Answered step by step

Verified Expert Solution

Question

1 Approved Answer

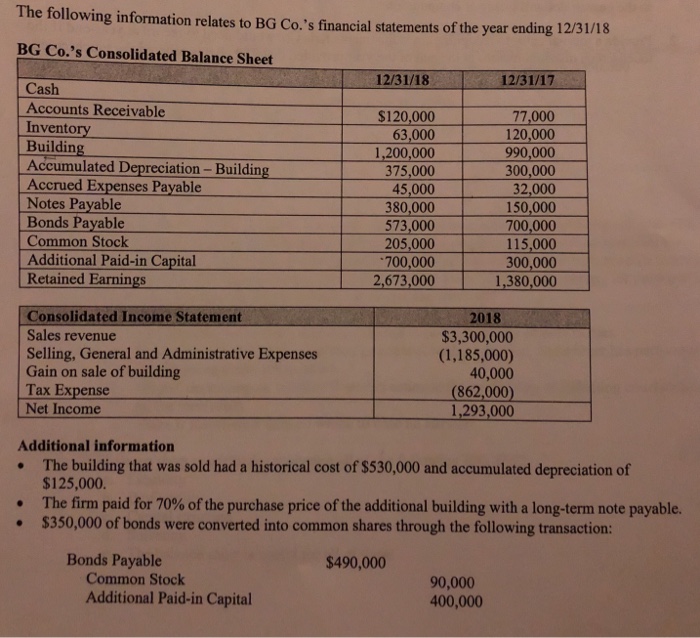

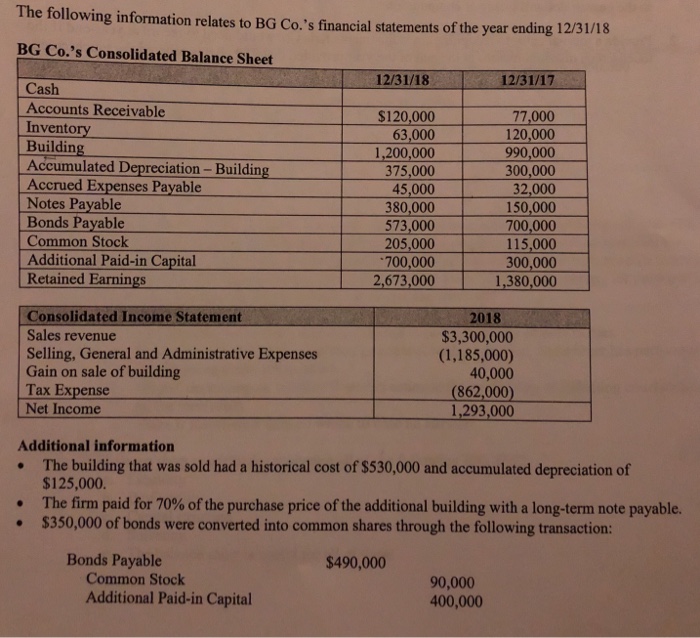

The following information relates to BG Co.'s financial statements of the year ending 12/31/18 BG Co.'s Consolidated Balance Sheet 12/31/18 12/31/17 Cash Accounts Receivable Inventory

The following information relates to BG Co.'s financial statements of the year ending 12/31/18 BG Co.'s Consolidated Balance Sheet 12/31/18 12/31/17 Cash Accounts Receivable Inventory Building Accumulated Depreciation- Building Accrued Expenses Payable Notes Payable Bonds Payable Common Stock Additional Paid-in Capital Retained Earnings $120,000 63,000 1,200,000 375,000 45,000 380,000 573,000 205,000 700,000 2,673,000 77,000 120,000 990,000 300,000 32,000 150,000 700,000 115,000 300,000 1,380,000 Consolidated Income Statement Sales revenue Selling, General and Administrative Expenses Gain on sale of building Tax Expense Net Income 2018 $3,300,000 (1,185,000) 40,000 (862,000) 1,293,000 Additional information The building that was sold had a historical cost of $530,000 and accumulated depreciation of $125,000. The firm paid for 70% of the purchase price of the additional building with a long-term note payable. $350,000 of bonds were converted into common shares through the following transaction: Bonds Payable $490,000 Common Stock Additional Paid-in Capital 90,000 400,000 The following information relates to BG Co.'s financial statements of the year ending 12/31/18 BG Co.'s Consolidated Balance Sheet 12/31/18 12/31/17 Cash Accounts Receivable Inventory Building Accumulated Depreciation- Building Accrued Expenses Payable Notes Payable Bonds Payable Common Stock Additional Paid-in Capital Retained Earnings $120,000 63,000 1,200,000 375,000 45,000 380,000 573,000 205,000 700,000 2,673,000 77,000 120,000 990,000 300,000 32,000 150,000 700,000 115,000 300,000 1,380,000 Consolidated Income Statement Sales revenue Selling, General and Administrative Expenses Gain on sale of building Tax Expense Net Income 2018 $3,300,000 (1,185,000) 40,000 (862,000) 1,293,000 Additional information The building that was sold had a historical cost of $530,000 and accumulated depreciation of $125,000. The firm paid for 70% of the purchase price of the additional building with a long-term note payable. $350,000 of bonds were converted into common shares through the following transaction: Bonds Payable $490,000 Common Stock Additional Paid-in Capital 90,000 400,000

The following information relates to BG Co.'s financial statements of the year ending 12/31/18 BG Co.'s Consolidated Balance Sheet 12/31/18 12/31/17 Cash Accounts Receivable Inventory Building Accumulated Depreciation- Building Accrued Expenses Payable Notes Payable Bonds Payable Common Stock Additional Paid-in Capital Retained Earnings $120,000 63,000 1,200,000 375,000 45,000 380,000 573,000 205,000 700,000 2,673,000 77,000 120,000 990,000 300,000 32,000 150,000 700,000 115,000 300,000 1,380,000 Consolidated Income Statement Sales revenue Selling, General and Administrative Expenses Gain on sale of building Tax Expense Net Income 2018 $3,300,000 (1,185,000) 40,000 (862,000) 1,293,000 Additional information The building that was sold had a historical cost of $530,000 and accumulated depreciation of $125,000. The firm paid for 70% of the purchase price of the additional building with a long-term note payable. $350,000 of bonds were converted into common shares through the following transaction: Bonds Payable $490,000 Common Stock Additional Paid-in Capital 90,000 400,000 The following information relates to BG Co.'s financial statements of the year ending 12/31/18 BG Co.'s Consolidated Balance Sheet 12/31/18 12/31/17 Cash Accounts Receivable Inventory Building Accumulated Depreciation- Building Accrued Expenses Payable Notes Payable Bonds Payable Common Stock Additional Paid-in Capital Retained Earnings $120,000 63,000 1,200,000 375,000 45,000 380,000 573,000 205,000 700,000 2,673,000 77,000 120,000 990,000 300,000 32,000 150,000 700,000 115,000 300,000 1,380,000 Consolidated Income Statement Sales revenue Selling, General and Administrative Expenses Gain on sale of building Tax Expense Net Income 2018 $3,300,000 (1,185,000) 40,000 (862,000) 1,293,000 Additional information The building that was sold had a historical cost of $530,000 and accumulated depreciation of $125,000. The firm paid for 70% of the purchase price of the additional building with a long-term note payable. $350,000 of bonds were converted into common shares through the following transaction: Bonds Payable $490,000 Common Stock Additional Paid-in Capital 90,000 400,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started