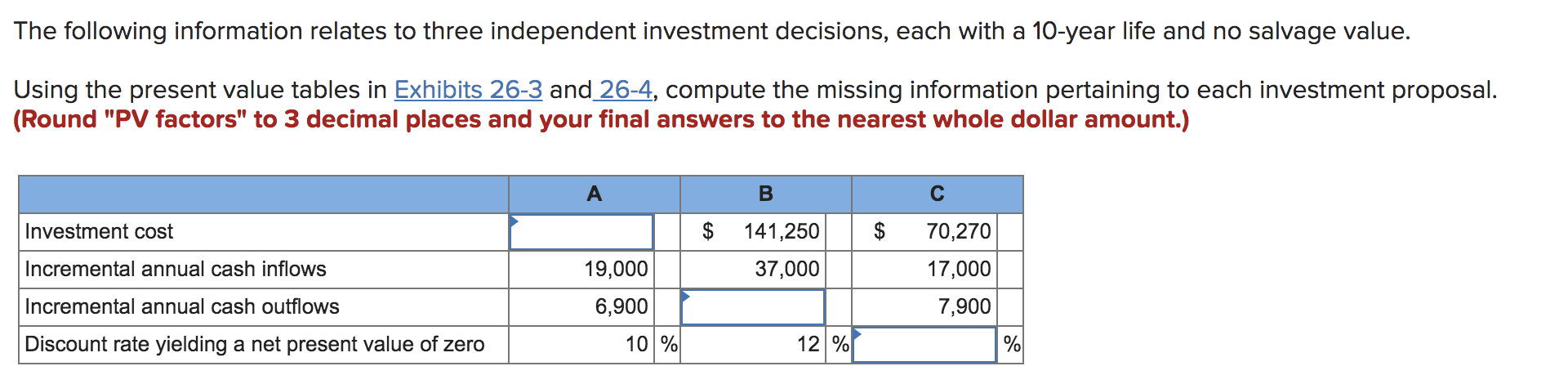

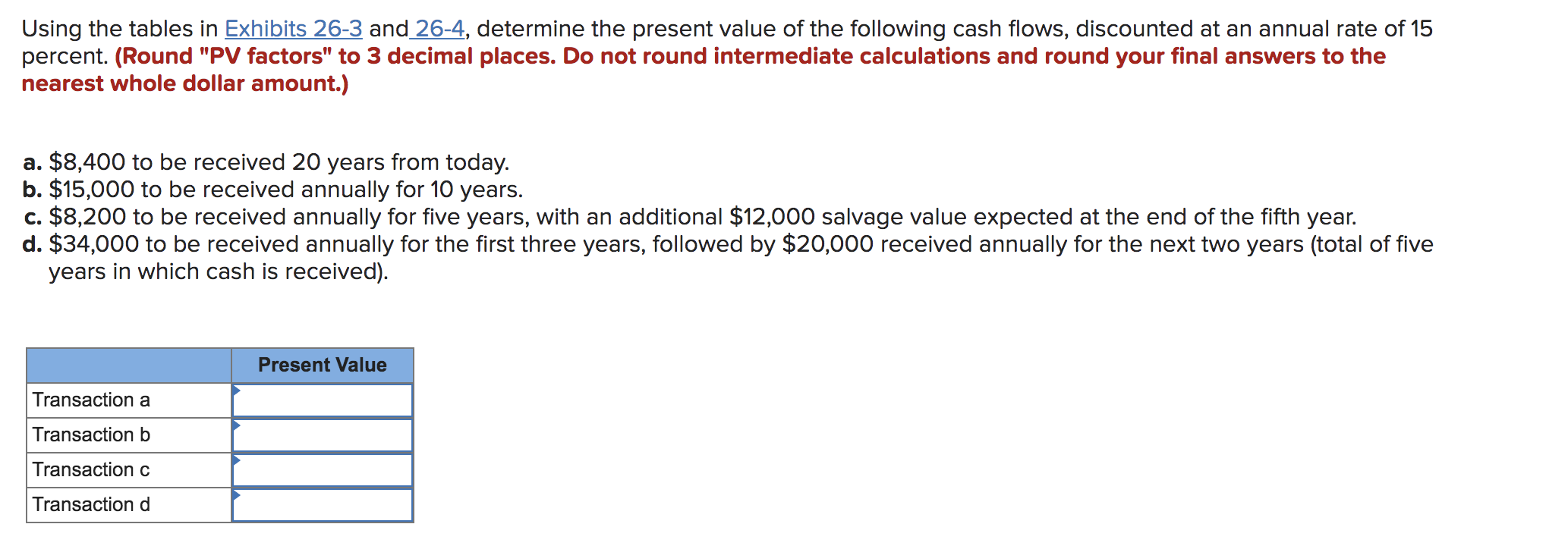

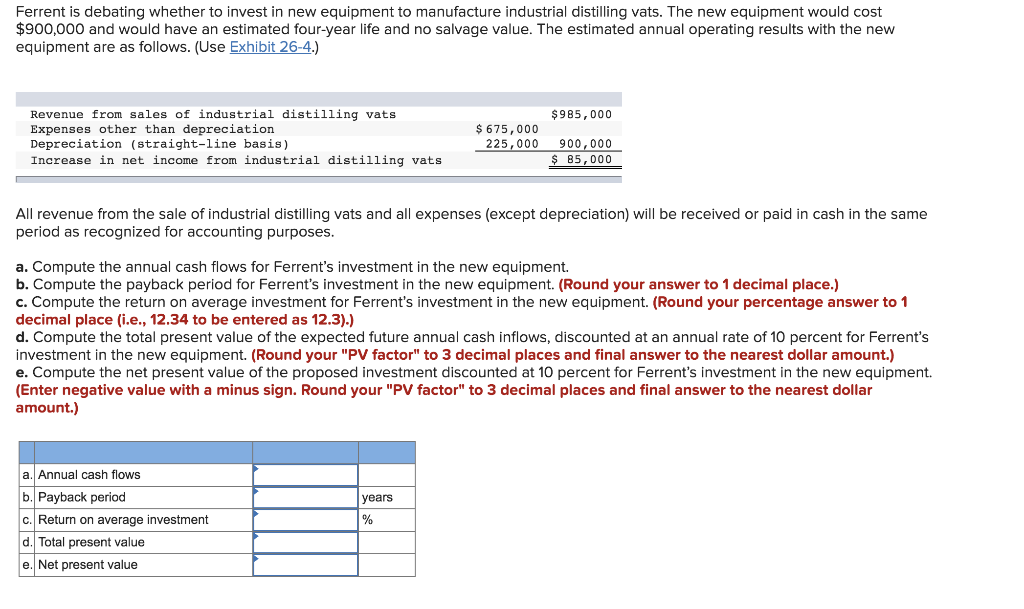

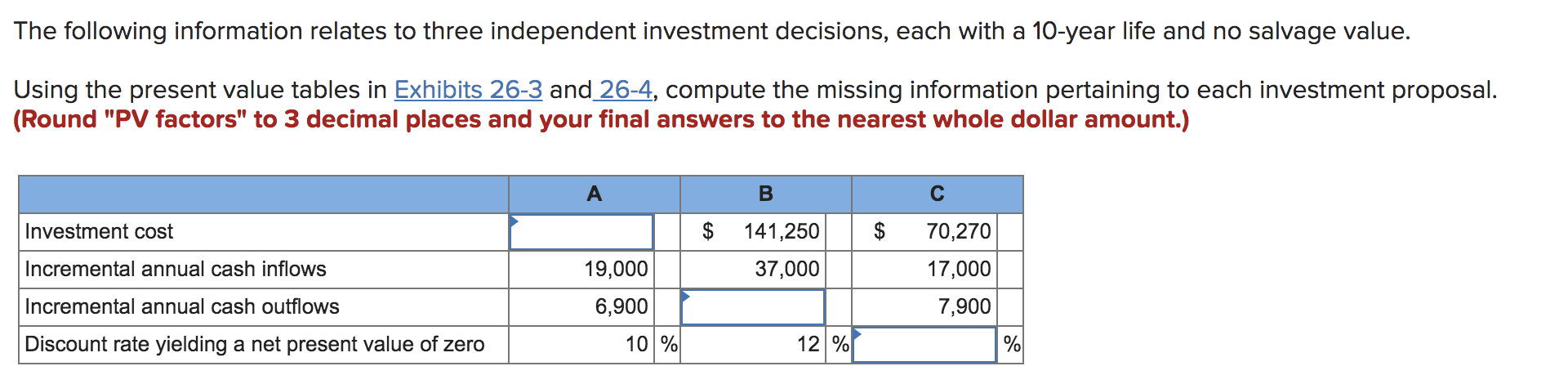

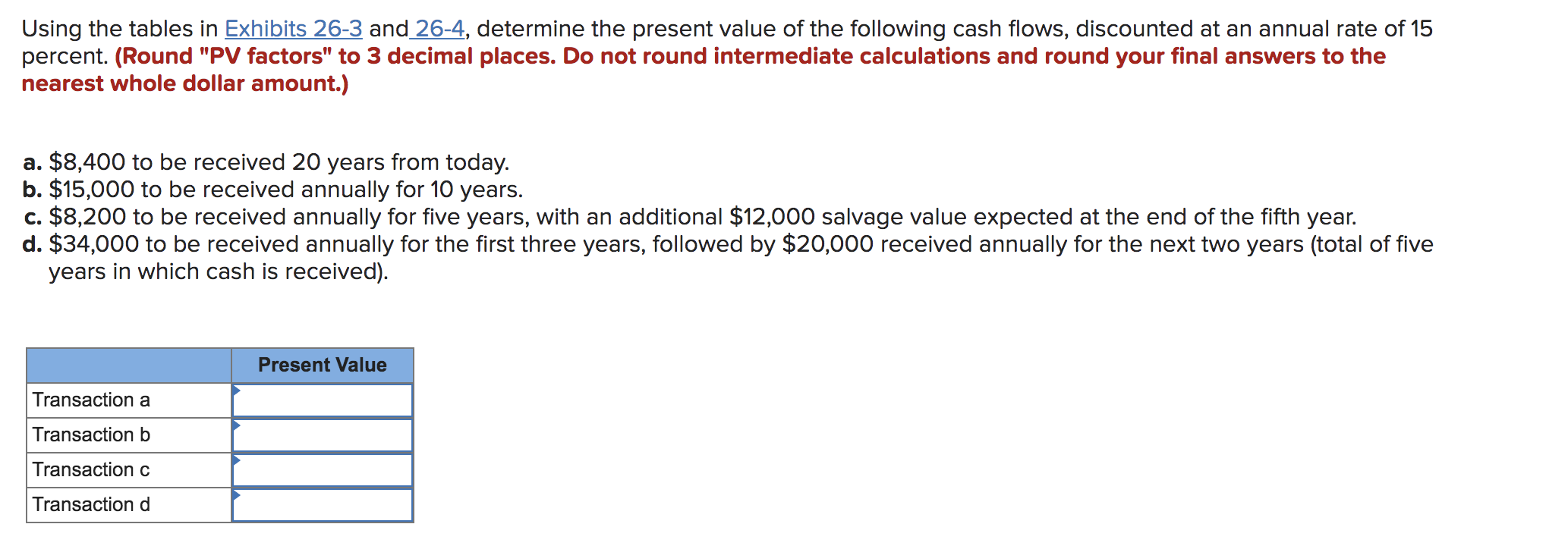

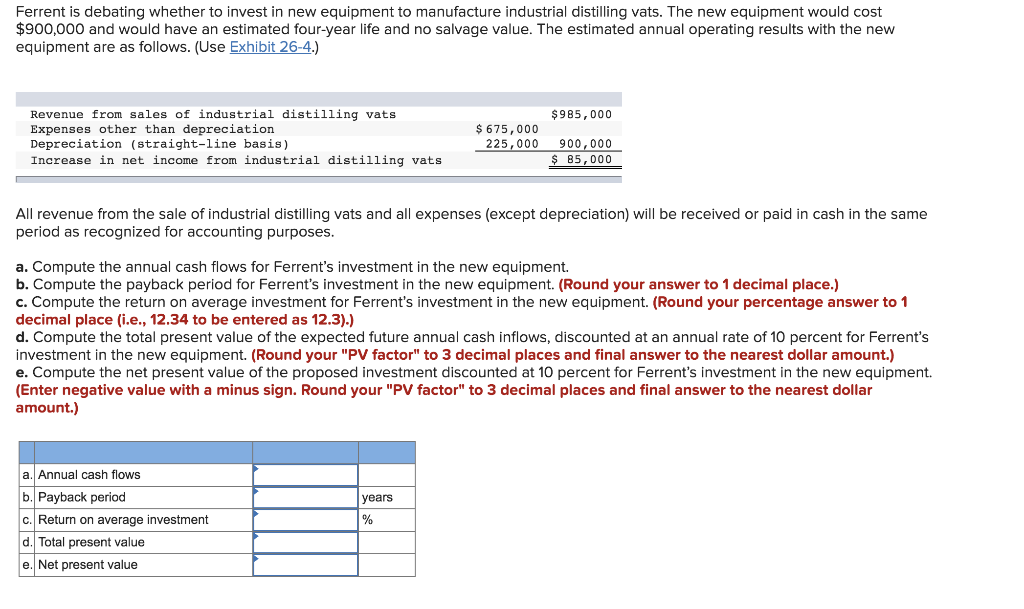

The following information relates to three independent investment decisions, each with a 10-year life and no salvage value. Using the present value tables in Exhibits 26-3 and 26-4, compute the missing information pertaining to each investment proposal. (Round "PV factors" to 3 decimal places and your final answers to the nearest whole dollar amount.) A B Investment cost $ $ 141,250 37,000 Incremental annual cash inflows 19,000 6,900 70,270 17,000 7,900 Incremental annual cash outflows Discount rate yielding a net present value of zero 10% 12 % % Using the tables