Answered step by step

Verified Expert Solution

Question

1 Approved Answer

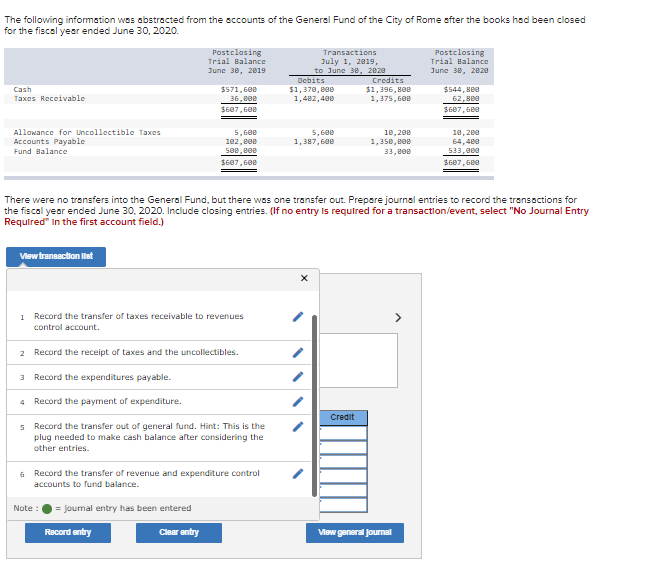

The following information was abstracted from the accounts of the General Fund of the City of Rome after the books had been closed for

The following information was abstracted from the accounts of the General Fund of the City of Rome after the books had been closed for the fiscal year ended June 30, 2020. Postclosing Trial Balance June 30, 2019 Transactions July 1, 2019, to June 30, 2828 Cash Taxes Receivable $571,600 36,000 Debits $1,370,000 Credits $1,396,800 1,482,400 1,375,600 $607,600 Postclosing Trial Balance June 30, 2828 $544,800 62,800 $607,600 Allowance for Uncollectible Taxes Accounts Payable 5,600 102,000 5,600 1,387,600 10,200 10,200 Fund Balance 500,000 $607,600 1,350,000 33,000 64,400 533,000 $687,600 There were no transfers into the General Fund, but there was one transfer out. Prepare journal entries to record the transactions for the fiscal year ended June 30, 2020. Include closing entries. (If no entry is required for a transaction/event, select "No Journal Entry Required" In the first account field.) View transaction let 1 Record the transfer of taxes receivable to revenues control account. 2 Record the receipt of taxes and the uncollectibles. 3 Record the expenditures payable. 4 Record the payment of expenditure. 5 Record the transfer out of general fund. Hint: This is the plug needed to make cash balance after considering the other entries. 6 Record the transfer of revenue and expenditure control accounts to fund balance. =journal entry has been entered Note: Record entry Clear entry x Credit View general journal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started