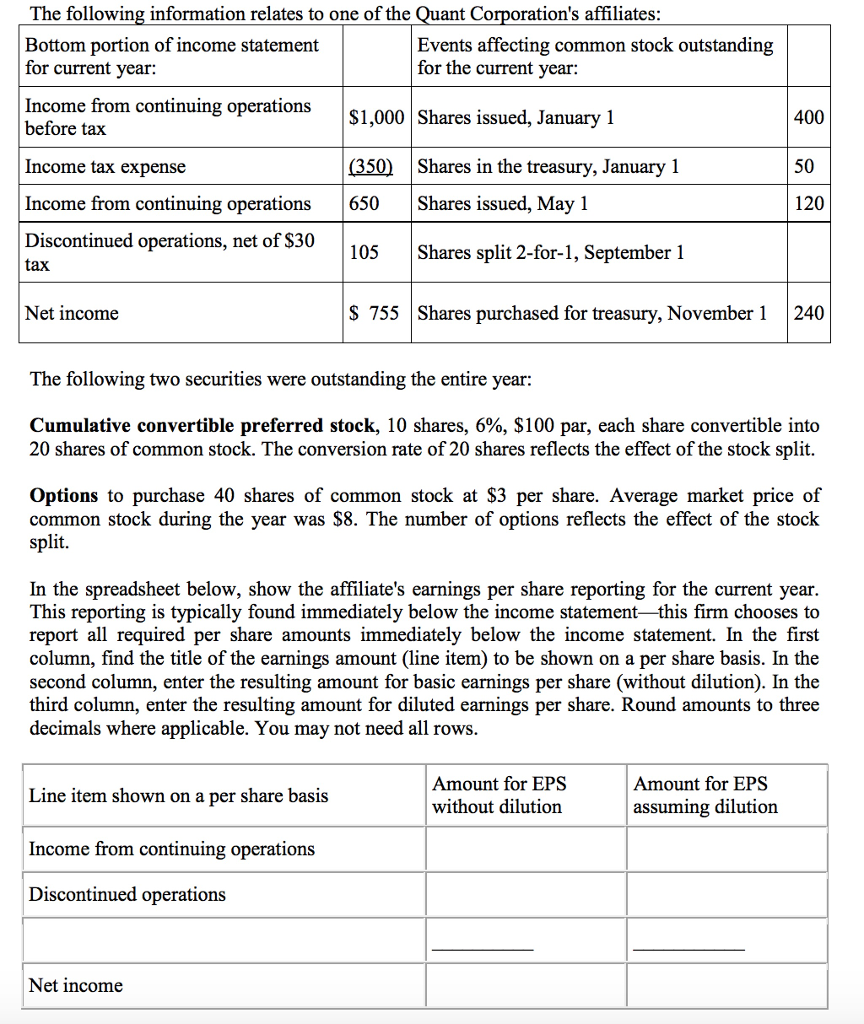

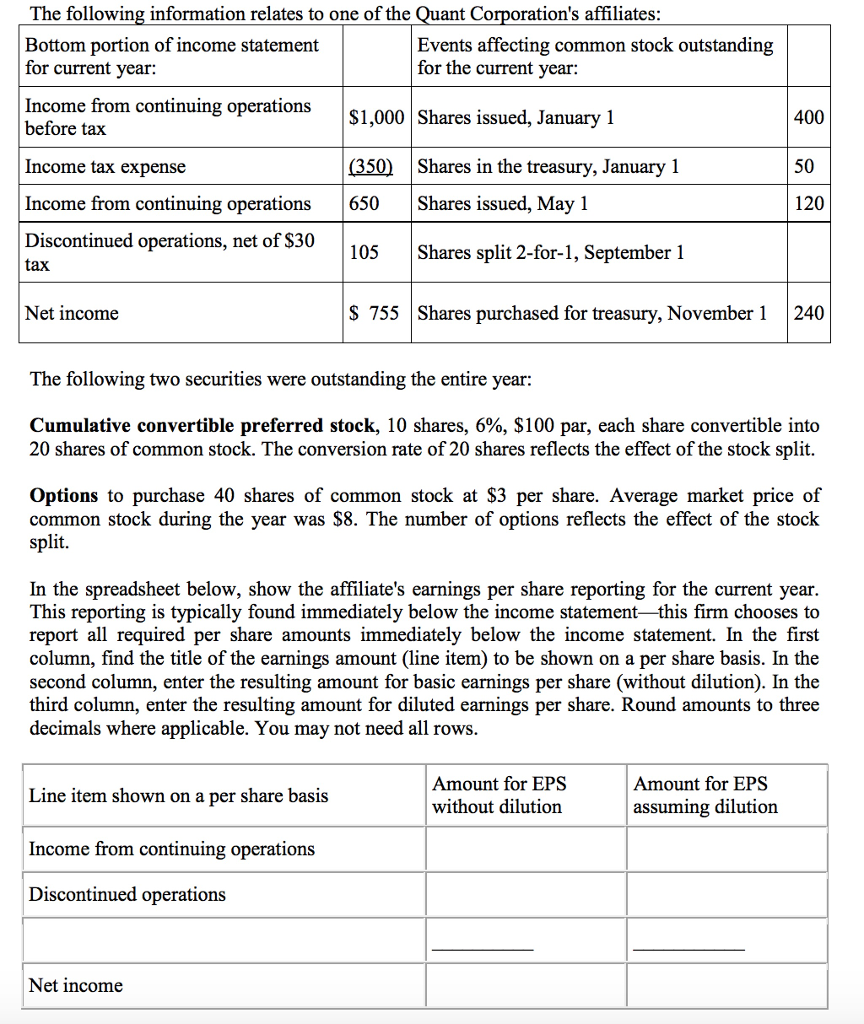

The following information relates to one of the Oant Corporation's affiliates: Bottom portion of income statement for current year: Income from continuing operations Events affecting common stock outstanding for the current year: $1,000 Shares issued, January1 400 before tax Income tax expense Income from continuing operations 650Shares issued, May 1 Discontinued operations, net of $30 (350) Shares in the treasury, January 1 50 105Shares split 2-for-1, September 1 tax Net income S 755 Shares purchased for treasury, November 1 240 The following two securities were outstanding the entire year: cumulative convertible preferred stock, 10 shares, 6%, $100 par, each share convertible into 20 shares of common stock. The conversion rate of 20 shares reflects the effect of the stock split. Options to purchase 40 shares of common stock at $3 per share. Average market price of common stock during the year was S8. The number of options reflects the effect of the stock split. In the spreadsheet below, show the affiliate's earnings per share reporting for the current year. This reporting is typically found immediately below the income statement-this firm chooses to report all required per share amounts immediately below the income statement. In the first column, find the title of the earnings amount (line item) to be shown on a per share basis. In the second column, enter the resulting amount for basic earnings per share (without dilution). In the third column, enter the resulting amount for diluted earnings per share. Round amounts to three decimals where applicable. You may not need all rows Amount for EPSS without dilution Amount for EPS assuming dilution Line item shown on a per share basis Income from continuing