Answered step by step

Verified Expert Solution

Question

1 Approved Answer

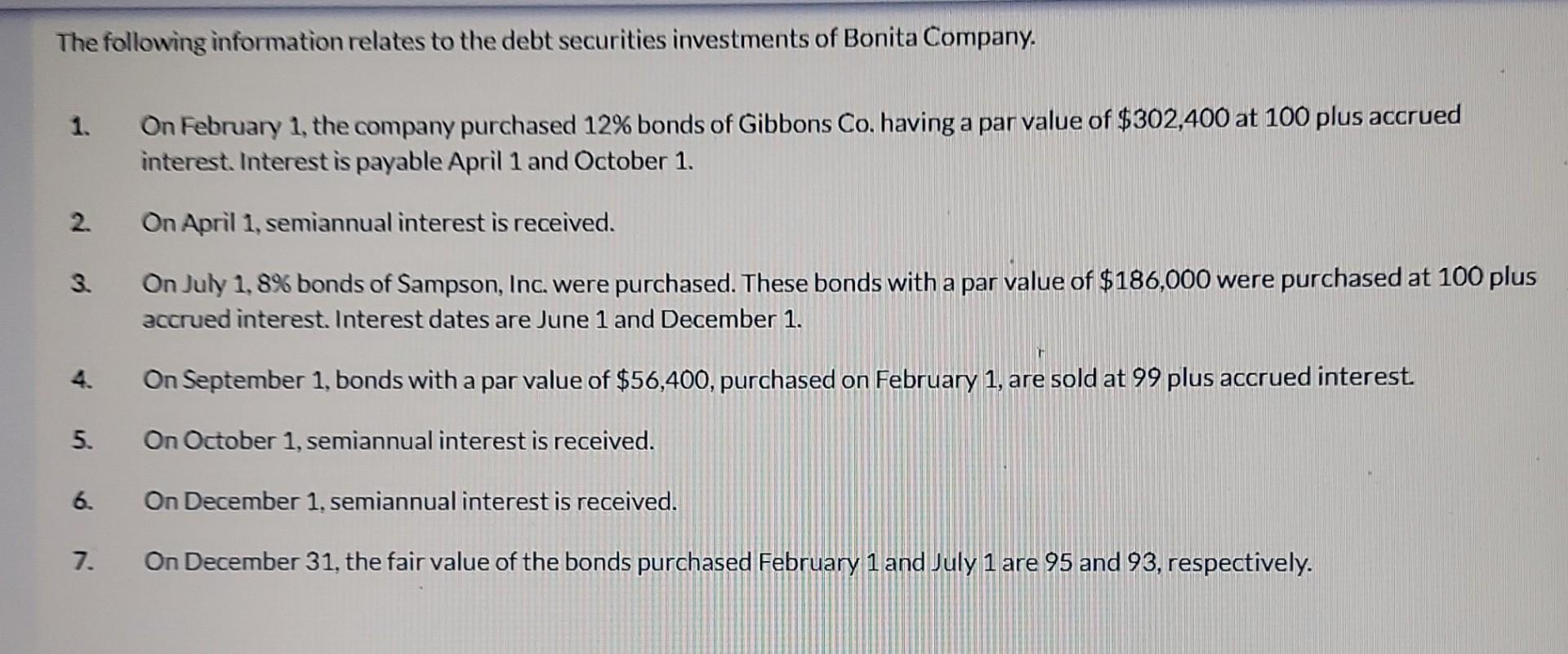

The following information relates to the debt securities investments of Bonita Company. 1. On February 1, the company purchased 12% bonds of Gibbons Co. having

