Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following information shows Carperk Company's individual Investments in securities during its current year, along with the December 31 fair values, a. Investment in Brava

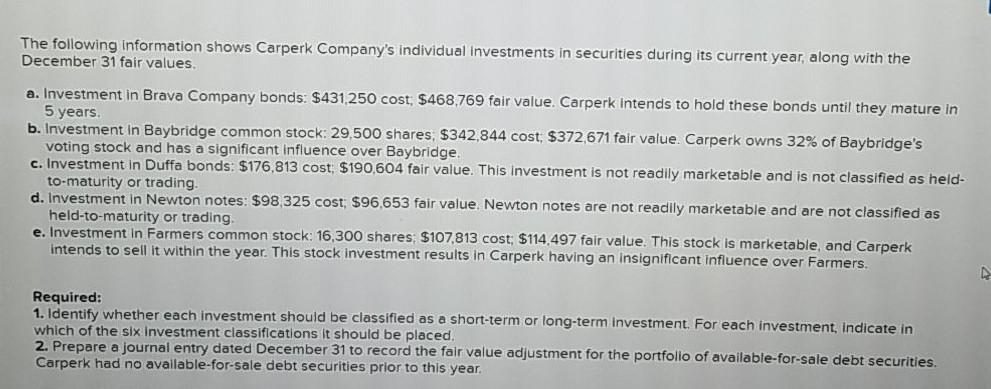

The following information shows Carperk Company's individual Investments in securities during its current year, along with the December 31 fair values, a. Investment in Brava Company bonds: $431,250 cost, $468,769 fair value. Carperk Intends to hold these bonds until they mature in 5 years b. Investment In Baybridge common stock: 29,500 shares, $342,844 cost, $372,671 fair value. Carperk owns 32% of Baybridge's voting stock and has a significant influence over Baybridge, c. Investment in Duffa bonds: $176,813 cost: $190.604 fair value. This investment is not readily marketable and is not classified as held- to-maturity or trading d. Investment in Newton notes: $98,325 cost; $96.653 fair value, Newton notes are not readily marketable and are not classified as held-to-maturity or trading. e. Investment in Farmers common stock: 16,300 shares: $107,813 cost; $114,497 fair value. This stock is marketable, and Carperk Intends to sell it within the year. This stock investment results in Carperk having an insignificant influence over Farmers. Required: 1. Identify whether each investment should be classified as a short-term or long-term Investment. For each investment, indicate in which of the six Investment classifications it should be placed. 2. Prepare a journal entry dated December 31 to record the fair value adjustment for the portfolio of available-for-sale debt securities. Carperk had no available-for-sale debt securities prior to this year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started