operations Discontinued operations Net income The following information relates to one of the Oant Corporation's affiliates: Bottom portion of income statement for current year: Income from continuing operations Events affecting common stock outstanding for the current year: $1,000 Shares issued, January1 400 before tax Income tax expense Income from continuing operations 650Shares issued, May 1 Discontinued operations, net of $30 (350) Shares in the treasury, January 1 50 105Shares split 2-for-1, September 1 tax Net income S 755 Shares purchased for treasury, November 1 240 The following two securities were outstanding the entire year: cumulative convertible preferred stock, 10 shares, 6%, $100 par, each share convertible into 20 shares of common stock. The conversion rate of 20 shares reflects the effect of the stock split. Options to purchase 40 shares of common stock at $3 per share. Average market price of common stock during the year was S8. The number of options reflects the effect of the stock split. In the spreadsheet below, show the affiliate's earnings per share reporting for the current year. This reporting is typically found immediately below the income statement-this firm chooses to report all required per share amounts immediately below the income statement. In the first column, find the title of the earnings amount (line item) to be shown on a per share basis. In the second column, enter the resulting amount for basic earnings per share (without dilution). In the third column, enter the resulting amount for diluted earnings per share. Round amounts to three decimals where applicable. You may not need all rows Amount for EPSS without dilution Amount for EPS assuming dilution Line item shown on a per share basis Income from continuing operations Discontinued operations Net income