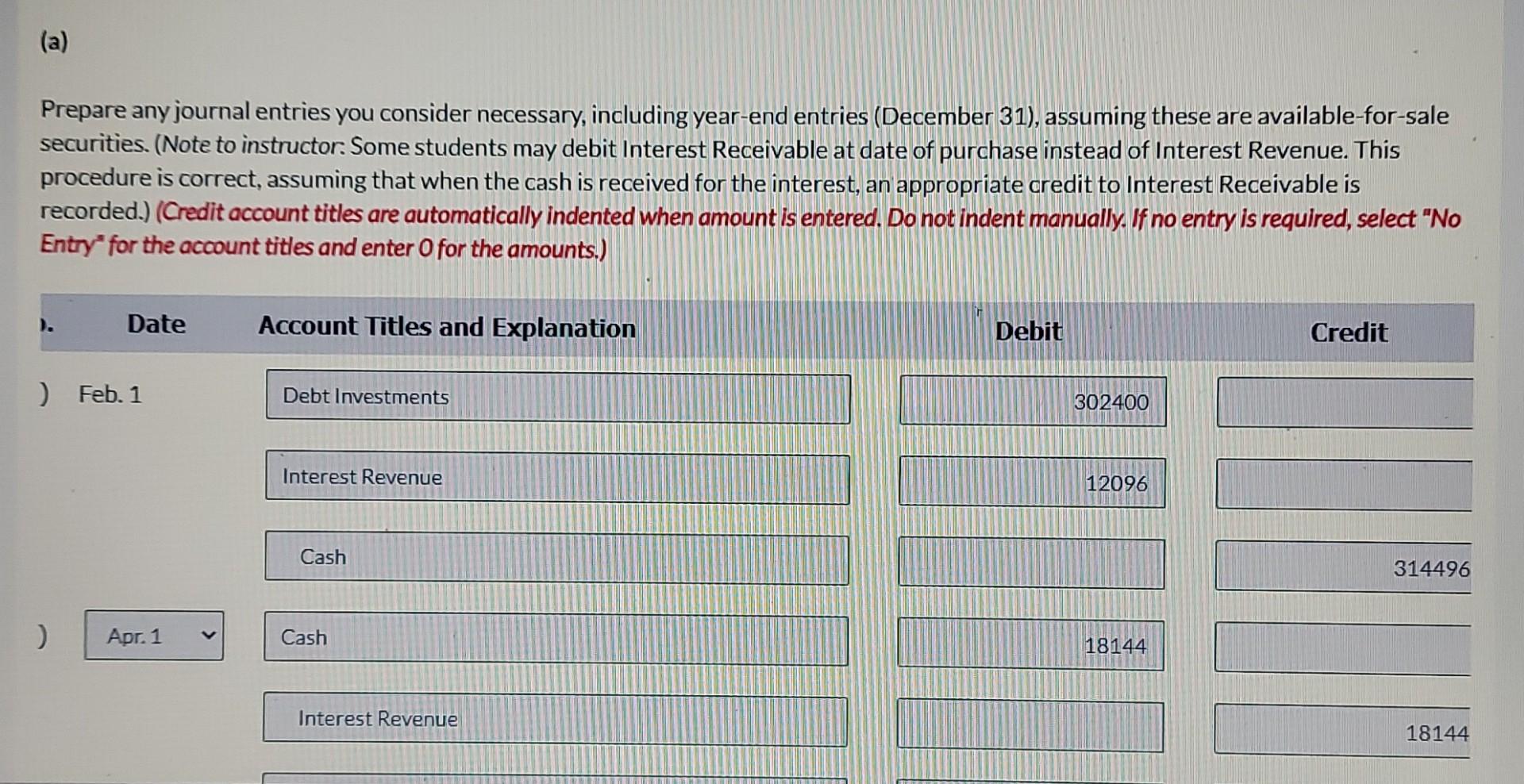

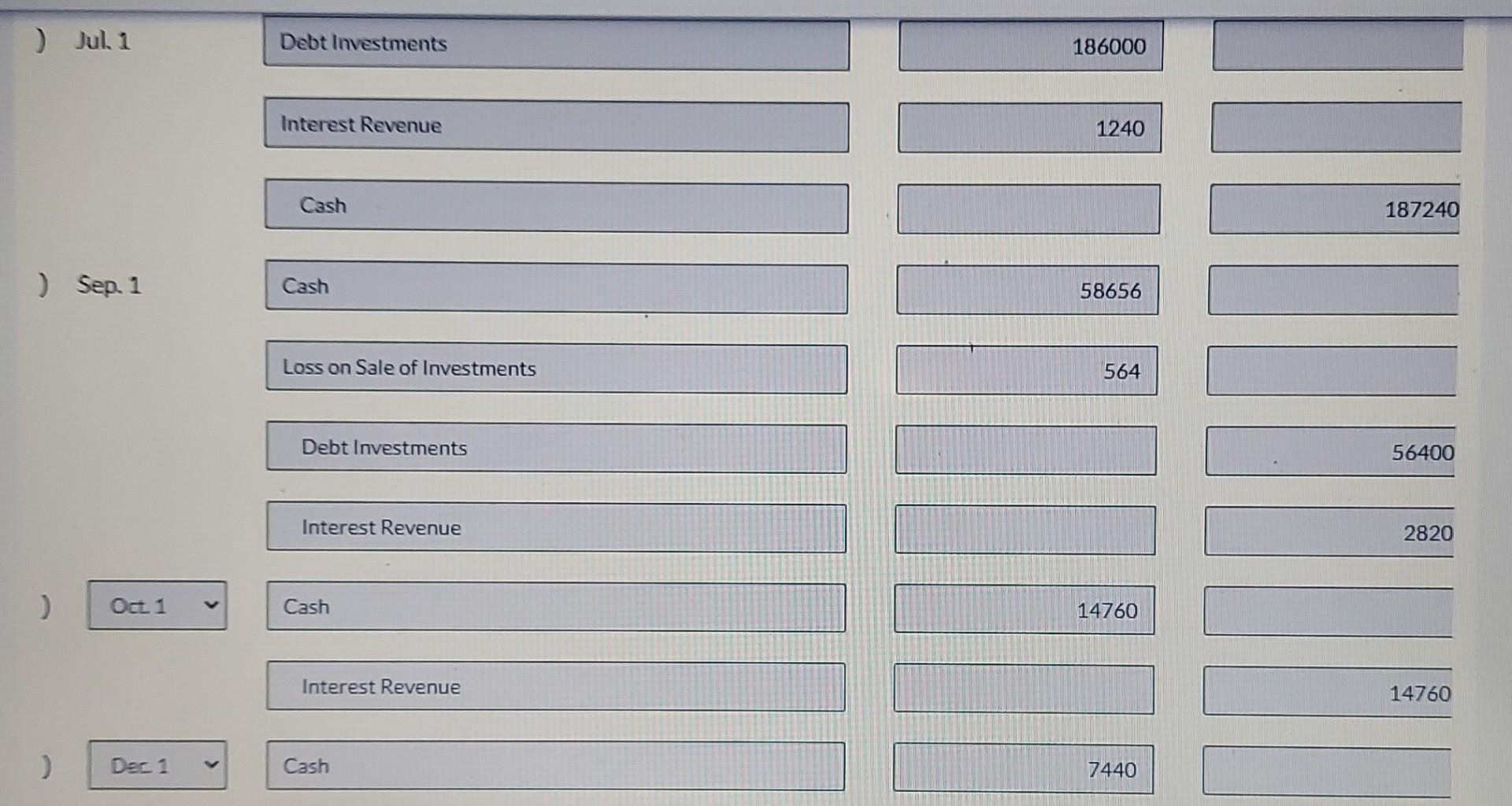

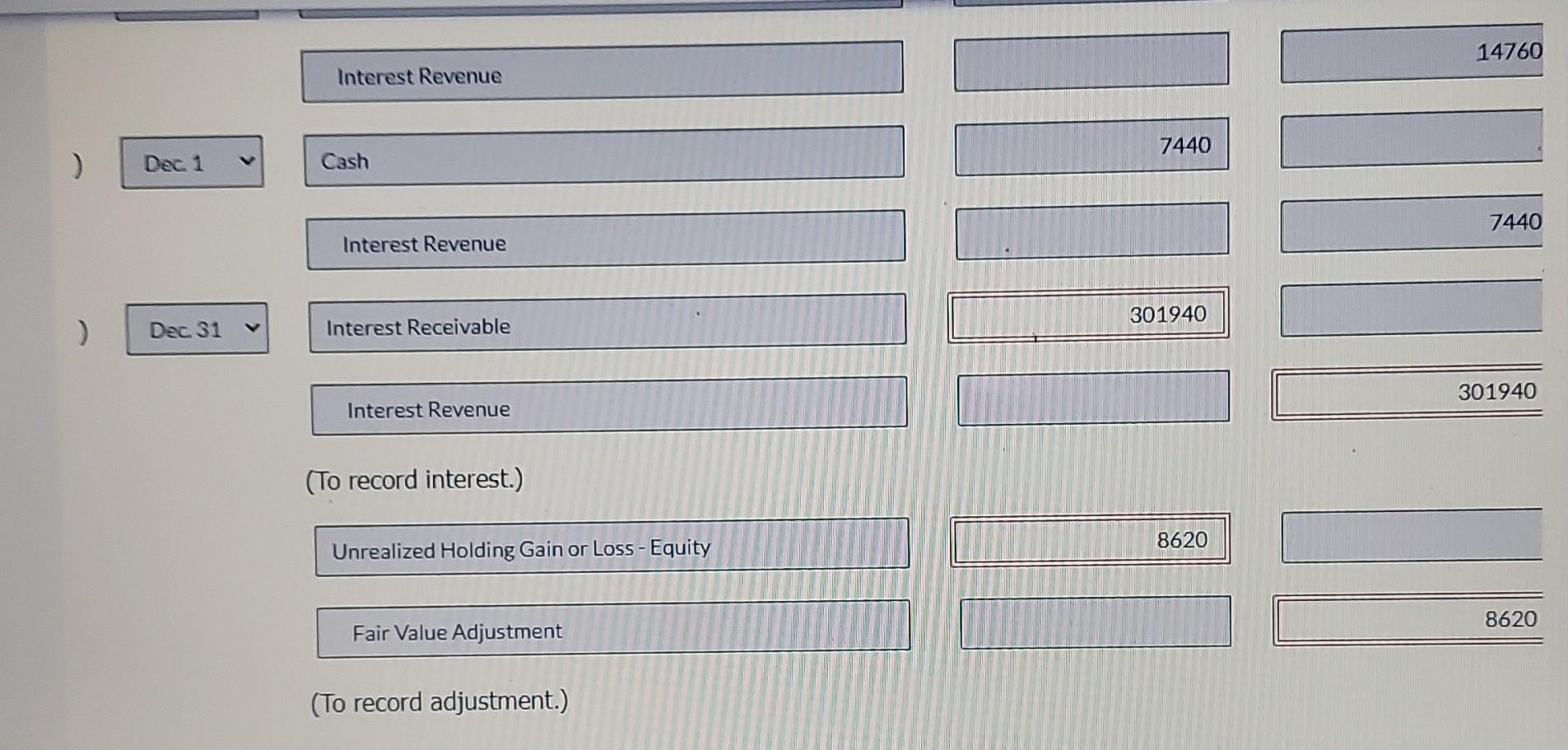

The following information relates to the debt securities investments of Bonita Company. 1. On February 1, the company purchased 12% bonds of Gibbons Co. having a par value of $302,400 at 100 plus accrued interest. Interest is payable April 1 and October 1. 2. On April 1, semiannual interest is received. 3. On July 1,8\% bonds of Sampson, Inc. were purchased. These bonds with a par value of $186,000 were purchased at 100 plus accrued interest. Interest dates are June 1 and December 1. 4. On September 1, bonds with a par value of $56,400, purchased on February 1 , are sold at 99 plus accrued interest. 5. On October 1 , semiannual interest is received. 6. On December 1 , semiannual interest is received. 7. On December 31 , the fair value of the bonds purchased February 1 and July 1 are 95 and 93 , respectively. Prepare any journal entries you consider necessary, including year-end entries (December 31), assuming these are available-for-sale securities. (Note to instructor. Some students may debit Interest Receivable at date of purchase instead of Interest Revenue. This procedure is correct, assuming that when the cash is received for the interest, an appropriate credit to Interest Receivable is recorded.) (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry " for the account titles and enter 0 for the amounts.) ) Jul. 1 Debt livestments 186000 Interest Revenue 1240 Cash ) Sep.1 Cash 58656 Loss on Sale of Investments 564 Debt Investments Interest Revenue ) \begin{tabular}{|ll|} \hline Oct.1 & Cash \\ \hline \end{tabular} 14760 Interest Revenue Interest Revenue 14760 Interest Revenue ) Dec.31 Interest Receivable Interest Revenue (To record interest.) Unrealized Holding Gain or Loss - Equity 8620 Fair Value Adjustment (To record adjustment.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started