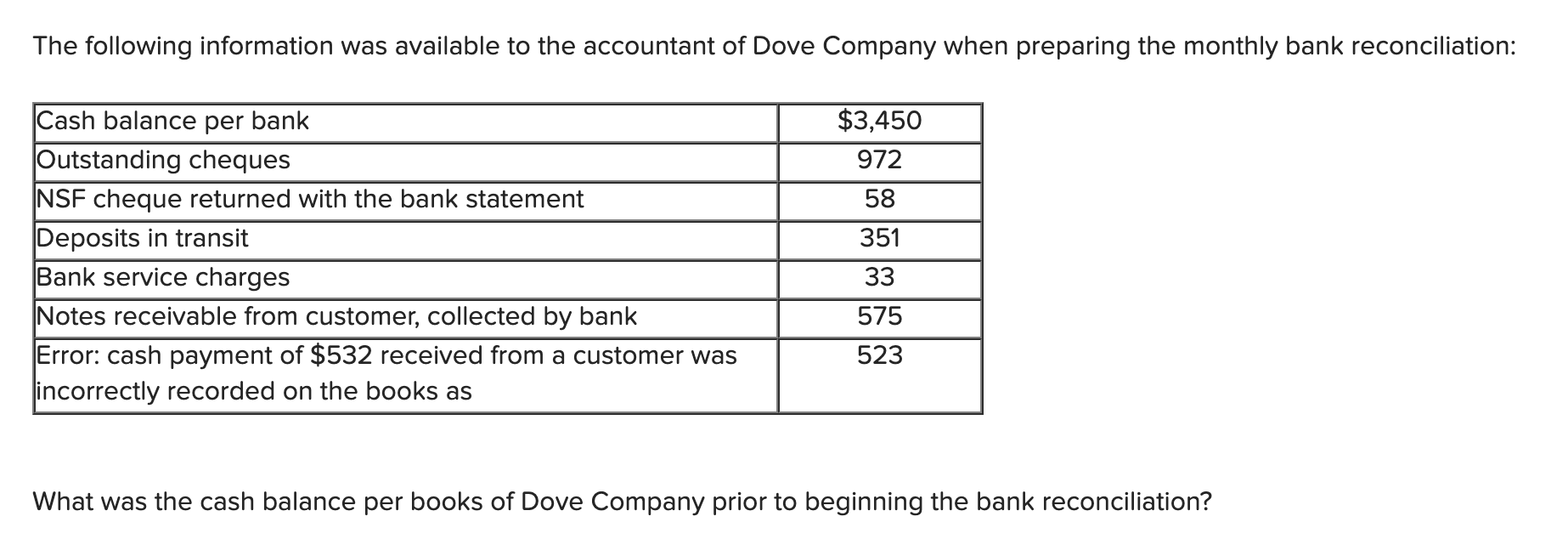

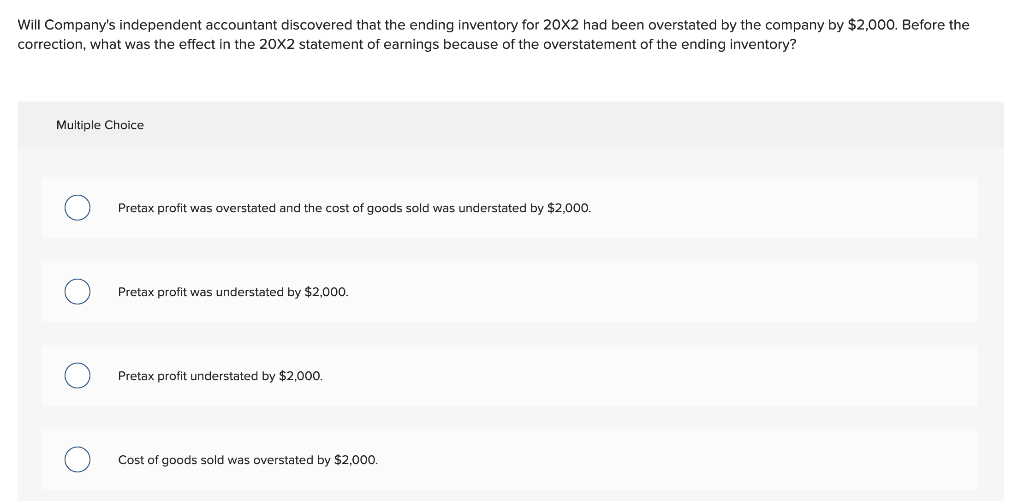

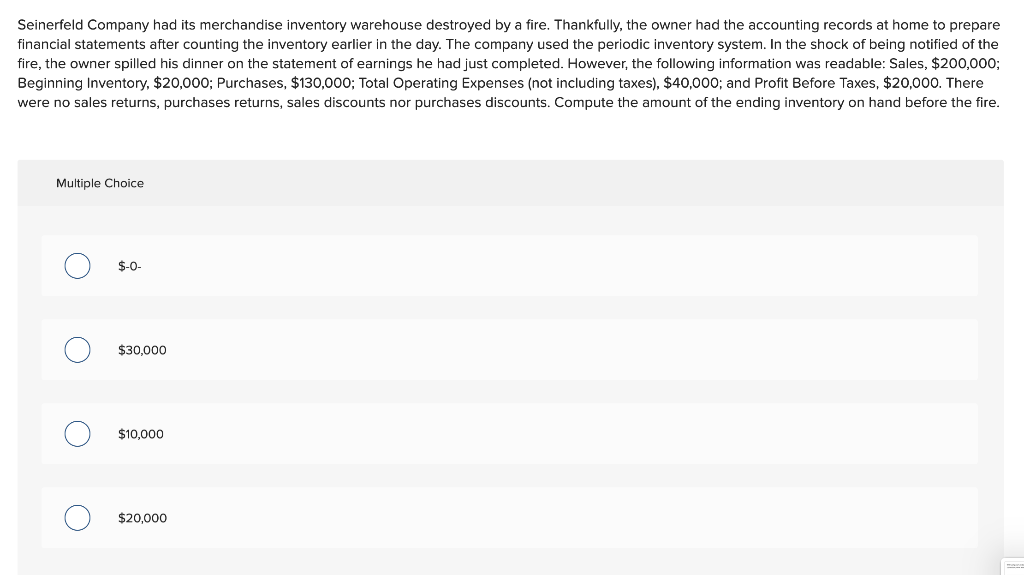

