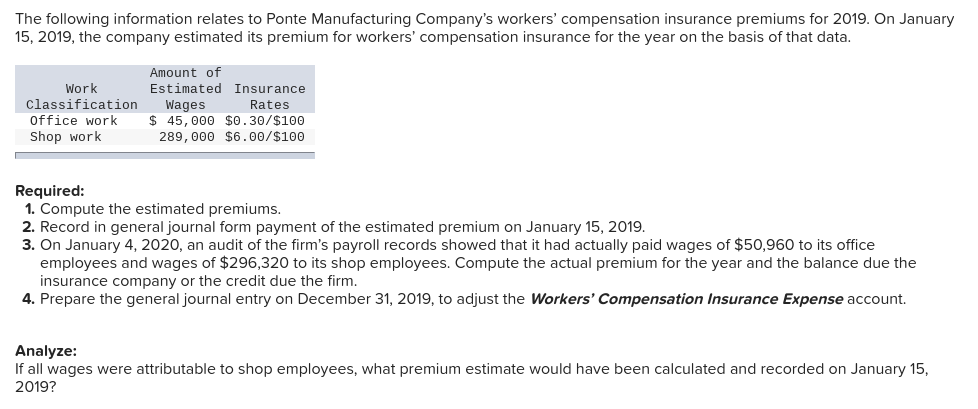

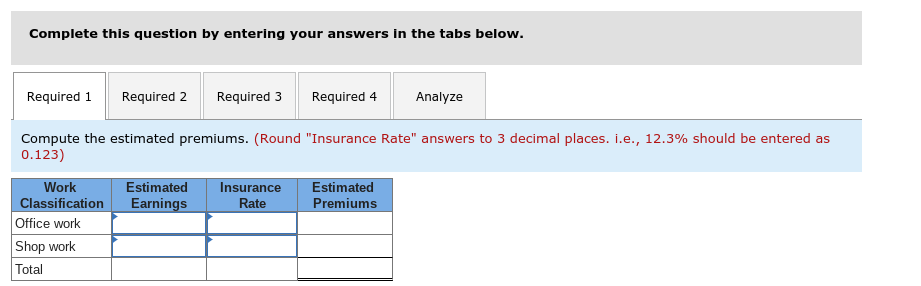

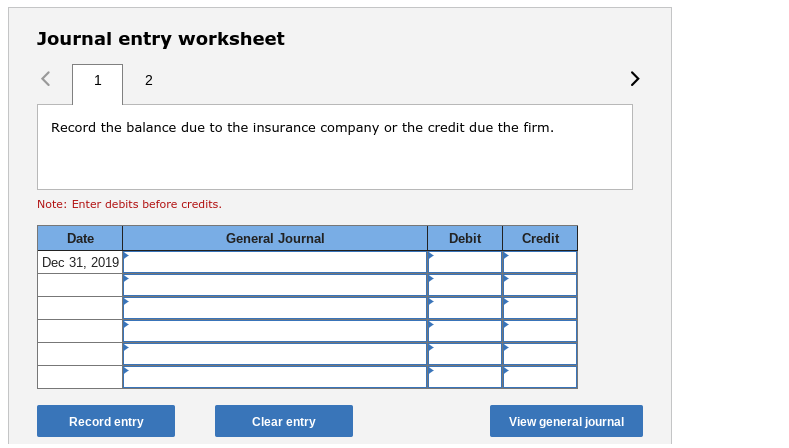

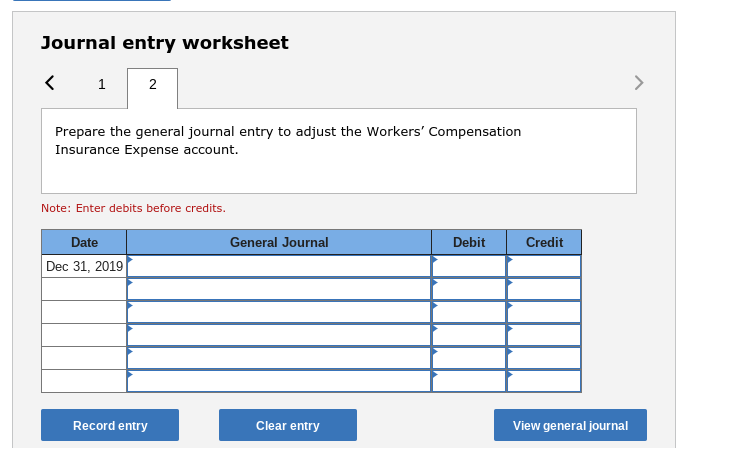

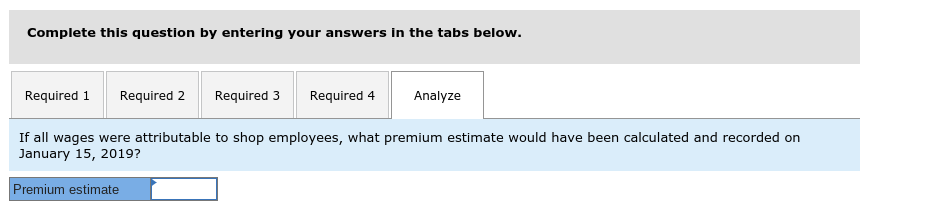

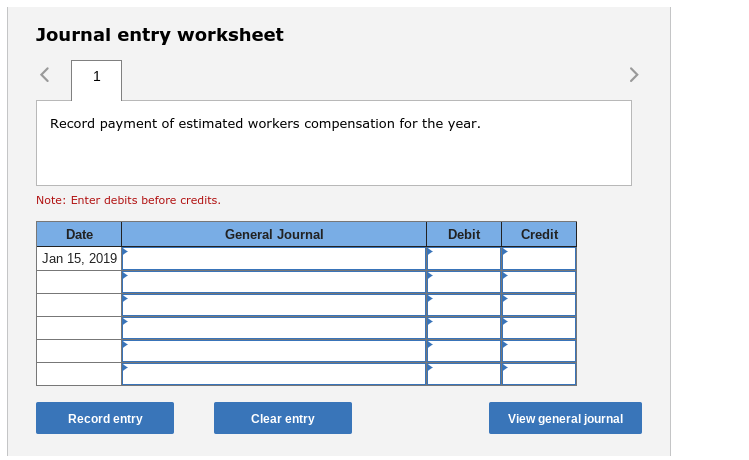

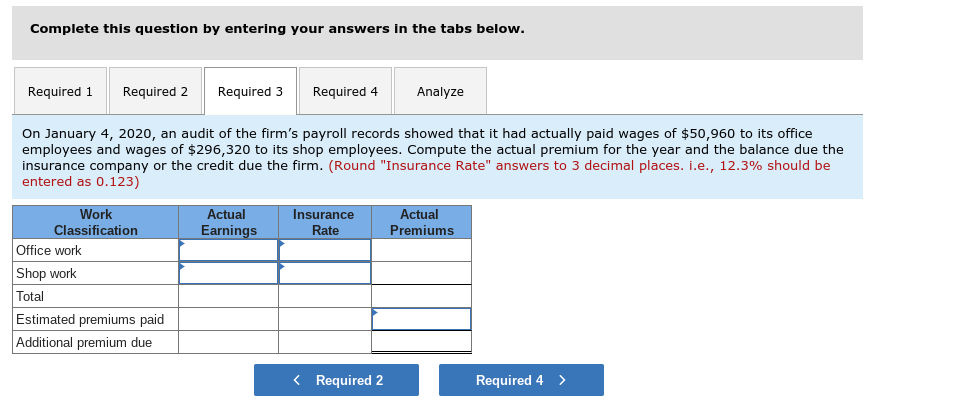

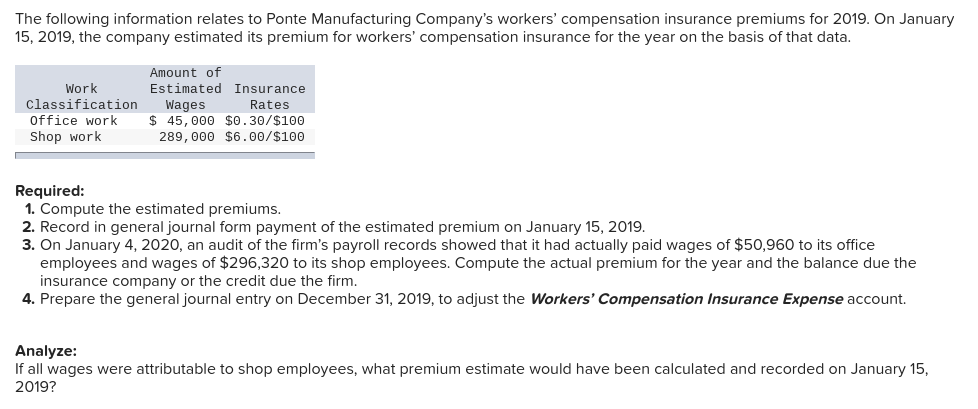

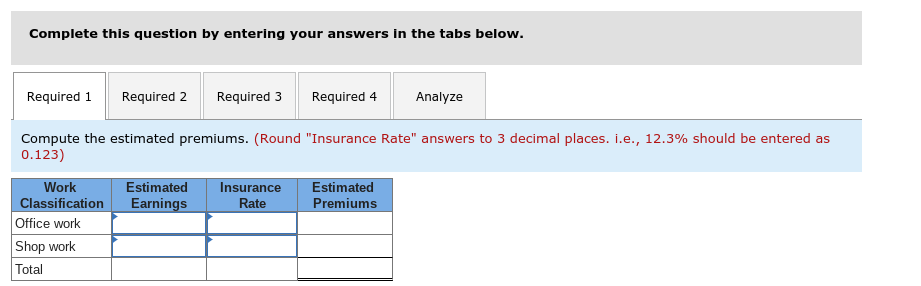

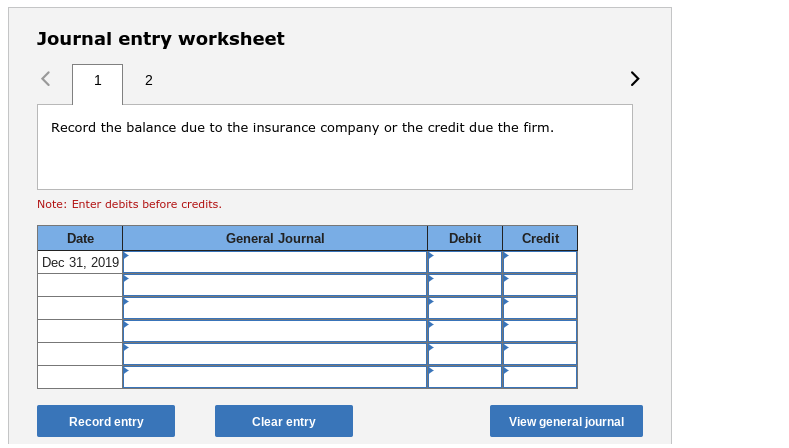

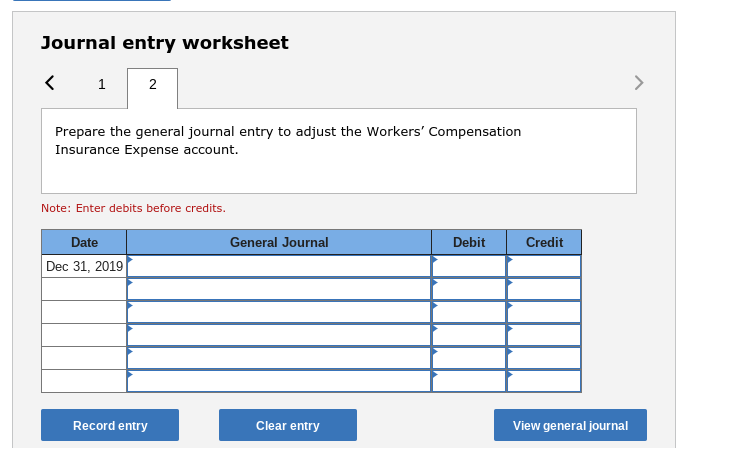

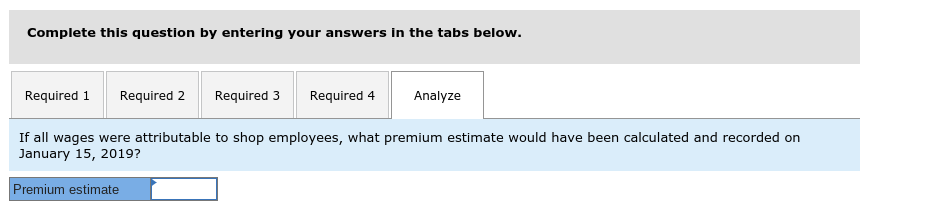

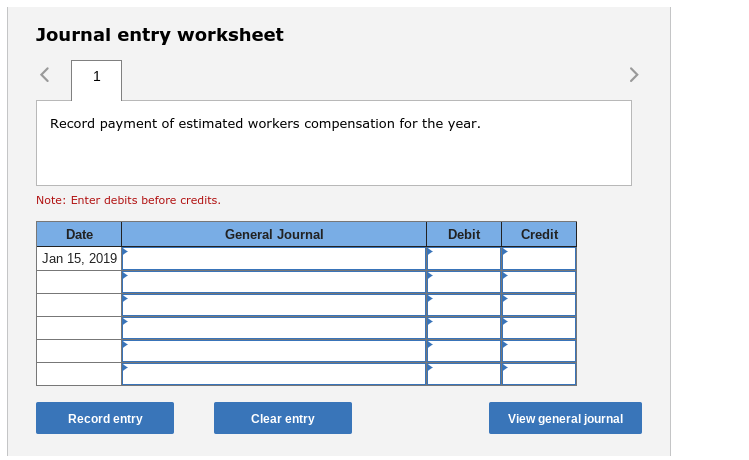

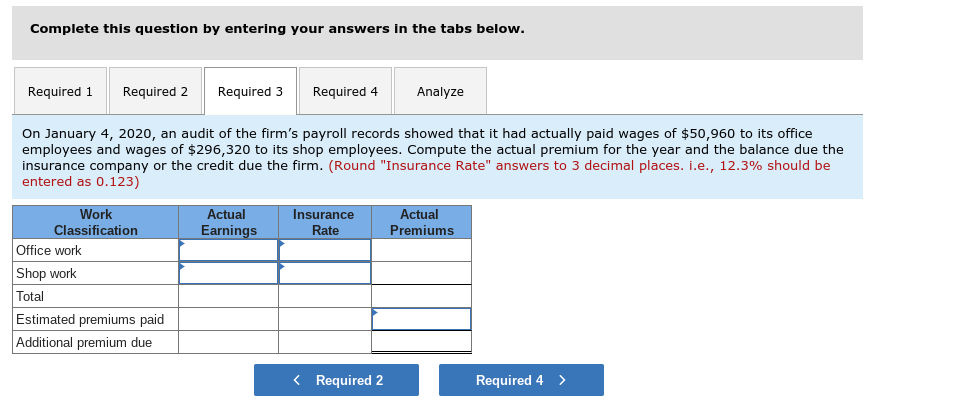

The following information relates to Ponte Manufacturing Company's workers' compensation insurance premiums for 2019. On January 5, 2019, the company estimated its premium for workers' compensation insurance for the year on the basis of that data. Amount of Work Estimated Insurance