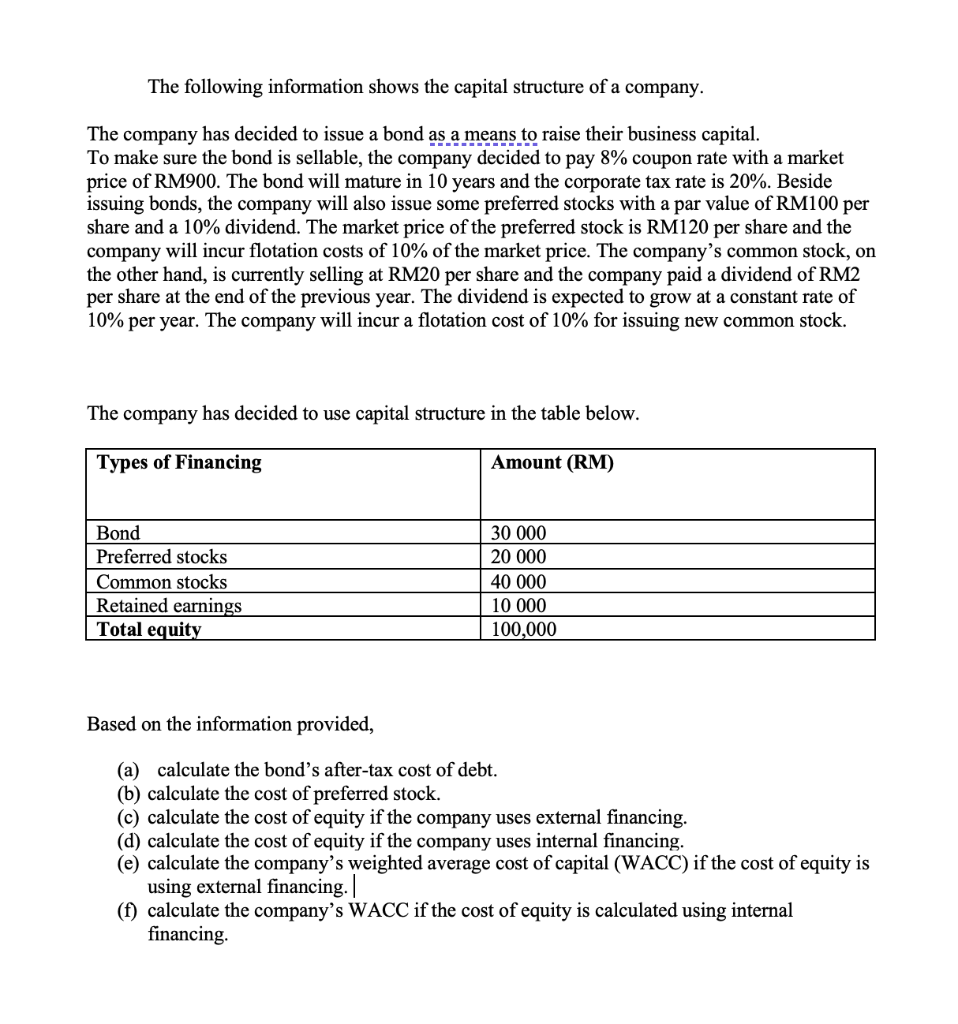

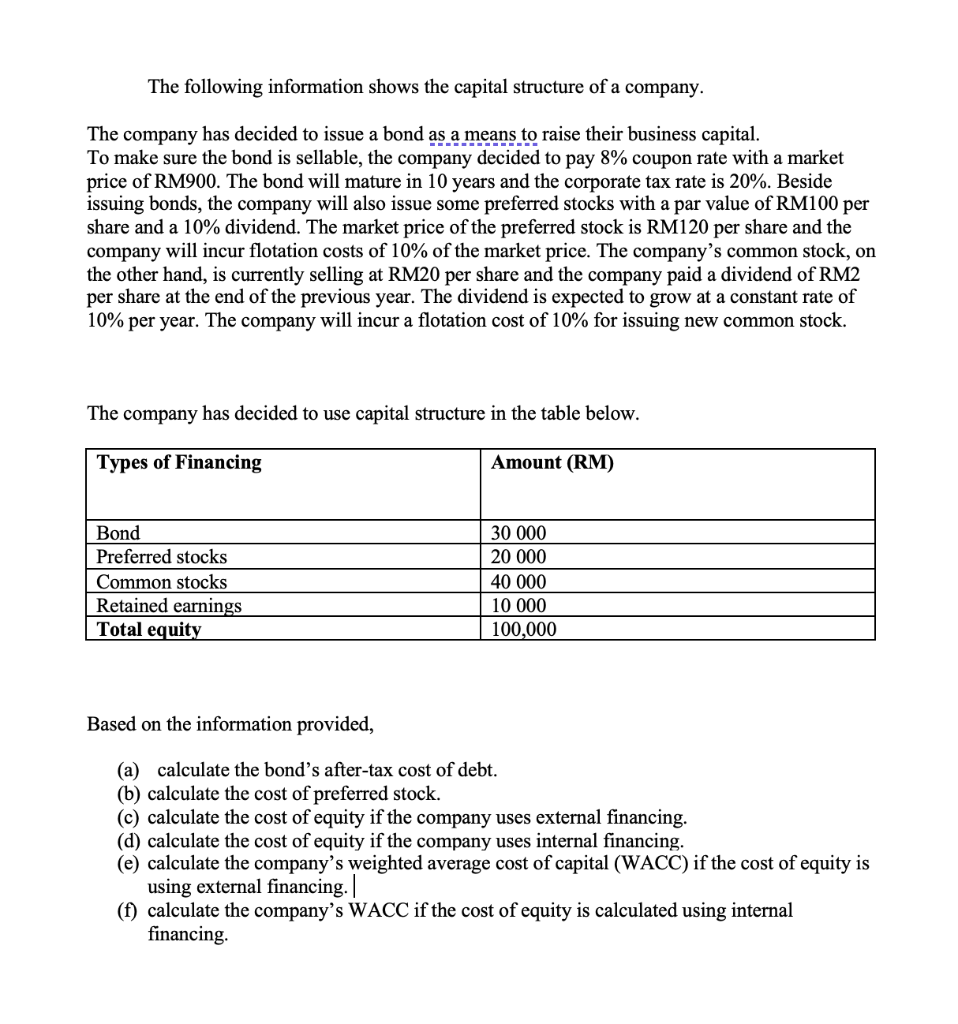

The following information shows the capital structure of a company. The company has decided to issue a bond as a means to raise their business capital. To make sure the bond is sellable, the company decided to pay 8% coupon rate with a market price of RM900. The bond will mature in 10 years and the corporate tax rate is 20%. Beside issuing bonds, the company will also issue some preferred stocks with a par value of RM100 per share and a 10% dividend. The market price of the preferred stock is RM120 per share and the company will incur flotation costs of 10% of the market price. The company's common stock, on the other hand, is currently selling at RM20 per share and the company paid a dividend of RM2 per share at the end of the previous year. The dividend is expected to grow at a constant rate of 10% per year. The company will incur a flotation cost of 10% for issuing new common stock. The company has decided to use capital structure in the table below. Types of Financing Amount (RM) Bond Preferred stocks Common stocks Retained earnings Total equity 30 000 20 000 40 000 10 000 100,000 Based on the information provided, (a) calculate the bond's after-tax cost of debt. (b) calculate the cost of preferred stock. (C) calculate the cost of equity if the company uses external financing. (d) calculate the cost of equity if the company uses internal financing. (e) calculate the company's weighted average cost of capital (WACC) if the cost of equity is using external financing. (f) calculate the company's WACC if the cost of equity is calculated using internal financing The following information shows the capital structure of a company. The company has decided to issue a bond as a means to raise their business capital. To make sure the bond is sellable, the company decided to pay 8% coupon rate with a market price of RM900. The bond will mature in 10 years and the corporate tax rate is 20%. Beside issuing bonds, the company will also issue some preferred stocks with a par value of RM100 per share and a 10% dividend. The market price of the preferred stock is RM120 per share and the company will incur flotation costs of 10% of the market price. The company's common stock, on the other hand, is currently selling at RM20 per share and the company paid a dividend of RM2 per share at the end of the previous year. The dividend is expected to grow at a constant rate of 10% per year. The company will incur a flotation cost of 10% for issuing new common stock. The company has decided to use capital structure in the table below. Types of Financing Amount (RM) Bond Preferred stocks Common stocks Retained earnings Total equity 30 000 20 000 40 000 10 000 100,000 Based on the information provided, (a) calculate the bond's after-tax cost of debt. (b) calculate the cost of preferred stock. (C) calculate the cost of equity if the company uses external financing. (d) calculate the cost of equity if the company uses internal financing. (e) calculate the company's weighted average cost of capital (WACC) if the cost of equity is using external financing. (f) calculate the company's WACC if the cost of equity is calculated using internal financing