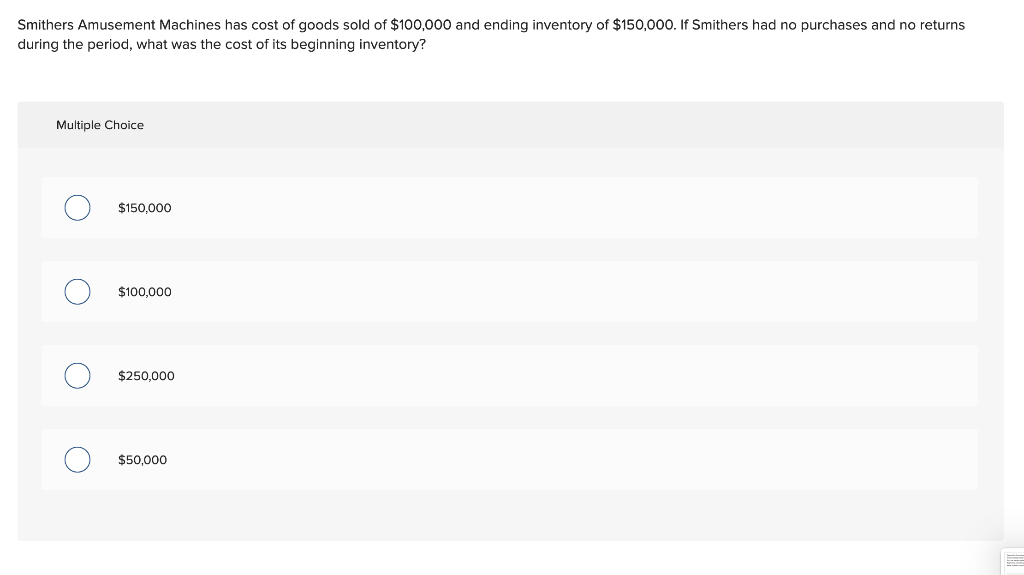

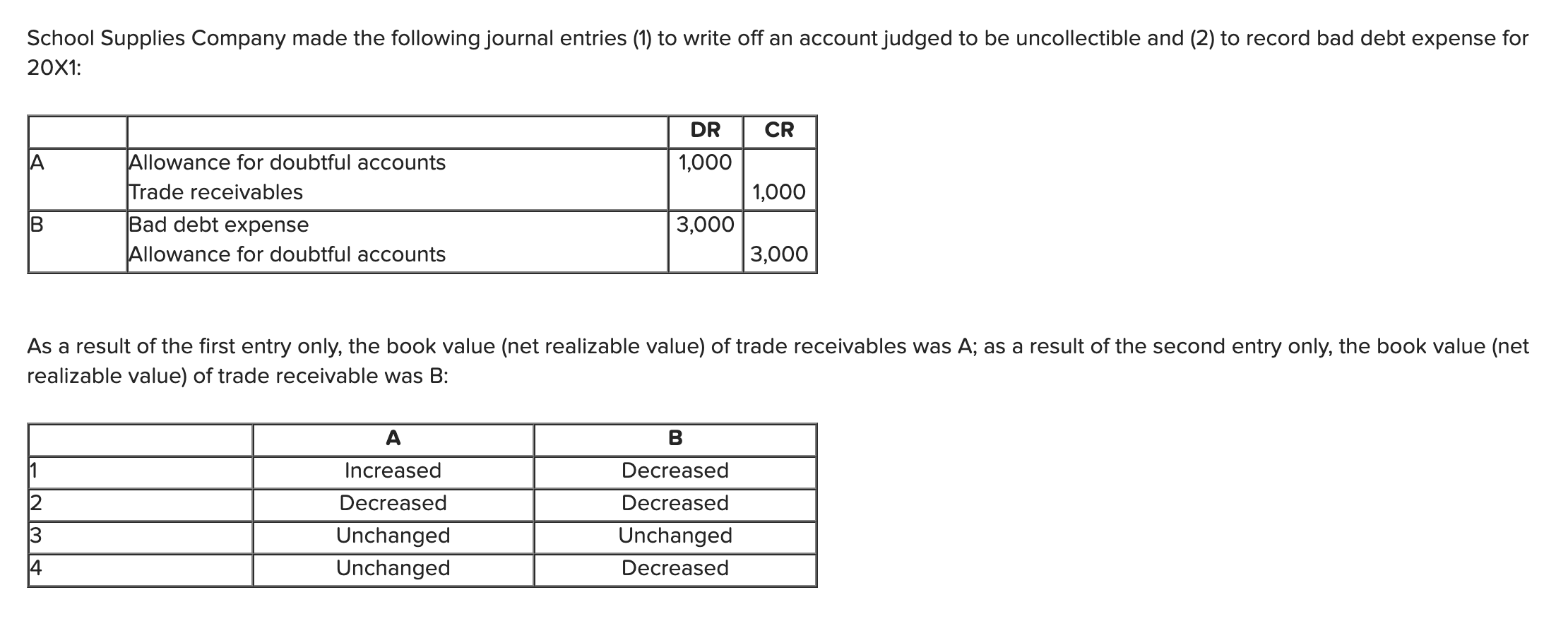

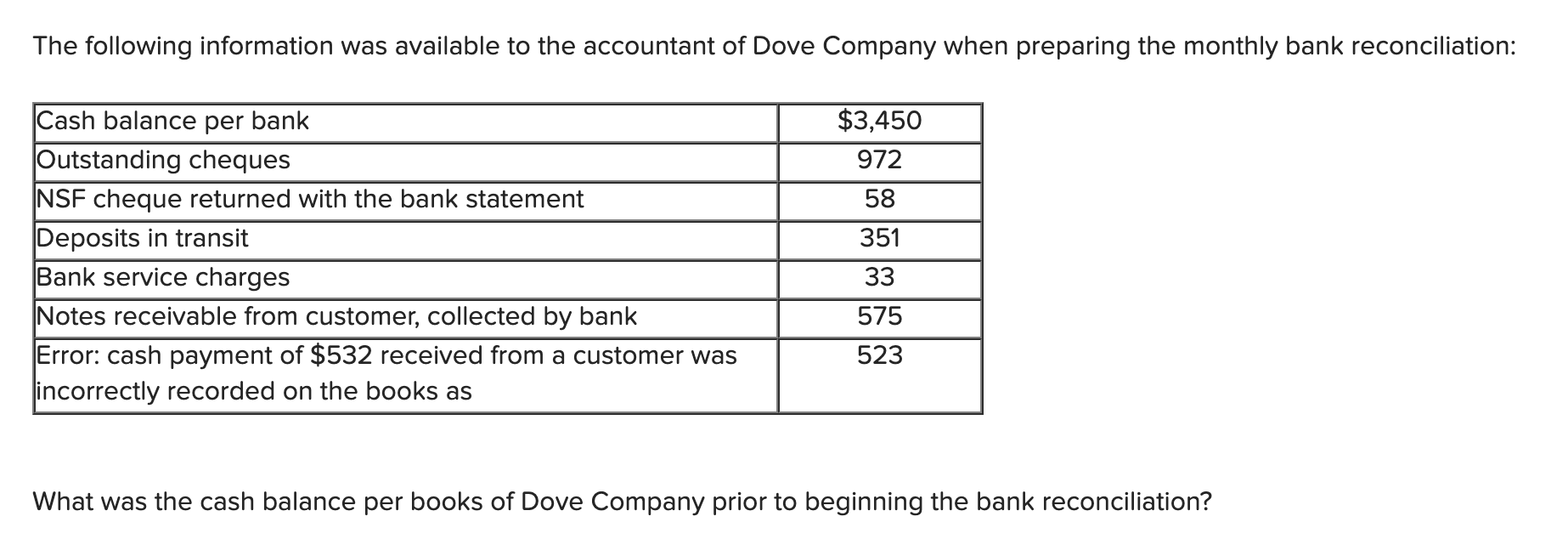

