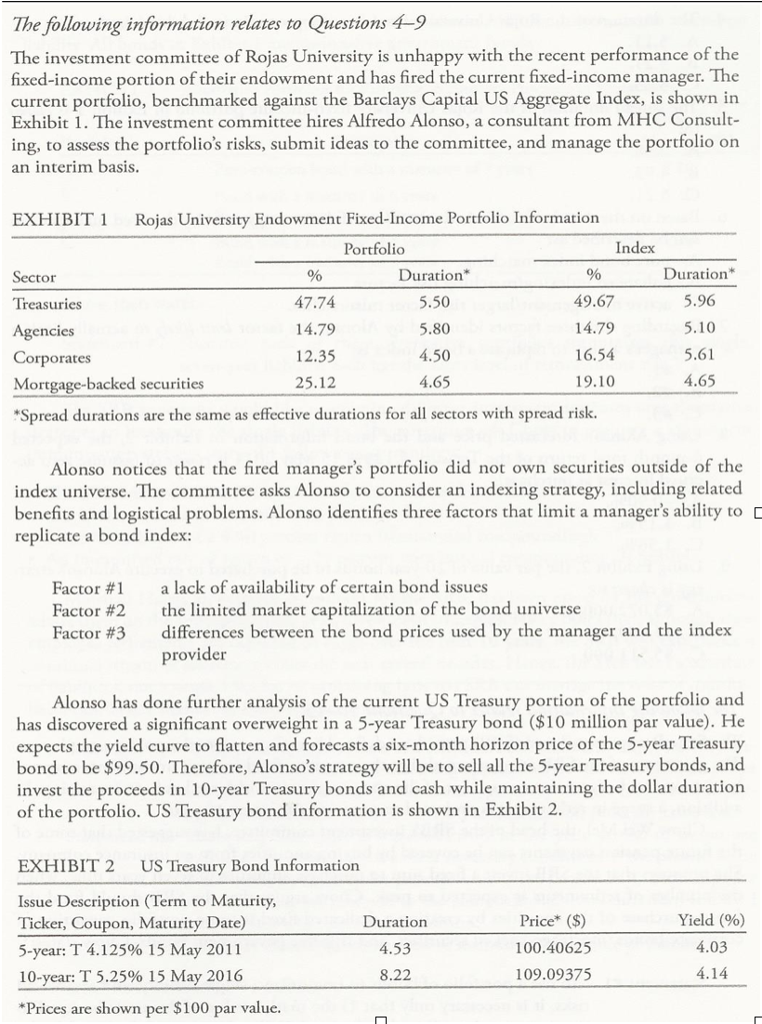

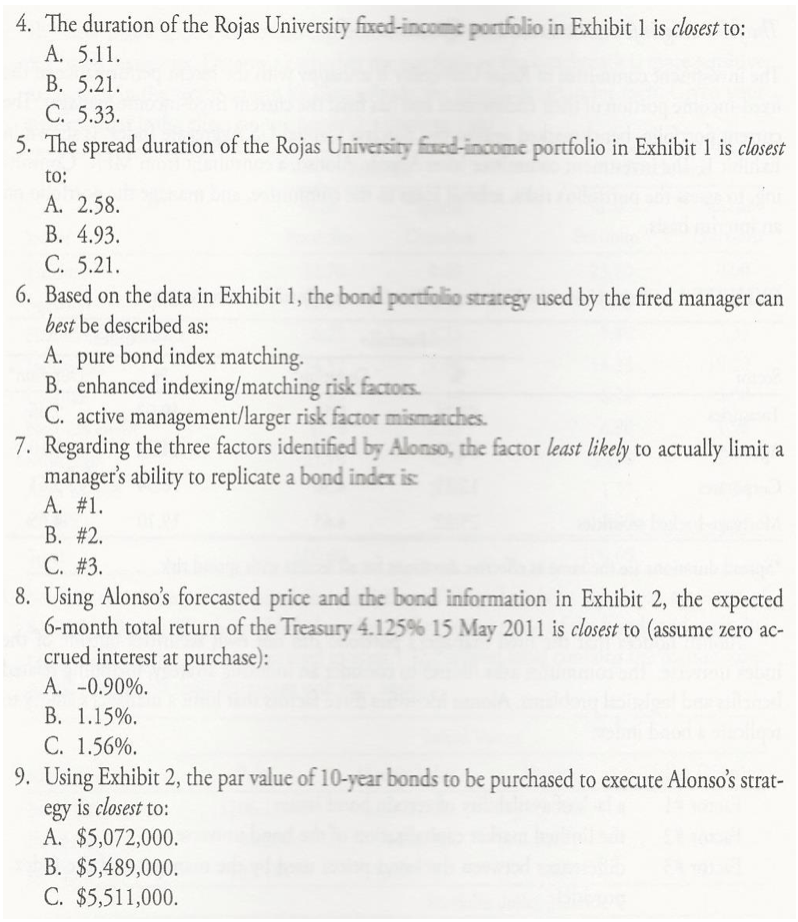

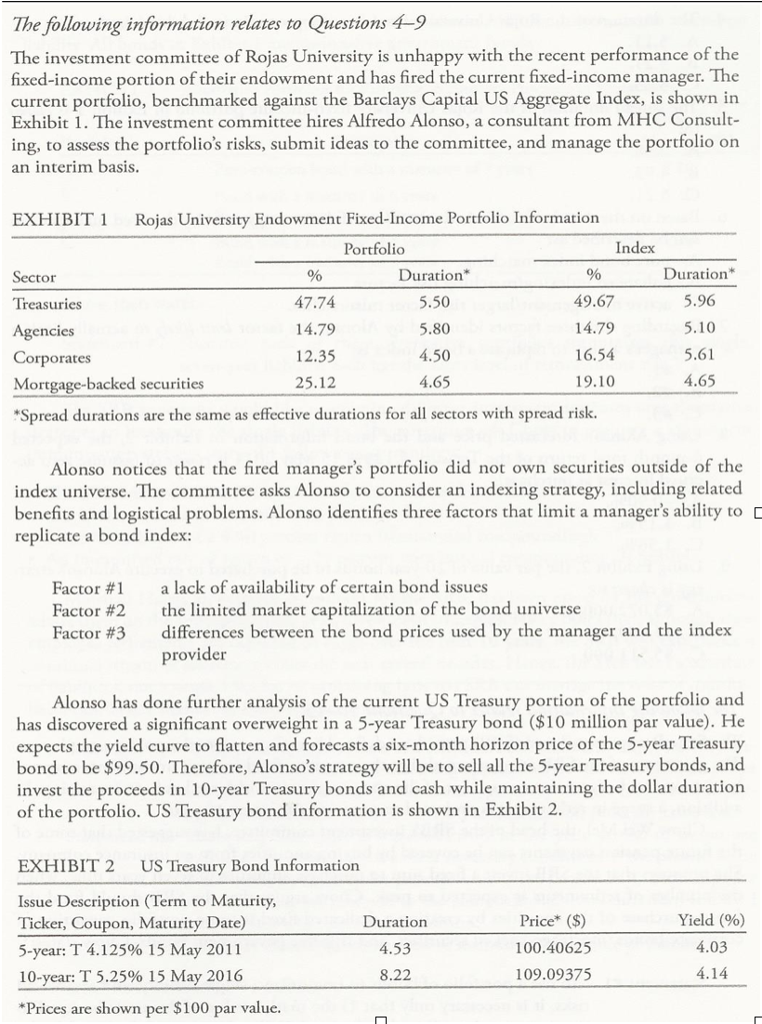

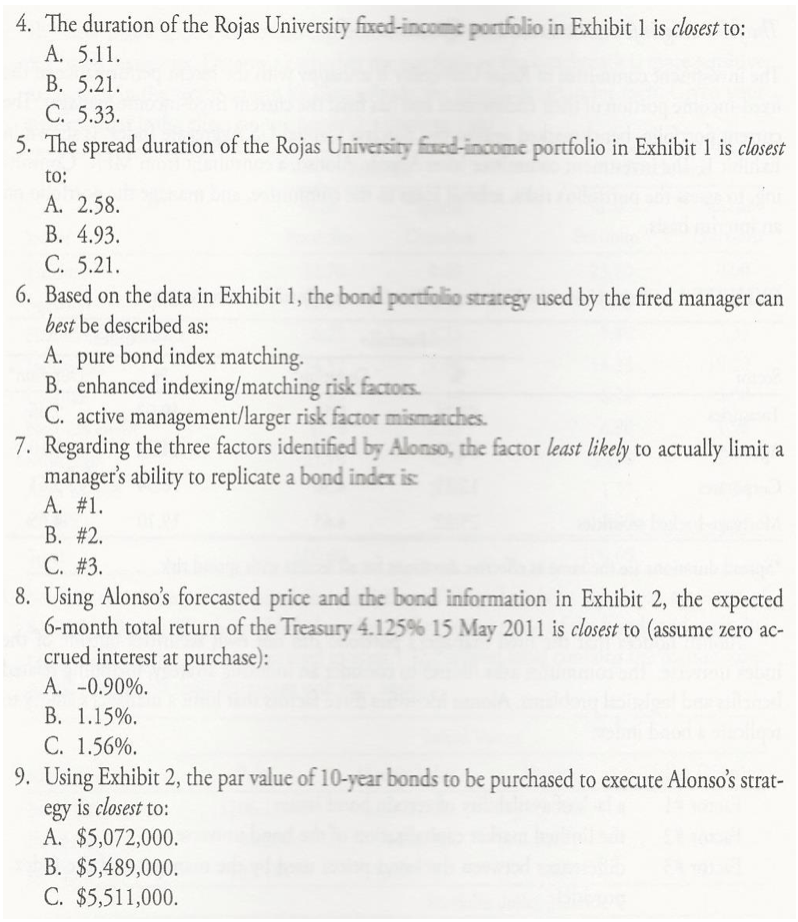

The following information relates to Questions 4-9 The investment committee of Rojas University is unhappy with the recent performance of the fixed-income portion of their endowment and has fired the current fixed-income manager. The current portfolio, benchmarked against the Barclays Capital US Aggregate Index, is shown in Exhibit 1The investment committee hires Alfredo Alonso, a consultant from MHC Consult- ing, to assess the portfolio's risks, submit ideas to the committee, and manage the portfolio on an interim basis EXHIBIT Rojas University Endowment Fixed-Income Portfolio Information Portfolio Index uration 