Answered step by step

Verified Expert Solution

Question

1 Approved Answer

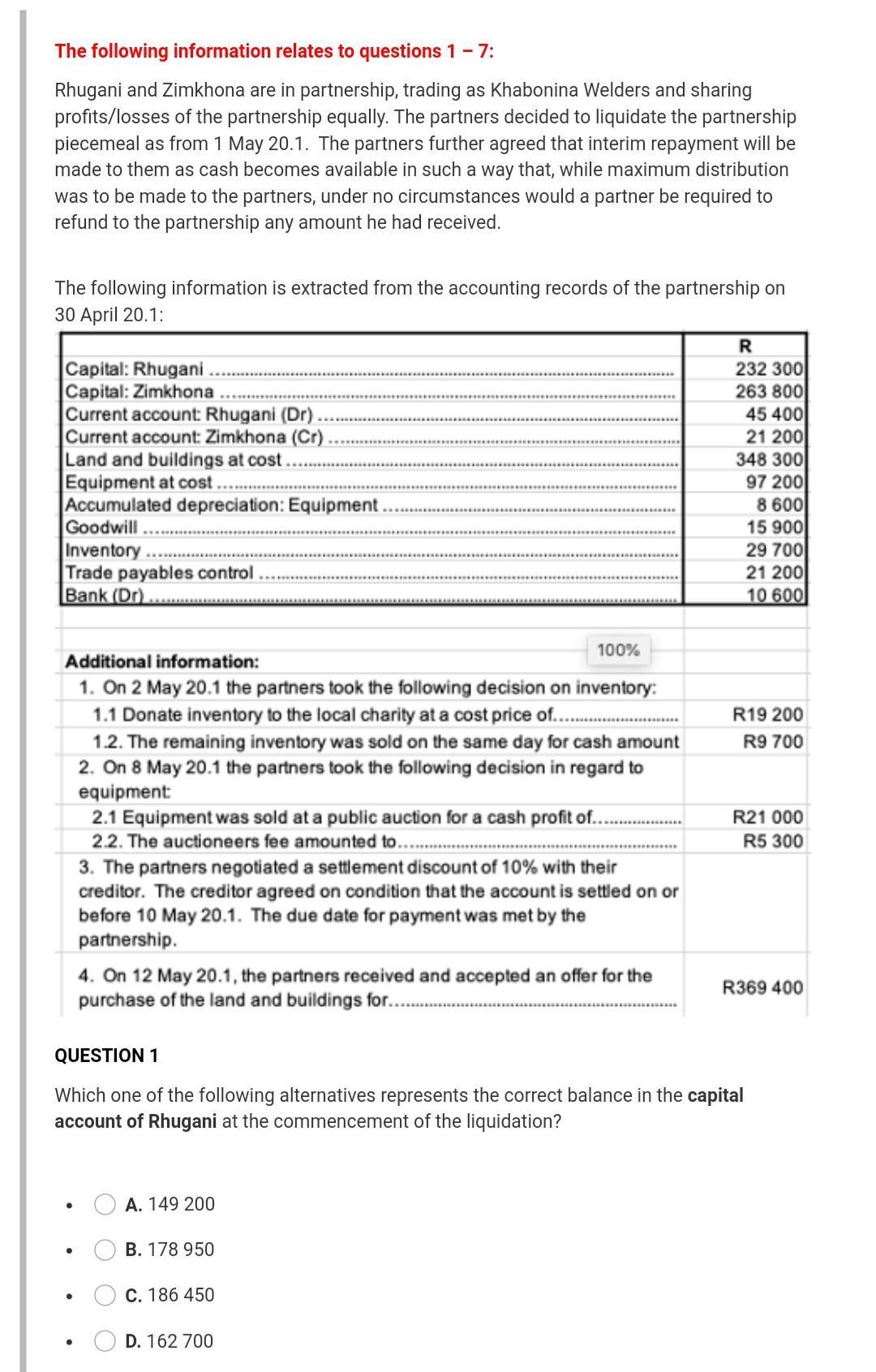

The following information relates to questions 1- 7: Rhugani and Zimkhona are in partnership, trading as Khabonina Welders and sharing profits/losses of the partnership

