Answered step by step

Verified Expert Solution

Question

1 Approved Answer

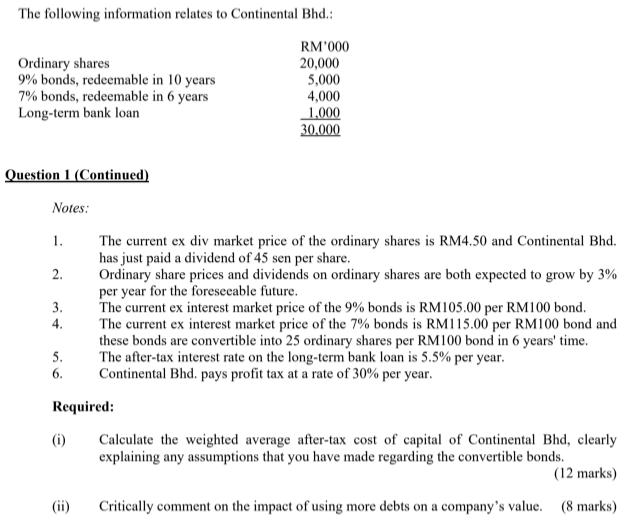

The following information relates to Continental Bhd.: RM'000 Ordinary shares 9% bonds, redeemable in 10 years 7% bonds, redeemable in 6 years Long-term bank

The following information relates to Continental Bhd.: RM'000 Ordinary shares 9% bonds, redeemable in 10 years 7% bonds, redeemable in 6 years Long-term bank loan 20,000 5,000 4,000 1.000 30.000 Question 1 (Continued) Notes: The current ex div market price of the ordinary shares is RM4.50 and Continental Bhd. has just paid a dividend of 45 sen per share. Ordinary share prices and dividends on ordinary shares are both expected to grow by 3% per year for the foreseeable future. The current ex interest market price of the 9% bonds is RM105.00 per RM100 bond. The current ex interest market price of the 7% bonds is RM115.00 per RM100 bond and these bonds are convertible into 25 ordinary shares per RM100 bond in 6 years' time. The after-tax interest rate on the long-term bank loan is 5.5% per year. Continental Bhd. pays profit tax at a rate of 30% per year. 1. 2. 3. 4. 5. 6. Required: (i) Calculate the weighted average after-tax cost of capital of Continental Bhd, clearly explaining any assumptions that you have made regarding the convertible bonds. (12 marks) (ii) Critically comment on the impact of using more debts on a company's value. (8 marks)

Step by Step Solution

★★★★★

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 The capital of a firm consists of multiple sources inclu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started