5.96 Sector Treasuries Agencies Corporates Mortgage-backed securities Spread durations are the same as effective durations for all sectors with spread risk. 47.74 14.79 12.35 25.12 Duration 5.50 5.80 4.50 4.65 49.67 14.79 16.54 19.10 5.61 4.65 Alonso notices that the fired manager's portfolio did not own securities outside of thoe index universe. The committee asks Alonso to consider an indexing strategy, including related benefits and logistical problems. Alonso identifies three factors that limit a manager's ability to replicate a bond index: Factor #1 Factor #2 Factor #3 a lack of availability of certain bond issues the limited market capitalization of the bond universe differences between the bond prices used by the manager and the index provider Alonso has done further analysis of the current US Treasury portion of the portfolio and has discovered a significant overweight in a 5-year Treasury bond ($10 million par value). He expects the yield curve to flatten and forecasts a six-month horizon price of the 5-year Treasury bond to be $99.50. Therefore, Alonso's strategy will be to sell all the 5-year Treasury bonds, and invest the proceeds in 10-year Treasury bonds and cash while maintaining the dollar duration of the portfolio. US Treasury bond information is shown in Exhibit 2. EXHIBIT 2 US Treasury Bond Information Issue Description (Term to Maturity, Ticker, Coupon, Maturity Date) 5-year: T 4.125% 15 May 2011 10-year T 5.25% 15 May 2016 *Prices are shown per $100 par value. Duration 4.53 8.22 Price ($) 100.40625 09.09375 Yield %) 4.03 4.14