Answered step by step

Verified Expert Solution

Question

1 Approved Answer

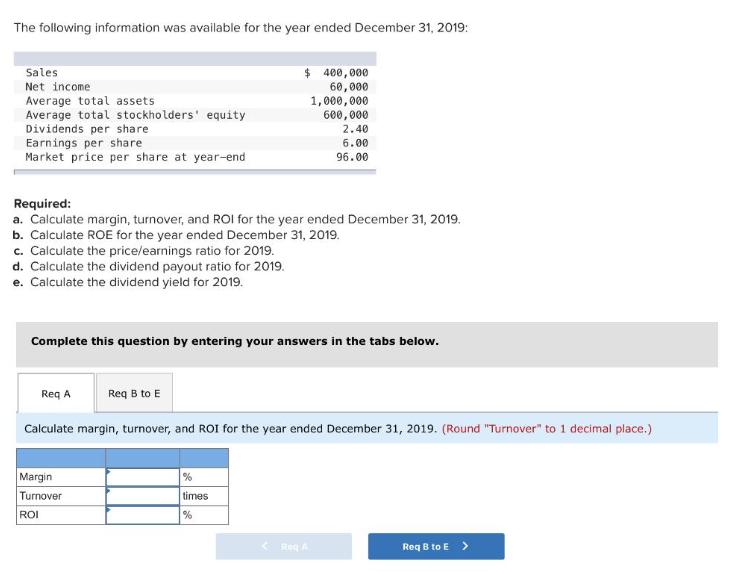

The following information was available for the year ended December 31, 2019: Sales Net income Average total assets Average total stockholders' equity Dividends per

The following information was available for the year ended December 31, 2019: Sales Net income Average total assets Average total stockholders' equity Dividends per share Earnings per share Market price per share at year-end $ 400,000 60,000 Required: a. Calculate margin, turnover, and ROI for the year ended December 31, 2019. b. Calculate ROE for the year ended December 31, 2019. c. Calculate the price/earnings ratio for 2019. d. Calculate the dividend payout ratio for 2019. e. Calculate the dividend yield for 2019. Margin Turnover ROI 1,000,000 600,000 Complete this question by entering your answers in the tabs below. Req B to E 2.40 6.00 96.00 Req A Calculate margin, turnover, and ROI for the year ended December 31, 2019. (Round "Turnover" to 1 decimal place.) % times % Req B to E> es The following information was available for the year ended December 31, 2019: Sales Net income Average total assets. Average total stockholders' equity Dividends per share Earnings per share Market price per share at year-end c. Calculate the price/earnings ratio for 2019. d. Calculate the dividend payout ratio for 2019. e. Calculate the dividend yield for 2019. Required: a. Calculate margin, turnover, and ROI for the year ended December 31, 2019. b. Calculate ROE for the year ended December 31, 2019. Req A e. Req B to E Complete this question by entering your answers in the tabs below. b. ROE C. Price/Earning ratio d. Dividend payout ratio Dividend yield $ 400,000 60,000 b. Calculate ROE for the year ended December 31, 2019. c. Calculate the price/earnings ratio for 2019. d. Calculate the dividend payout ratio for 2019. e. Calculate the dividend yield for 2019. (Round your answer to 1 decimal place.). % 1,000,000 600,000 % % 2.40 6.00 96.00 Req A Reg B to E > Show less A

Step by Step Solution

★★★★★

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

MarginNet operating incomeSales 60000400000 15 TurnoverSalesAve...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started