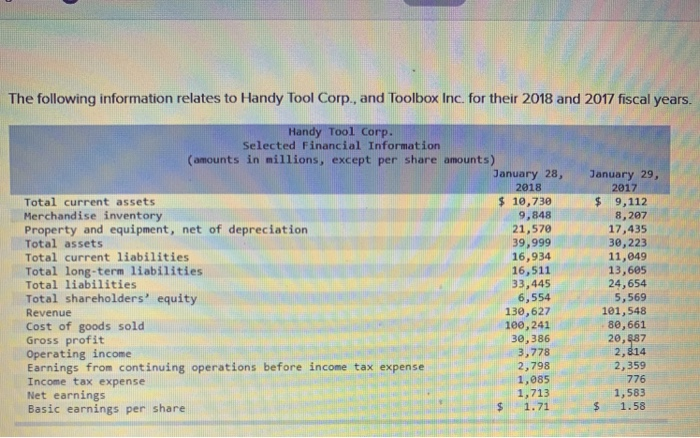

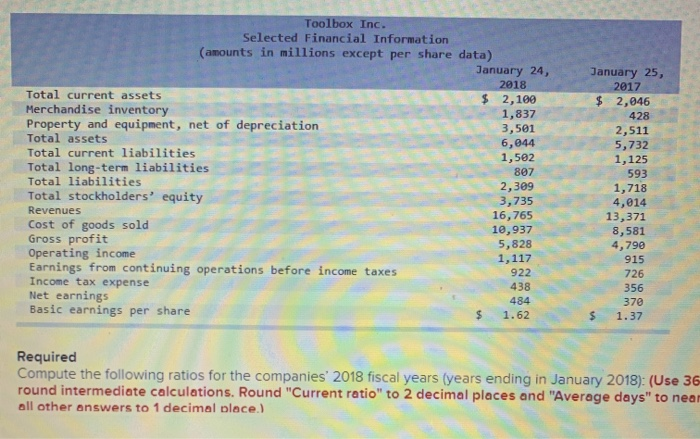

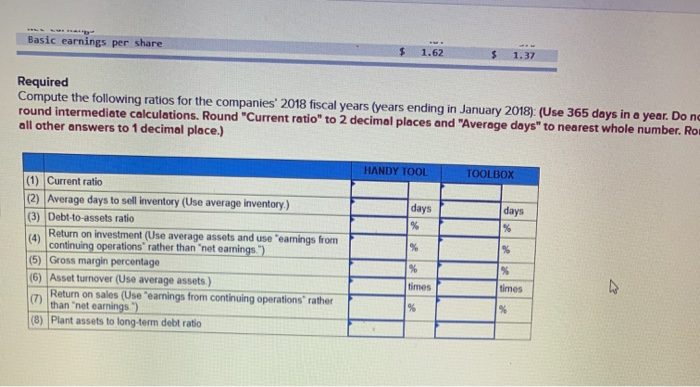

The following information relates to Handy Tool Corp., and Toolbox Inc. for their 2018 and 2017 fiscal years. January 29, 2017 $ 9,112 8,207 17,435 Handy Tool Corp. Selected Financial Information (amounts in millions, except per share amounts) January 28, 2018 Total current assets $ 10,730 Merchandise inventory 9,848 Property and equipment, net of depreciation 21,570 Total assets 39,999 Total current liabilities 16,934 Total long-term liabilities 16,511 Total liabilities 33,445 Total shareholders' equity 6,554 Revenue 130,627 Cost of goods sold 100,241 Gross profit 30,386 Operating income 3,778 Earnings from continuing operations before income tax expen 2,798 Income tax expense 1,085 Net earnings 1,713 Basic earnings per share $ 1.71 30,223 11,049 13,605 24,654 5,569 101,548 80,661 20,987 2,814 2,359 776 1,583 1.58 $ Toolbox Inc. Selected Financial Information Camounts in millions except per share data) January 24, 2018 Total current assets $ 2,100 Merchandise inventory 1,837 Property and equipment, net 3,501 Total assets 6,044 Total current liabilities 1,502 Total long-term liabilities 807 Total liabilities 2,309 Total stockholders' equity 3,735 Revenues 16,765 Cost of goods sold 10,937 Gross profit 5,828 Operating income 1,117 Earnings from continuing operations before income taxes 922 Income tax expense Net earnings Basic earnings per share January 25, 2017 $ 2,046 428 2,511 5,732 1,125 593 1,718 4,014 13,371 8,581 4,790 915 726 356 370 1.37 ods sold 438 484 Required Compute the following ratios for the companies' 2018 fiscal years (years ending in January 2018): (Use 36 round intermediate calculations. Round "Current ratio" to 2 decimal places and "Average days" to nean all other answers to 1 decimal place.) Basic earnings per share $ 1.37 Required Compute the following ratios for the companies' 2018 fiscal years (years ending in January 2018): (Use 365 days in a year. Do ne round intermediate calculations. Round "Current ratio" to 2 decimal places and "Average days" to nearest whole number. Ro all other answers to 1 decimal place.) HANDY TOOL TOOLBOX days (1) Current ratio (2) Average days to sell inventory (Use average Inventory.) (3) Debt-to-assets ratio Return on investment (Use average assets and use earnings from (*) continuing operations rather than "net earnings.") (5) Gross margin percentage (6) Asset turnover (Use average assets) Return on sales (Use 'earnings from continuing operations rather than "net earnings (8) Plant assets to long-term debt ratio times