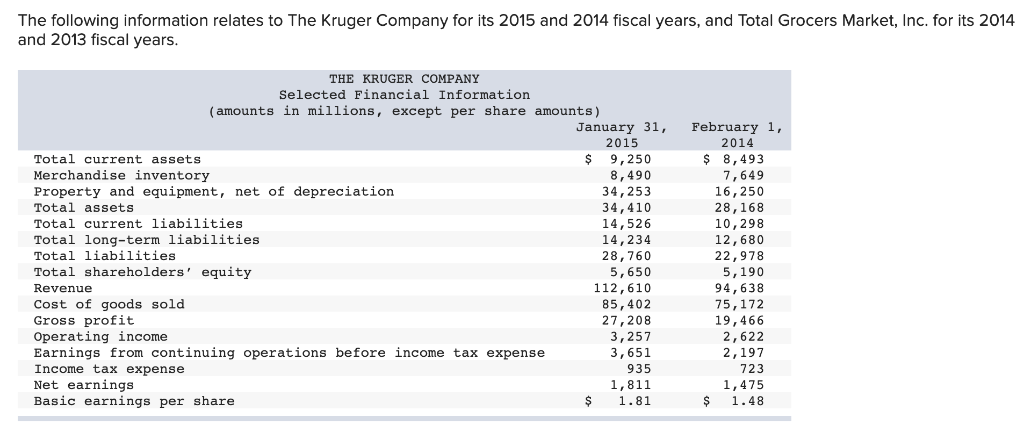

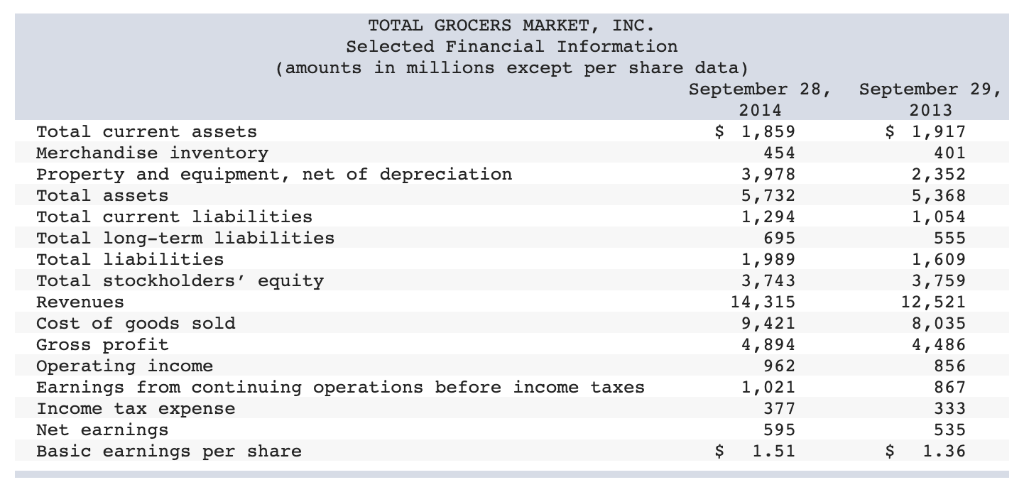

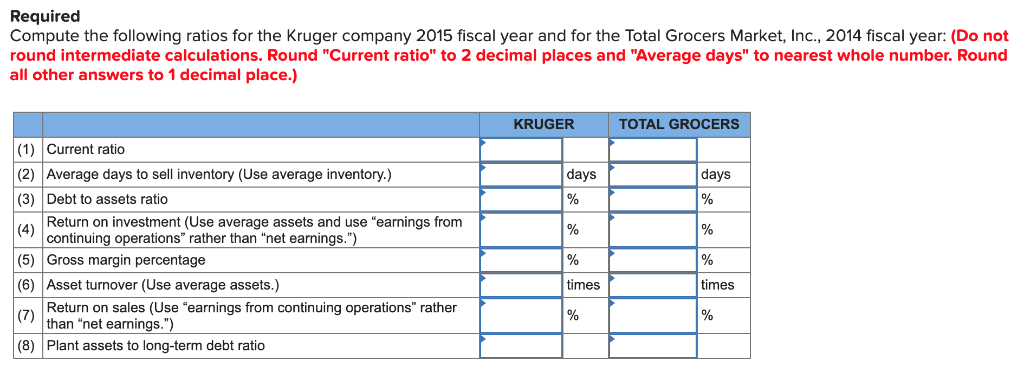

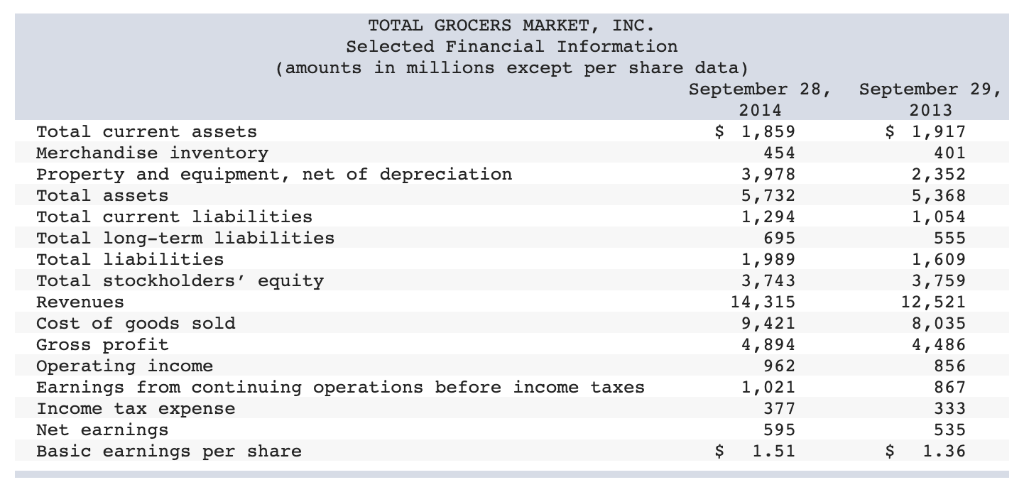

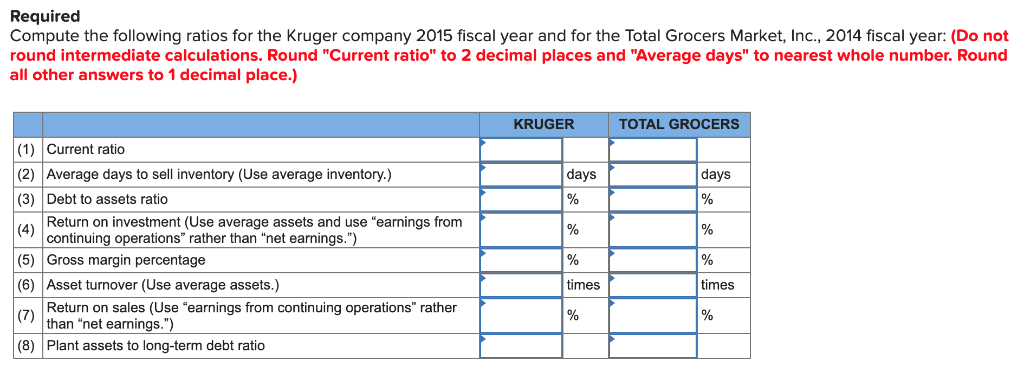

The following information relates to The Kruger Company for its 2015 and 2014 fiscal years, and Total Grocers Market, Inc. for its 2014 and 2013 fiscal years. THE KRUGER COMPANY Selected Financial Information (amounts in millions, except per share amounts) February 1, January 31, 2015 2014 $ 8,493 7,649 16,250 Total current assets 9,250 8,490 Merchandise inventory Property and equipment, net of depreciation 34,253 34,410 14,526 14,234 28,760 5,650 112,610 28,168 10,298 12,680 22,978 5,190 94,638 75,172 Total assets Total current liabilities Total long-term liabilities Total liabilities Total shareholders' equity Revenue Cost of goods sold Gross profit Operating income Earnings from continuing operations before income tax expense Income tax expense earnings Basic earnings per share 85,402 27,208 3,257 19,466 2,622 2.197 3,651 935 723 1,811 ,475 1.81 1.48 TOTAL GROCERS MARKET, INC. Selected Financial Information (amounts in millions except per share data) September 28, September 29, 2014 2013 Total current assets Merchandise inventory Property and equipment, net of depreciation Total assets $ 1,917 1,859 454 401 3,978 5,732 1,294 2,352 5,368 1,054 Total current liabilities Total long-term liabilities Total liabilities Total stockholders ' equity 695 555 1,989 3,743 14,315 1,609 3,759 12,521 8,035 4,486 856 Revenues Cost of goods sold Gross profit Operating income Earnings from continuing operations before income taxes Income tax expense Net earnings Basic earnings per share 9,421 4,894 962 1,021 867 377 333 595 535 1.36 1.51 Required Compute the following ratios for the Kruger company 2015 fiscal year and for the Total Grocers Market, Inc., 2014 fiscal year: (Do not round intermediate calculations. Round "Current ratio" to 2 decimal places and "Average days" to nearest whole number. Round all other answers to 1 decimal place.) KRUGER TOTAL GROCERS (1) Current ratio (2) Average days to sell inventory (Use average inventory.) days days (3) Debt to assets ratio % IAReturn on investment (Use average assets and use "earnings from continuing operations" rather than "net earnings.") (5) Gross margin percentage (6) Asset turnover (Use average assets.) Return on sales (Use "earnings from continuing operations" rather (7) than "net earnings.") % % % times times % (8) Plant assets to long-term debt ratio