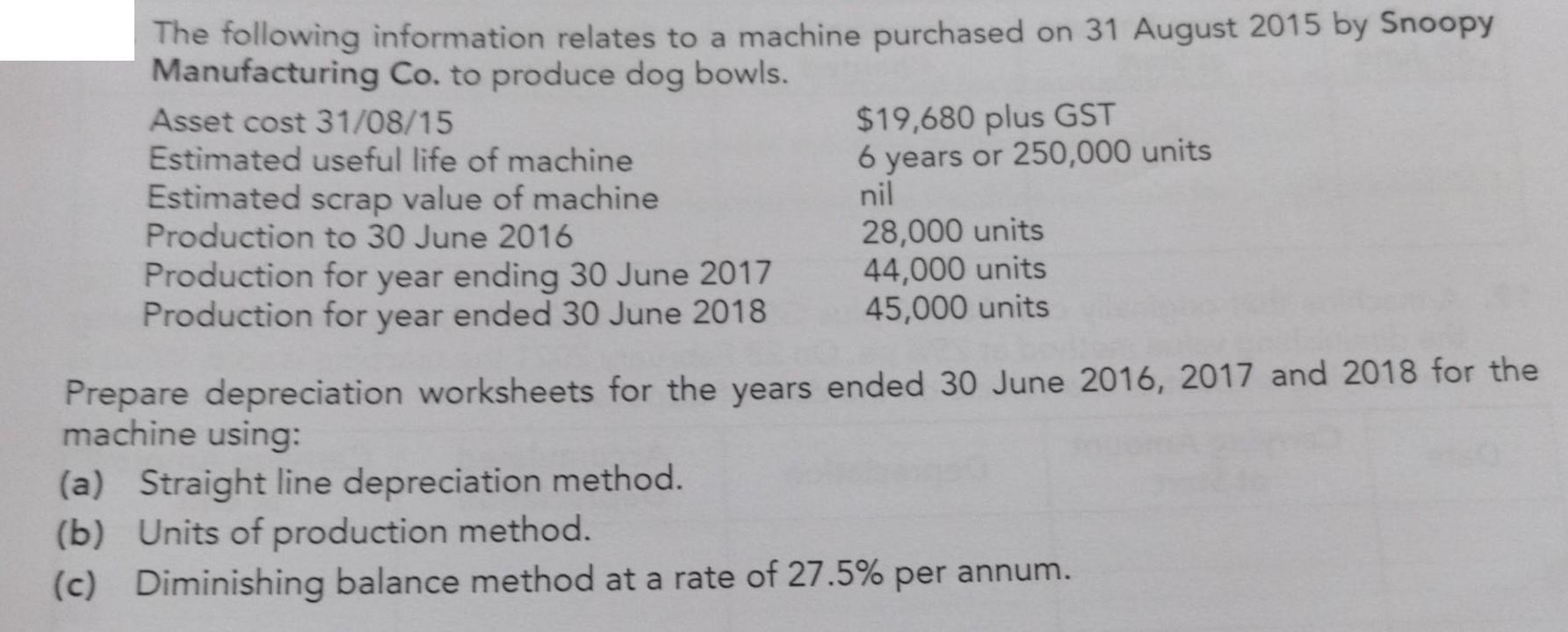

The following information relates to a machine purchased on 31 August 2015 by Snoopy Manufacturing Co. to produce dog bowls. Asset cost 31/08/15 Estimated

