Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following information relating to an investment in equipment has been extracted from the books of LRB Ltd: The total purchase price is $77,930. Net

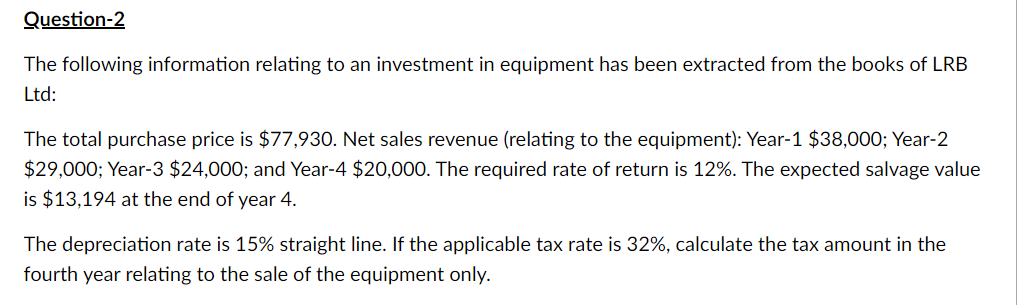

The following information relating to an investment in equipment has been extracted from the books of LRB Ltd: The total purchase price is $77,930. Net sales revenue (relating to the equipment): Year- 1$38,000; Year-2 $29,000; Year-3 $24,000; and Year-4 $20,000. The required rate of return is 12%. The expected salvage value is $13,194 at the end of year 4 . The depreciation rate is 15% straight line. If the applicable tax rate is 32%, calculate the tax amount in the fourth year relating to the sale of the equipment only

The following information relating to an investment in equipment has been extracted from the books of LRB Ltd: The total purchase price is $77,930. Net sales revenue (relating to the equipment): Year- 1$38,000; Year-2 $29,000; Year-3 $24,000; and Year-4 $20,000. The required rate of return is 12%. The expected salvage value is $13,194 at the end of year 4 . The depreciation rate is 15% straight line. If the applicable tax rate is 32%, calculate the tax amount in the fourth year relating to the sale of the equipment only Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started