Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following information relates to Home Depot, Inc., and Lowe's Companies, Inc. for their 2018 and 2017 fiscal years. HOME DEPOT, INC. Selected Financial Information

The following information relates to Home Depot, Inc., and Lowe's Companies, Inc. for their 2018 and 2017 fiscal years.

| HOME DEPOT, INC. | |||||||

| Selected Financial Information | |||||||

| (amounts in millions, except per share amounts) | |||||||

| January 28, 2018 | January 29, 2017 | ||||||

| Total current assets | $ | 18,933 | $ | 17,724 | |||

| Merchandise inventory | 12,748 | 12,549 | |||||

| Property and equipment, net of depreciation | 22,075 | 21,914 | |||||

| Total assets | 44,529 | 42,966 | |||||

| Total current liabilities | 16,194 | 14,133 | |||||

| Total long-term liabilities | 26,881 | 24,500 | |||||

| Total liabilities | 43,075 | 38,633 | |||||

| Total shareholders equity | 1,454 | 4,333 | |||||

| Revenue | 100,904 | 94,595 | |||||

| Cost of goods sold | 66,548 | 62,282 | |||||

| Gross profit | 34,356 | 32,313 | |||||

| Operating income | 14,681 | 13,427 | |||||

| Earnings from continuing operations before income tax expense | 13,698 | 12,491 | |||||

| Income tax expense | 5,068 | 4,534 | |||||

| Net earnings | 8,630 | 7,957 | |||||

| Basic earnings per share | $ | 7.33 | $ | 6.47 | |||

| LOWE'S COMPANIES, INC. | |||||||

| Selected Financial Information | |||||||

| (amounts in millions except per share data) | |||||||

| January 24, 2018 | January 25, 2017 | ||||||

| Total current assets | $ | 12,000 | $ | 10,561 | |||

| Merchandise inventory | 10,458 | 9,458 | |||||

| Property and equipment, net of depreciation | 19,949 | 19,577 | |||||

| Total assets | 34,408 | 31,266 | |||||

| Total current liabilities | 11,974 | 10,492 | |||||

| Total long-term liabilities | 16,000 | 13,120 | |||||

| Total liabilities | 27,974 | 23,612 | |||||

| Total stockholders equity | 6,434 | 7,654 | |||||

| Revenues | 65,017 | 59,074 | |||||

| Cost of goods sold | 42,553 | 38,504 | |||||

| Gross profit | 22,464 | 20,570 | |||||

| Operating income | 5,846 | 4,971 | |||||

| Earnings from continuing operations before income taxes | 5,201 | 4,419 | |||||

| Income tax expense | 2,108 | 1,873 | |||||

| Net earnings | 3,093 | 2,546 | |||||

| Basic earnings per share | $ | 3.48 | $ | 2.73 | |||

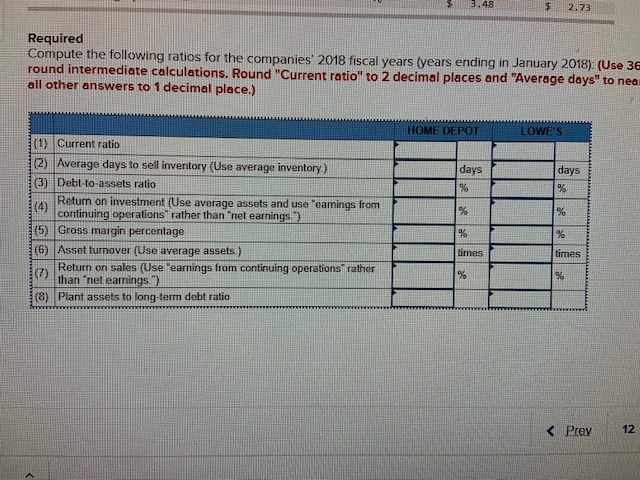

Required

Compute the following ratios for the companies 2018 fiscal years (years ending in January 2018): (Use 365 days in a year. Do not round intermediate calculations. Round "Current ratio" to 2 decimal places and "Average days" to nearest whole number. Round all other answers to 1 decimal place.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started