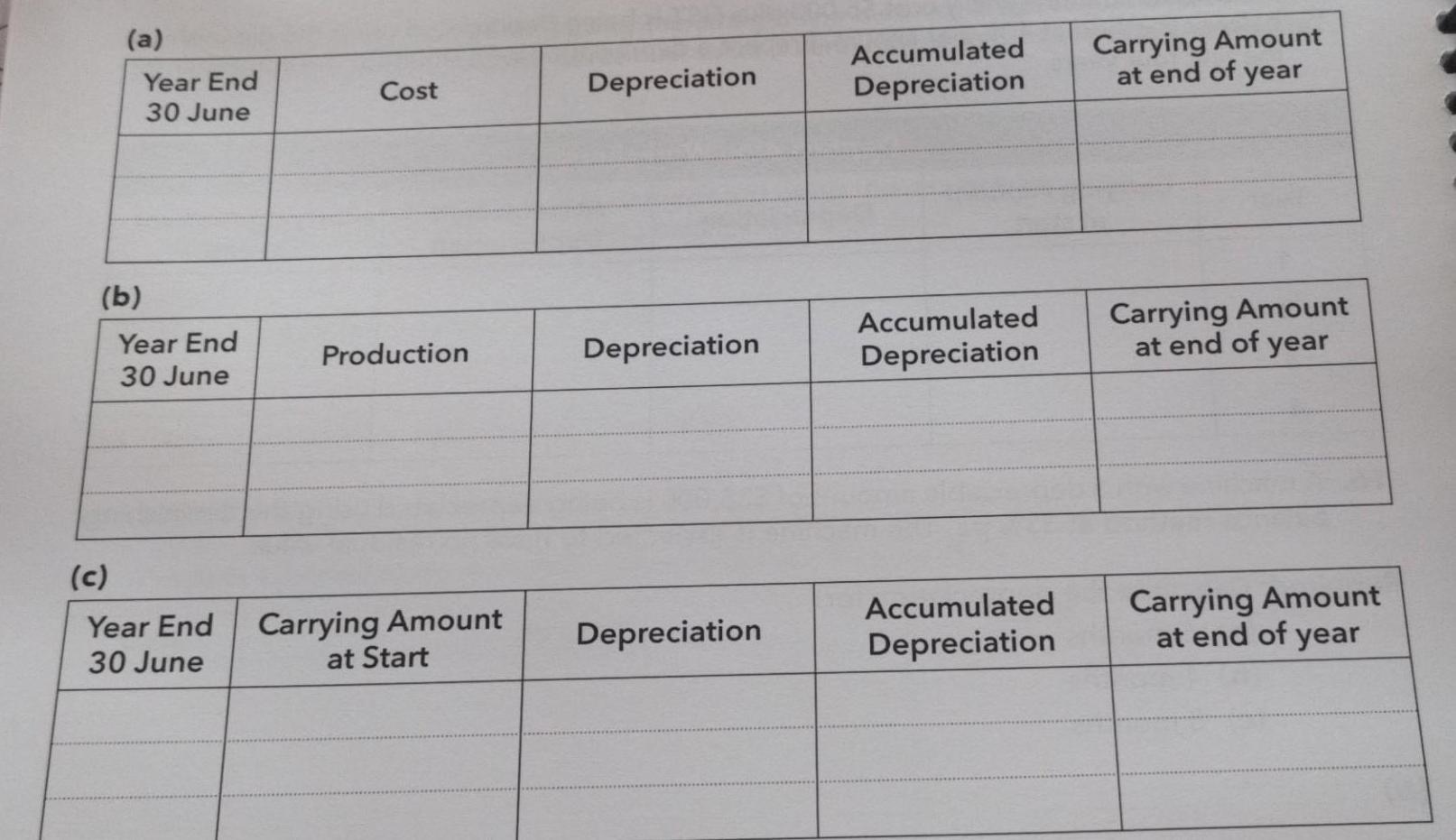

The following information relates to a machine purchased on 31 August 2015 by Snoopy Manufacturing Co. to produce dog bowls. Asset cost 31/08/15 Estimated useful life of machine Estimated scrap value of machine Production to 30 June 2016 Production for year ending 30 June 2017 Production for year ended 30 June 2018 $19,680 plus GST 6 years or 250,000 units nil 28,000 units 44,000 units 45,000 units Prepare depreciation worksheets for the years ended 30 June 2016, 2017 and 2018 for the machine using: (a) Straight line depreciation method. (b) Units of production method. (c) Diminishing balance method at a rate of 27.5% per annum. (a) Year End 30 June (b) Year End 30 June Cost Production (c) Year End Carrying Amount at Start 30 June Depreciation Depreciation Depreciation Accumulated Depreciation Accumulated Depreciation Accumulated Depreciation Carrying Amount at end of year Carrying Amount at end of year Carrying Amount at end of year

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION a Straight line depreciation method Year Ended 30 June 2016 Cost 19680 Depreciation 19680 6 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started