in Exhibits 26-3 and 26-4, determine the present value of the following cash flows, discounted at an annual rate of 15 percent. (Round "PV factors" to 3 decimal places. Do not round intermediate calculations and round your final answers to the nearest whole dollar amount.) a. $8,400 to be received 20 years from today. b. $15,000 to be received annually for 10 years. c. $8,200 to be received annually for five years, with an additional $12,000 salvage value expected at the end of the fifth year. d. $34,000 to be received annually for the first three years, followed by $20,000 received annually for the next two years (total of five years in which cash is received). Present Value Transaction a Transaction b Transaction c Transaction d Ferrent is debating whether to invest in new equipment to manufacture industrial distilling vats. The new equipment would cost $900,000 and would have an estimated four-year life and no salvage value. The estimated annual operating results with the new equipment are as follows. (Use Exhibit 26-4.) $985,000 Revenue from sales of industrial distilling vats Expenses other than depreciation Depreciation (straight-line basis) Increase in net income from industrial distilling vats $ 675,000 225,000 900,000 $ 85,000 All revenue from the sale of industrial distilling vats and all expenses (except depreciation) will be received or paid in cash in the same period as recognized for accounting purposes. a. Compute the annual cash flows for Ferrent's investment in the new equipment. b. Compute the payback period for Ferrent's investment in the new equipment. (Round your answer to 1 decimal place.) c. Compute the return on average investment for Ferrent's investment in the new equipment. (Round your percentage answer to 1 decimal place (i.e., 12.34 to be entered as 12.3).) d. Compute the total present value of the expected future annual cash inflows, discounted at an annual rate of 10 percent for Ferrent's investment in the new equipment. (Round your "PV factor" to 3 decimal places and final answer to the nearest dollar amount.) e. Compute the net present value of the proposed investment discounted at 10 percent for Ferrent's investment in the new equipment. (Enter negative value with a minus sign. Round your "PV factor" to 3 decimal places and final answer to the nearest dollar amount.) years a. Annual cash flows b. Payback period c. Return on average investment d. Total present value e. Net present value %