Question

The following information relates to Carried Away Hot Air Balloons, Inc.: Costs Advertising Costs Sales Salary Sales Revenue President's Salary Office Rent Manufacturing Equipment

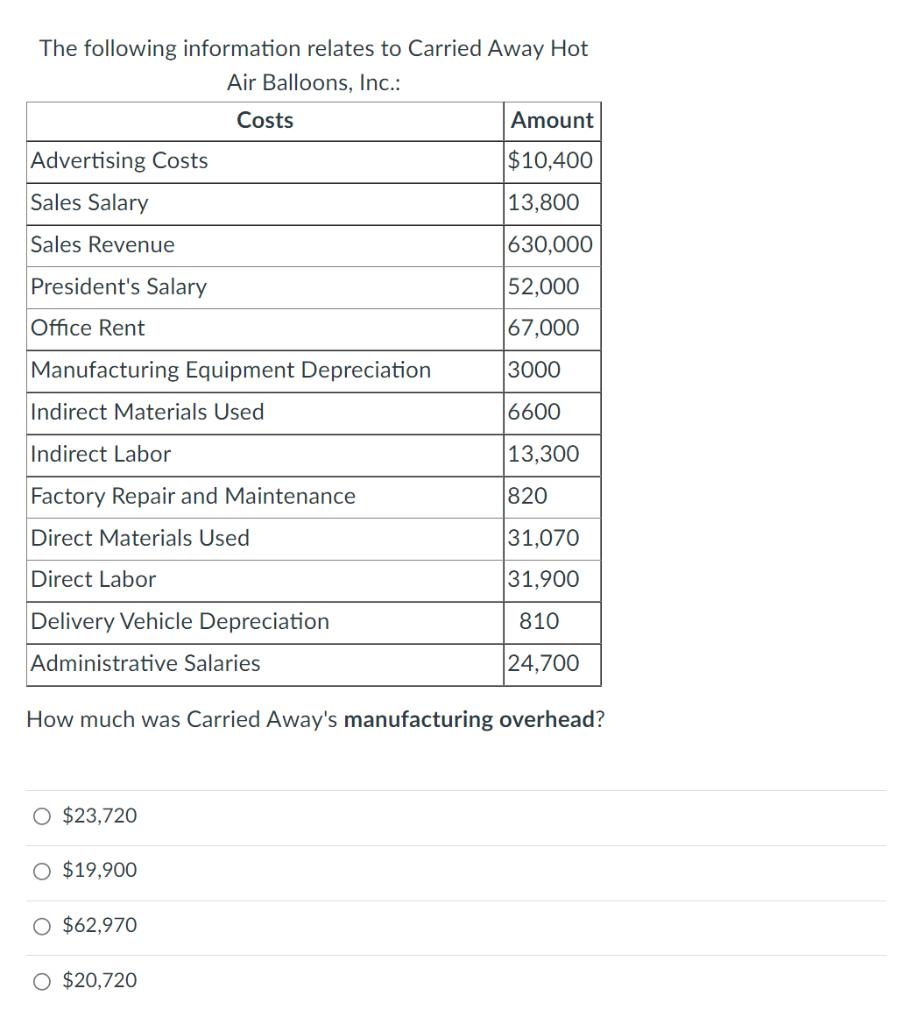

The following information relates to Carried Away Hot Air Balloons, Inc.: Costs Advertising Costs Sales Salary Sales Revenue President's Salary Office Rent Manufacturing Equipment Depreciation Indirect Materials Used Indirect Labor Factory Repair and Maintenance Direct Materials Used Direct Labor Delivery Vehicle Depreciation Administrative Salaries How much was Carried Away's manufacturing overhead? O $23,720 O $19,900 O $62,970 Amount $10,400 13,800 630,000 52,000 67,000 3000 6600 13,300 820 31,070 31,900 810 24,700 O $20,720

Step by Step Solution

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Correct Option is 23720 Explanation Q Selution Total Manufacturi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Donald Kieso, Jerry Weygandt, Terry Warfield, Nicola Young,

10th Canadian Edition, Volume 1

978-1118735329, 9781118726327, 1118735323, 1118726324, 978-0176509736

Students also viewed these Economics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App