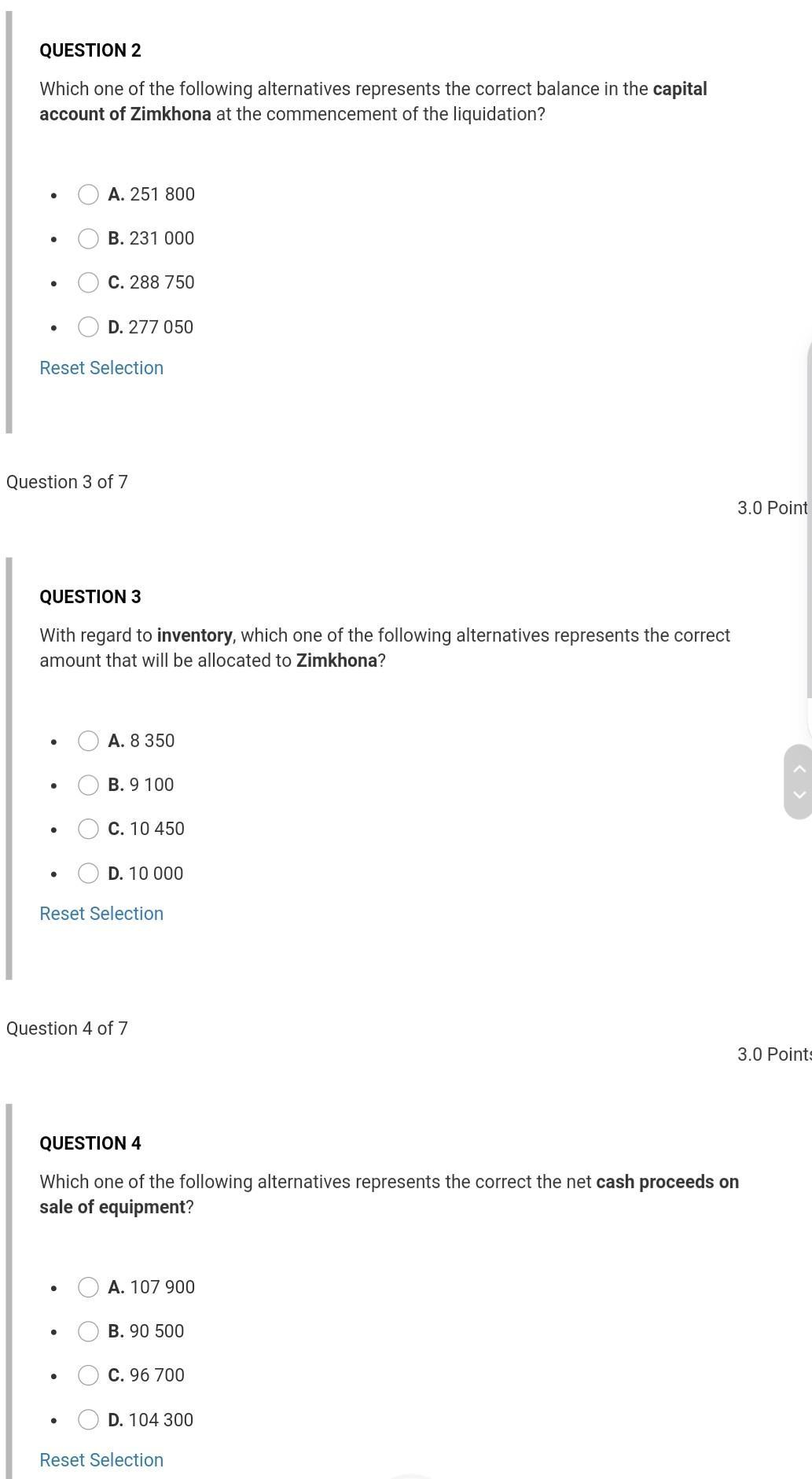

The following information relates to questions 1- 7: Rhugani and Zimkhona are in partnership, trading as Khabonina Welders and sharing profits/losses of the partnership equally. The partners decided to liquidate the partnership piecemeal as from 1 May 20.1. The partners further agreed that interim repayment will be made to them as cash becomes available in such a way that, while maximum distribution was to be made to the partners, under no circumstances would a partner be required to refund to the partnership any amount he had received. The following information is extracted from the accounting records of the partnership on 30 April 20.1: R Capital: Rhugani Capital: Zimkhona Current account Rhugani (Dr) Current account: Zimkhona (Cr) Land and buildings at cost. Equipment at cost .. Accumulated depreciation: Equipment Goodwill Inventory .. Trade payables control Bank (Dr) 232 300 263 800 45 400 21 200 348 300 97 200 8 600 15 900 29 700 21 200 10 600 Wwwww. w 100% Additional information: 1. On 2 May 20.1 the partners took the following decision on inventory: 1.1 Donate inventory to the local charity at a cost price of... R19 200 1.2. The remaining inventory was sold on the same day for cash amount 2. On 8 May 20.1 the partners took the following decision in regard to equipment R9 700 2.1 Equipment was sold at a public auction for a cash profit of.. 2.2. The auctioneers fee amounted to.. R21 000 R5 300 3. The partners negotiated a settlement discount of 10% with their creditor. The creditor agreed on condition that the account is settled on or before 10 May 20.1. The due date for payment was met by the partnership. 4. On 12 May 20.1, the partners received and accepted an offer for the purchase of the land and buildings for... R369 400 QUESTION 1 Which one of the following alternatives represents the correct balance in the capital account of Rhugani at the commencement of the liquidation? A. 149 200 B. 178 950 C. 186 450 D. 162 700 O O QUESTION 2 Which one of the following alternatives represents the correct balance in the capital account of Zimkhona at the commencement of the liquidation? A. 251 800 B. 231 000 C. 288 750 D. 277 050 Reset Selection Question 3 of 7 3.0 Point QUESTION 3 With regard to inventory, which one of the following alternatives represents the correct amount that will be allocated to Zimkhona? A. 8 350 B. 9 100 C. 10 450 D. 10 000 Reset Selection Question 4 of 7 3.0 Points QUESTION 4 Which one of the following alternatives represents the correct the net cash proceeds on sale of equipment? A. 107 900 B. 90 500 C. 96 700 D. 104 300 Reset Selection < >

Step by Step Solution

★★★★★

3.51 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started