Classification Wages Office Shop work Rates work 45, 000 $0.30/$100 289, $6./S100 Required 1. Compute the estimated premiums 2. Record in general journal form payment of the estimated premium on January 15, 2019. 3. On January 4, 2020, an audit of the firm's payroll records showed that it had actually paid wages of $50,960 to its office employees and wages of $296,320 to its shop employees. Compute the actual premium for the year and the balance due the insurance company or the credit due the firm. 4. Prepare the general journal entry on December 31, 2019, to adjust the Workers' Compensation Insurance Expense account. Analyze: If all wages were attributable to shop employees, what premium estimate would have been calculated and recorded on January 15, 2019? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3Required 4 Analyze Compute the estimated premiums. (Round "Insurance Rate" answers to 3 decimal places. i.e., 12.3% should be entered as 0.123) Work Office work Shop work Estimated Insurance Estimated lassification Earnings Rae Premiums Total Journal entry worksheet 2 Record the balance due to the insurance company or the credit due the firm. Note: Enter debits before credits. Date General Journal Debit Credit Dec 31, 2019 Record entry Clear entry View general journal Journal entry worksheet Prepare the general journal entry to adjust the Workers' Compensation Insurance Expense account. Note: Enter debits before credits. Date General Journal Debit Credit Dec 31, 2019 Record entry Clear entry View general journal Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4Analyze If all wages were attributable to shop employees, what premium estimate would have been calculated and recorded on January 15, 2019? Premium estimate Journal entry worksheet Record payment of estimated workers compensation for the year. Note: Enter debits before credits. Date General Journal Debit Credit Jan 15, 2019 Record entry Clear entry View general journal Complete this question by entering your answers in the tabs below Required 1 Required Required 3 Required 4 Analyze On January 4, 2020, an audit of the firm's payroll records showed that it had actually paid wages of $50,960 to its office employees and wages of $296,320 to its shop employees. Compute the actual premium for the year and the balance due the insurance company or the credit due the firm. (Round "Insurance Rate" answers to 3 decimal places. i.e., 12.3% should be entered as 0.123) Work Classification Actual Earnings Insurance Rate Actual Premiums Office work Shop work Total Estimated premiums paid Additional premium due Required 2 Required 4