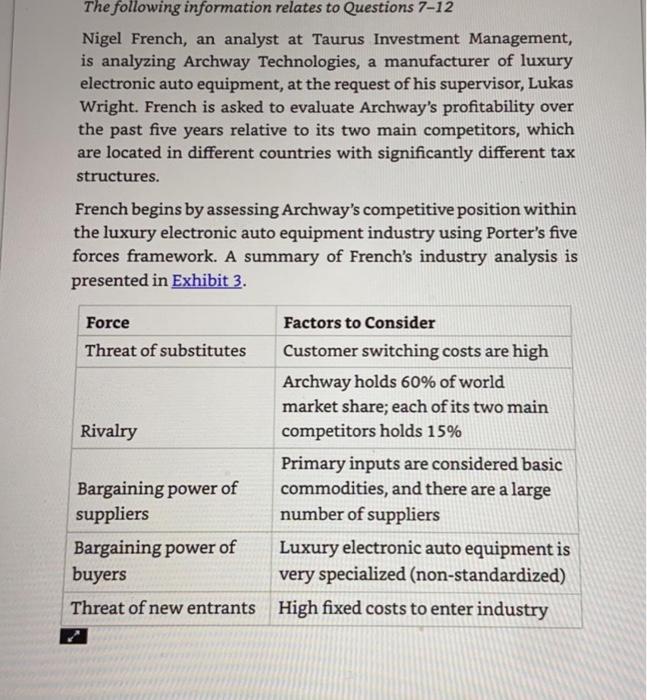

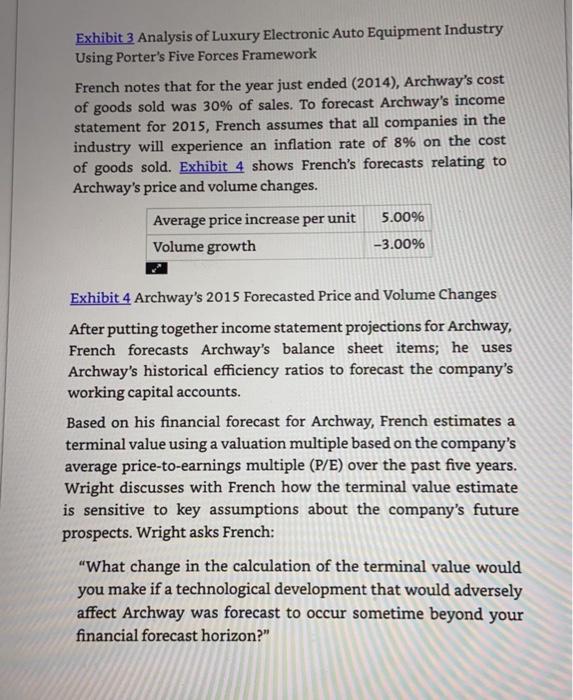

The following information relates to Questions 7-12 Nigel French, an analyst at Taurus Investment Management, is analyzing Archway Technologies, a manufacturer of luxury electronic auto equipment, at the request of his supervisor, Lukas Wright. French is asked to evaluate Archway's profitability over the past five years relative to its two main competitors, which are located in different countries with significantly different tax structures. French begins by assessing Archway's competitive position within the luxury electronic auto equipment industry using Porter's five forces framework. A summary of French's industry analysis is presented in Exhibit 3. Force Factors to consider Threat of substitutes Customer switching costs are high Archway holds 60% of world market share; each of its two main Rivalry competitors holds 15% Primary inputs are considered basic Bargaining power of commodities, and there are a large suppliers number of suppliers Bargaining power of Luxury electronic auto equipment is buyers very specialized (non-standardized) Threat of new entrants High fixed costs to enter industry 10. Based on Exhibit 4, Archway's forecasted gross profit margin for 2015 is closest to: A. 62.7%. B. 67.0%. C. 69.1%. Exhibit 3 Analysis of Luxury Electronic Auto Equipment Industry Using Porter's Five Forces Framework French notes that for the year just ended (2014), Archway's cost of goods sold was 30% of sales. To forecast Archway's income statement for 2015, French assumes that all companies in the industry will experience an inflation rate of 8% on the cost of goods sold. Exhibit 4 shows French's forecasts relating to Archway's price and volume changes. 5.00% Average price increase per unit Volume growth -3.00% Exhibit 4 Archway's 2015 Forecasted Price and Volume Changes After putting together income statement projections for Archway, French forecasts Archway's balance sheet items; he uses Archway's historical efficiency ratios to forecast the company's working capital accounts. Based on his financial forecast for Archway, French estimates a terminal value using a valuation multiple based on the company's average price-to-earnings multiple (P/E) over the past five years. Wright discusses with French how the terminal value estimate is sensitive to key assumptions about the company's future prospects. Wright asks French: "What change in the calculation of the terminal value would you make if a technological development that would adversely affect Archway was forecast to occur sometime beyond your financial forecast horizon