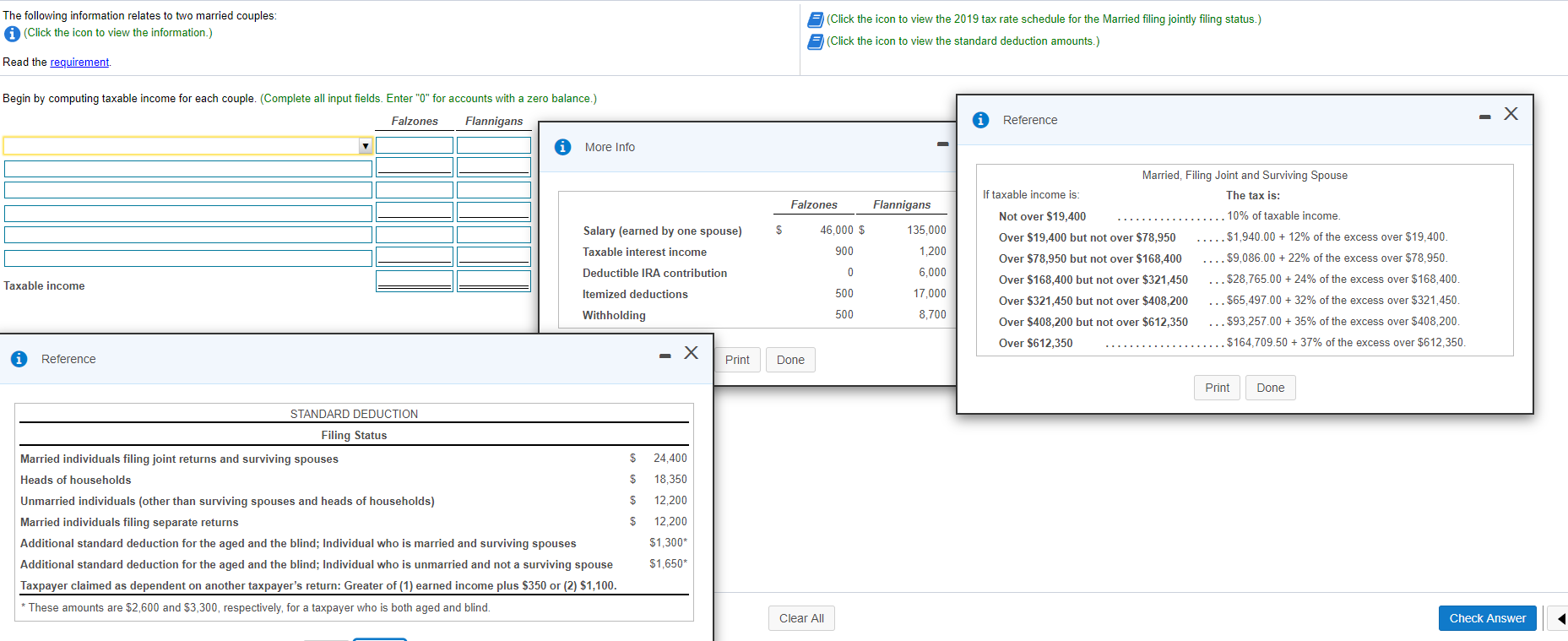

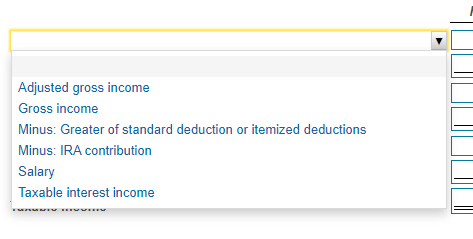

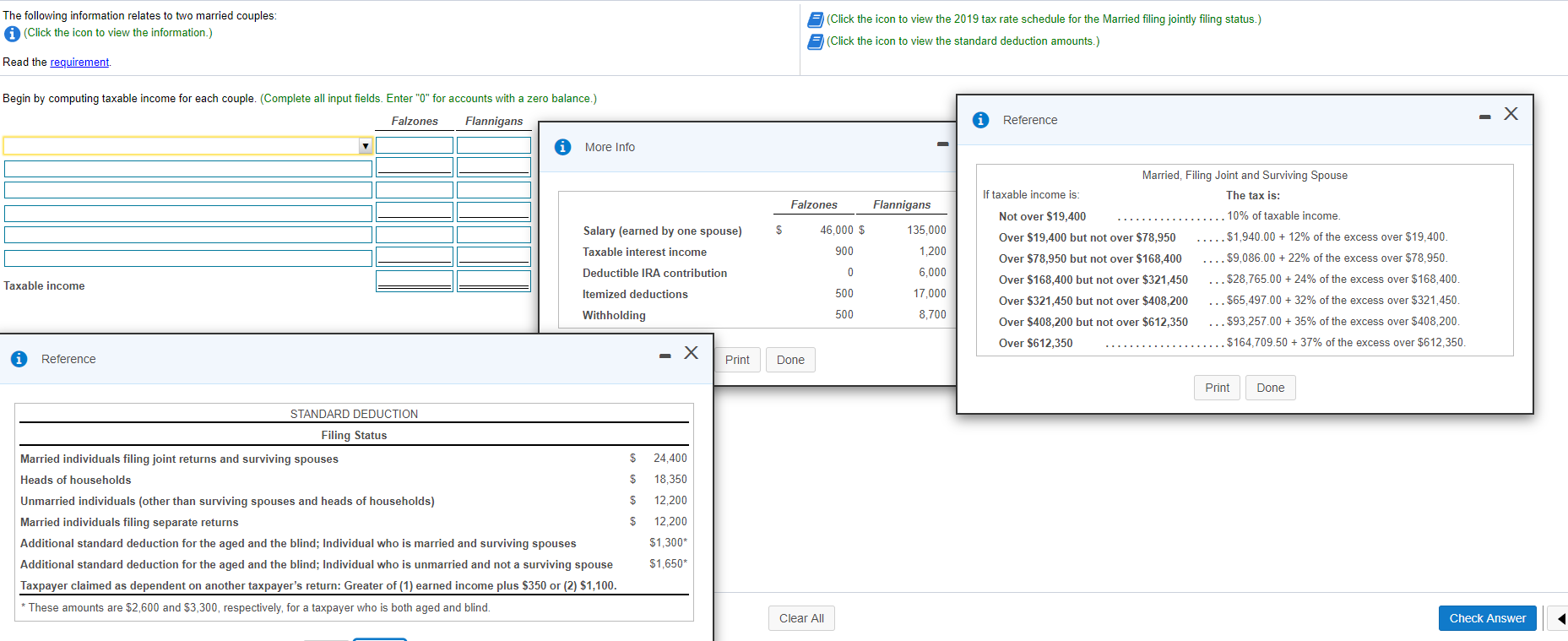

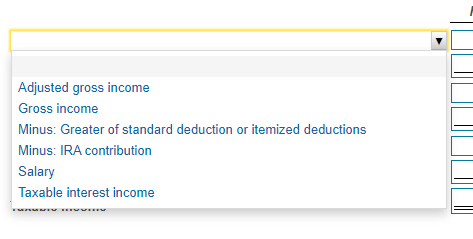

The following information relates to two married couples: (Click the icon to view the information.) 3 (Click the icon to view the 2019 tax rate schedule for the Married filing jointly filing status.) (Click the icon to view the standard deduction amounts.) Read the requirement. Begin by computing taxable income for each couple. (Complete all input fields. Enter "0" for accounts with a zero balance.) Falzones Flannigans Reference More Info Falzones Flannigans $ 46,000 $ 135,000 Salary (earned by one spouse) Taxable interest income Deductible IRA contribution 900 1.200 Married, Filing Joint and Surviving Spouse If taxable income is The tax is: Not over $19,400 10% of taxable income. Over $19,400 but not over $78,950 ..... $1,940.00 + 12% of the excess over $19,400. Over $78,950 but not over $168,400 ..... $9,086.00 + 22% of the excess over $78,950. Over $168,400 but not over $321,450 ... $28,765.00 + 24% of the excess over $168,400 Over $321,450 but not over $408,200 ... $65,497.00 + 32% of the excess over $321,450. Over $408,200 but not over $612,350 . $93,257.00 + 35% of the excess over $408,200 Over $612,350 $164,709.50 + 37% of the excess over $612,350. 0 6.000 Taxable income Itemized deductions 500 17,000 Withholding 500 8,700 Reference - X Print Done Print Done STANDARD DEDUCTION Filing Status $ 24.400 $ 18,350 $ 12,200 $ 12.200 Married individuals filing joint returns and surviving spouses Heads of households Unmarried individuals (other than surviving spouses and heads of households) Married individuals filing separate returns Additional standard deduction for the aged and the blind; Individual who is married and surviving spouses Additional standard deduction for the aged and the blind; Individual who is unmarried and not a surviving spouse Taxpayer claimed as dependent on another taxpayer's return: Greater of (1) earned income plus $350 or (2) $1,100. * These amounts are $2,600 and $3,300, respectively, for a taxpayer who is both aged and blind. $1,300* $1,650* Clear All Check Answer Adjusted gross income Gross income Minus: Greater of standard deduction or itemized deductions Minus: IRA contribution Salary Taxable interest income