Question

The following information relates to XY Ltd: a. It is expected that the cash balance on 31 May will be GH 22,000. b. The wages

The following information relates to XY Ltd:

a. It is expected that the cash balance on 31 May will be GH 22,000.

b. The wages may be assumed to be paid within the month they are incurred.

c. It is company policy to pay suppliers for materials three months after receipt.

d. Credit customers are expected to pay two months after delivery.

e. Included in the overhead figure is GH 2,000 per month which represents depreciation on two cars and one delivery van.

f. There is a one-month delay in paying the overhead expenses.

g. Ten per cent of the monthly sales are for cash and 90 per cent are sold on credit.

h. A commission of 5 per cent is paid to agents on all the sales on credit but this is not paid until the month following the sales to which it relates; this expense is not included in the overhead figures shown.

i. It is intended to repay a loan of GH 25,000 on 30 June.

j. Delivery is expected in July of a new machine costing GH 45,000 of which GH 15,000 will be paid on delivery and GH 15,000 in each of the following two months.

You are required to prepare a cash budget for each of June, July and August.

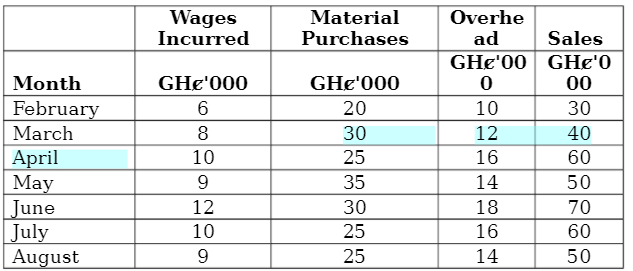

Wages Incurred Material Purchases Month February March April May June July August GHE'000 6 8 10 9 12 10 9 GHc'000 20 30 25 35 30 25 25 Overhe ad Sales GHe'00 GHe'O 0 00 10 30 12 40 16 60 14 50 18 70 16 60 14 50 9Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started