Answered step by step

Verified Expert Solution

Question

1 Approved Answer

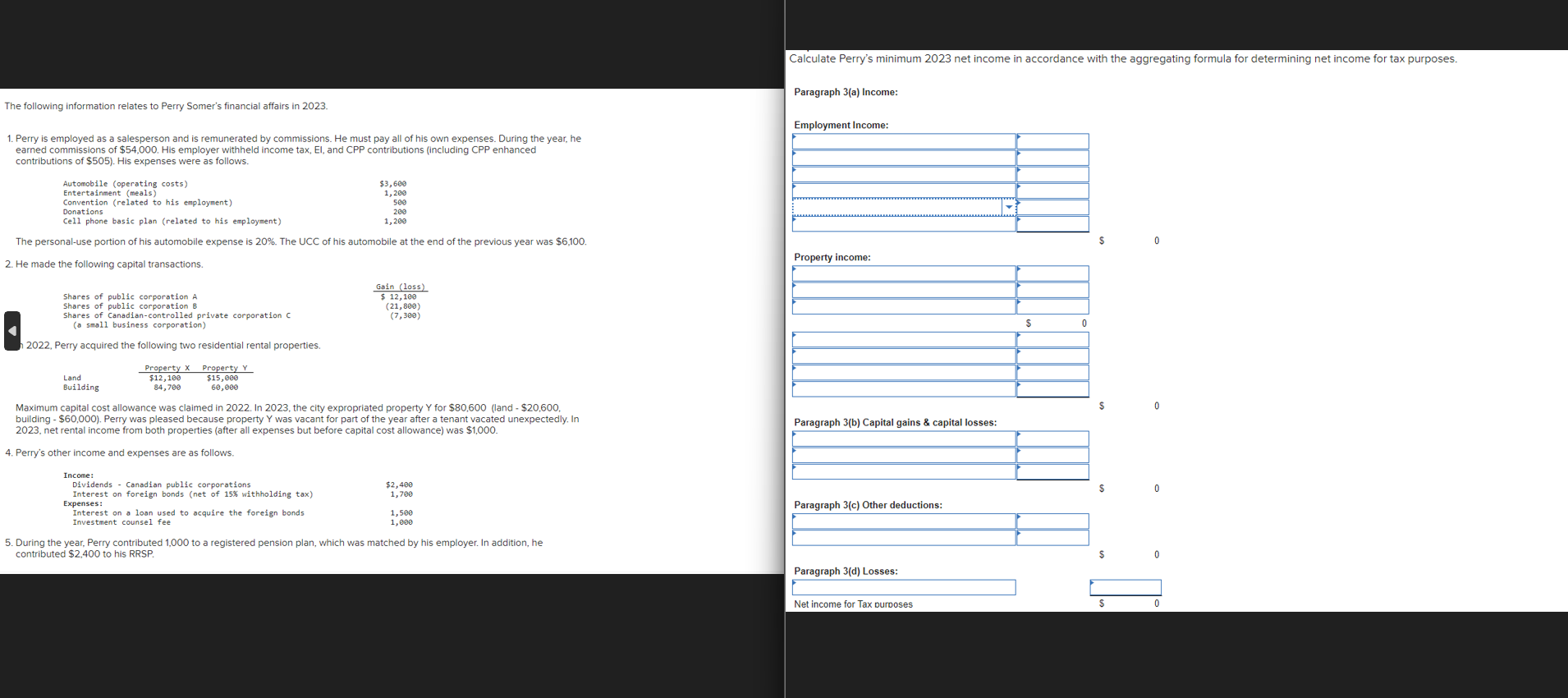

The following information relates to Perry Somer's financial affairs in 2 0 2 3 . Perry is employed as a salesperson and is remunerated by

The following information relates to Perry Somer's financial affairs in

Perry is employed as a salesperson and is remunerated by commissions. He must pay all of his own expenses. During the year, he

earned commissions of $ His employer witheld income tax, El and CPP contributions including CPP enhanced

contributions of $ His expenses were as follows.

The personaluse portion of his automobile expense is The UCC of his automobile at the end of the previous year was $

He made the following capital transactions.

In Perry acquired the following two residential rental properties.

Maximum capital cost allowance was claimed in In the city expropriated property for $land $

building $ Perry was pleased because property was vacant for part of the year after a tenant vacated unexpectedly. In

net rental income from both properties after all expenses but before capital cost allowance was $

Perry's other income and expenses are as follows.

During the year, Perry contributed to a registered pension plan, which was matched by his employer. In addition, he

contributed $ to his RRSPParagraph a Income:

Employment Income:

Property income:

Paragraph b Capital gains & capital losses:

Paragraph c Other deductions:

Paragraph d Losses:

Net income for Tax purooses

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started