Answered step by step

Verified Expert Solution

Question

1 Approved Answer

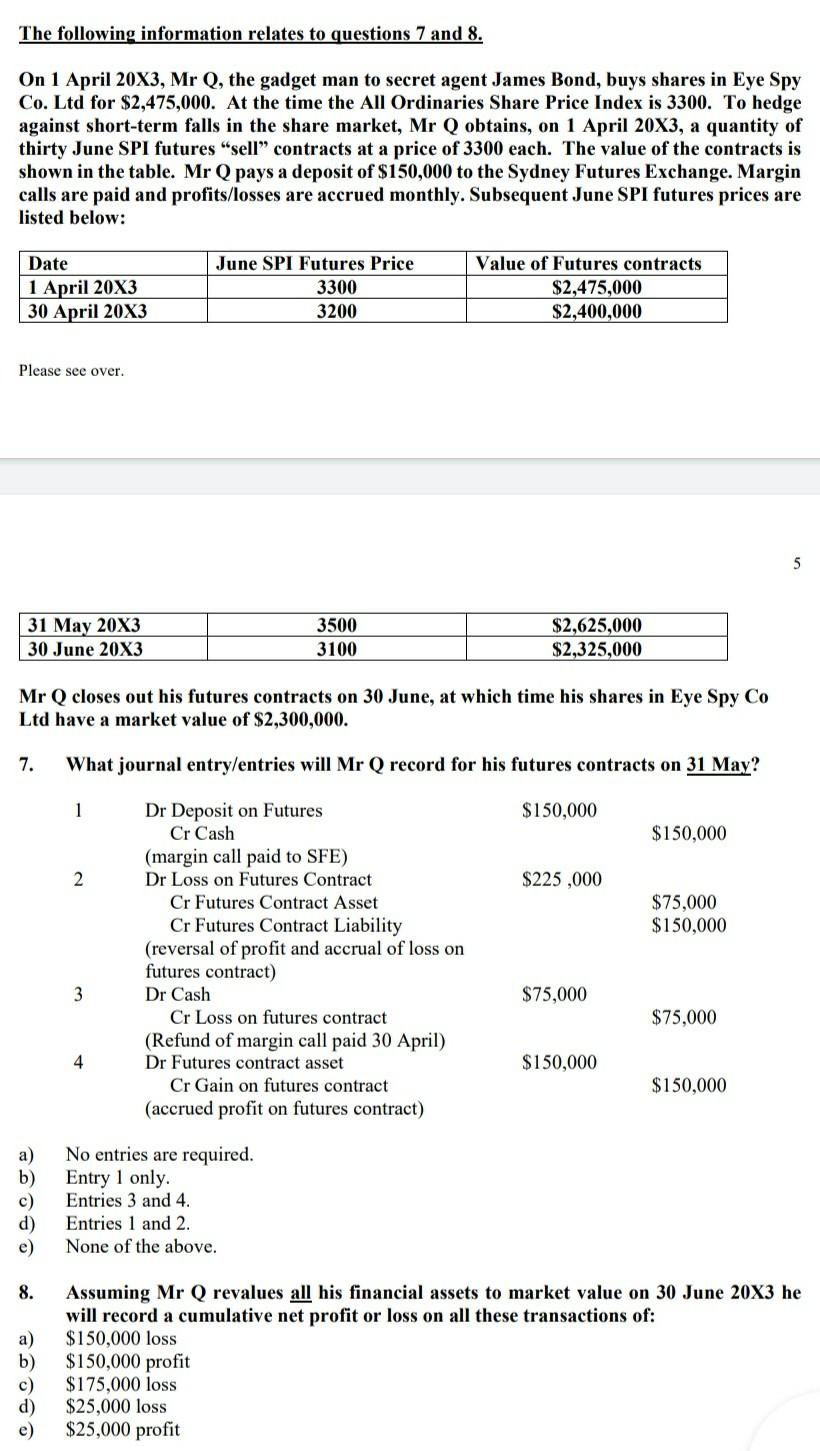

The following information relates to questions 7 and 8. On 1 April 20X3, Mr Q, the gadget man to secret agent James Bond, buys shares

The following information relates to questions 7 and 8. On 1 April 20X3, Mr Q, the gadget man to secret agent James Bond, buys shares in Eye Spy Co. Ltd for $2,475,000. At the time the All Ordinaries Share Price Index is 3300. To hedge against short-term falls in the share market, Mr Q obtains, on 1 April 20X3, a quantity of thirty June SPI futures sell contracts at a price of 3300 each. The value of the contracts is shown in the table. Mr Q pays a deposit of $150,000 to the Sydney Futures Exchange. Margin calls are paid and profits/losses are accrued monthly. Subsequent June SPI futures prices are listed below: Date 1 April 20X3 30 April 20X3 June SPI Futures Price 3300 3200 Value of Futures contracts $2,475,000 $2,400,000 Please see over. 5 31 May 20X3 30 June 20X3 3500 3100 $2,625,000 $2,325,000 Mr Q closes out his futures contracts on 30 June, at which time his shares in Eye Spy Co Ltd have a market value of $2,300,000. 7. What journal entry/entries will Mr Q record for his futures contracts on 31 May? 1 $150,000 $150,000 2 $225,000 $75,000 $150,000 Dr Deposit on Futures Cr Cash (margin call paid to SFE) Dr Loss on Futures Contract Cr Futures Contract Asset Cr Futures Contract Liability (reversal of profit and accrual of loss on futures contract) Dr Cash Cr Loss on futures contract (Refund of margin call paid 30 April) Dr Futures contract asset Cr Gain on futures contract (accrued profit on futures contract) 3 $75,000 $75,000 4 $150,000 $150,000 a) b) c) d) e) No entries are required. Entry 1 only. Entries 3 and 4. Entries 1 and 2. None of the above. 8. a) b) c) d) e) Assuming Mr Q revalues all his financial assets to market value on 30 June 20X3 he will record a cumulative net profit or loss on all these transactions of: $150,000 loss $150,000 profit $175,000 loss $25,000 loss $25,000 profit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started