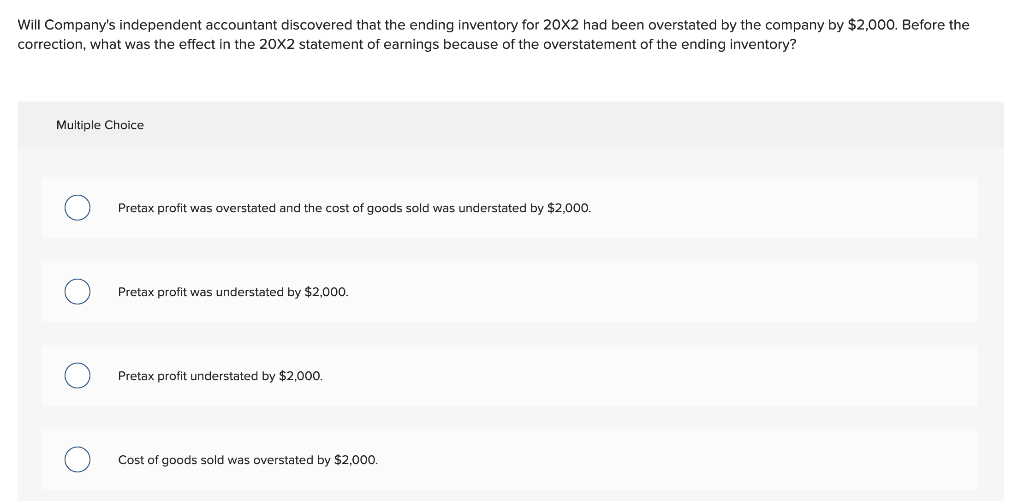

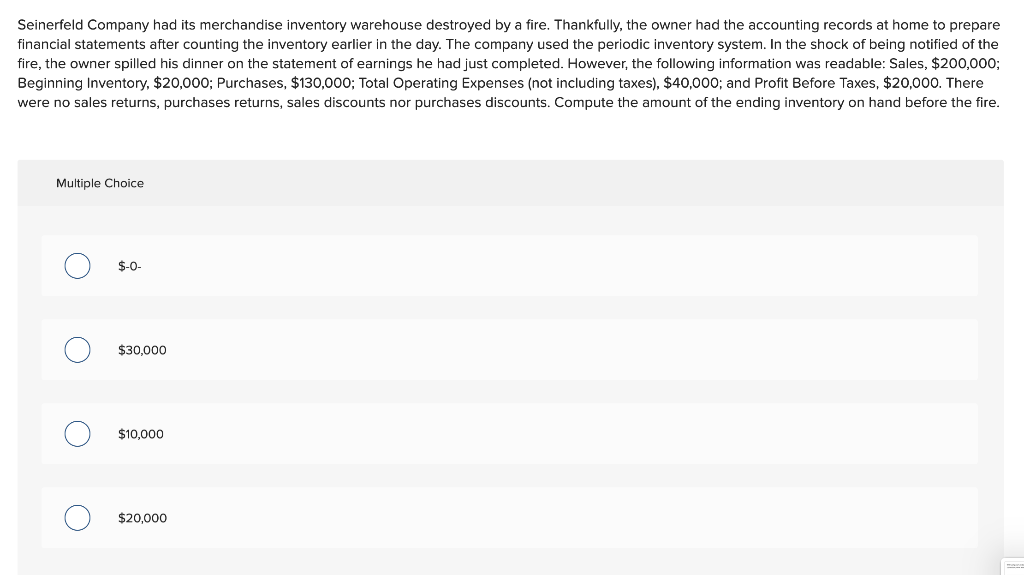

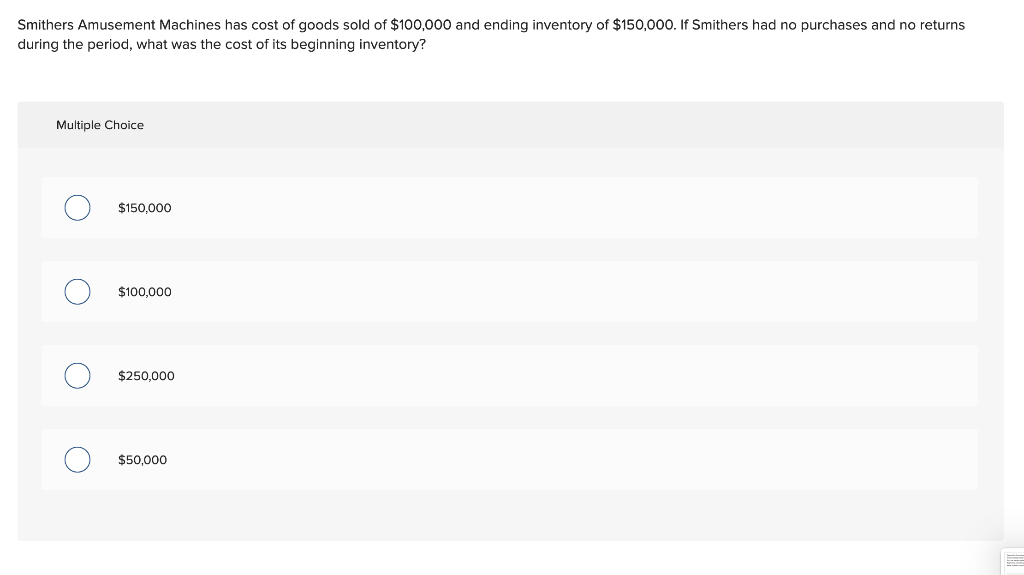

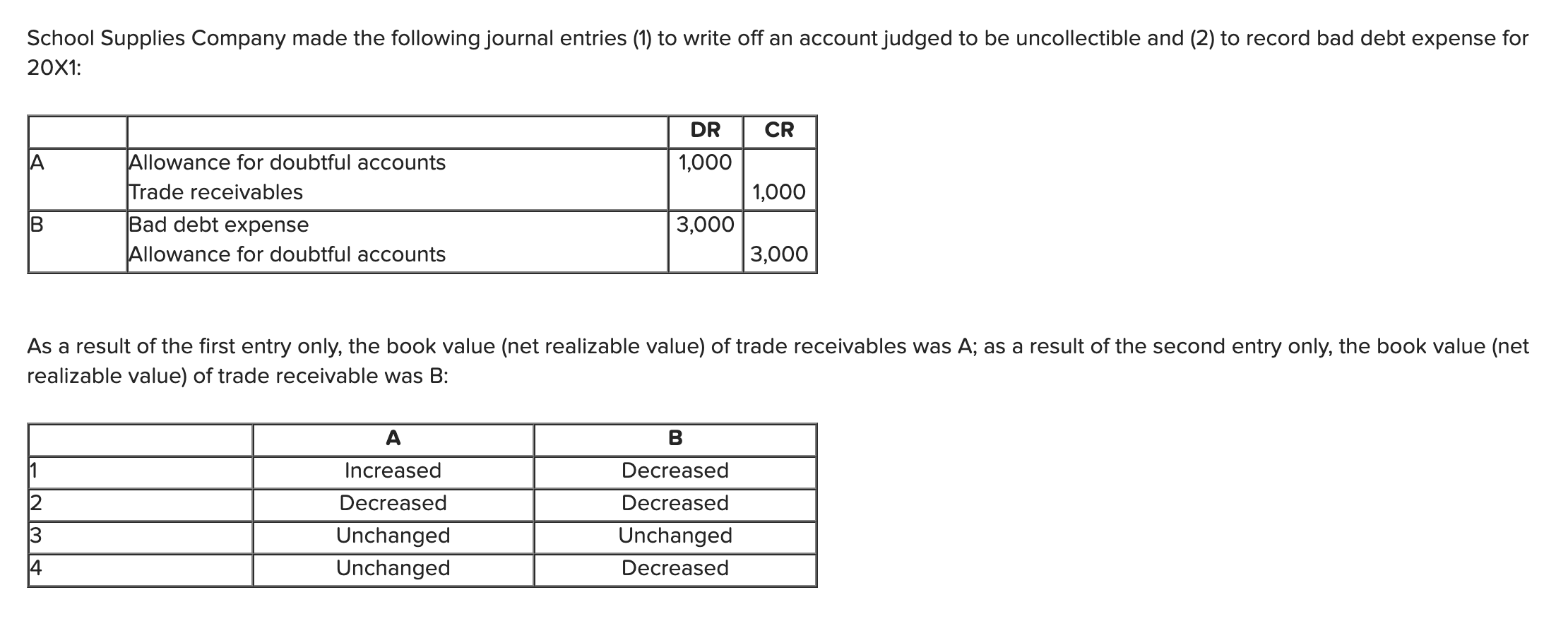

The following information was available to the accountant of Dove Company when preparing the monthly bank reconciliation: Cash balance per bank Outstanding cheques NSF cheque returned with the bank statement Deposits in transit Bank service charges Notes receivable from customer, collected by bank Error: cash payment of $532 received from a customer was incorrectly recorded on the books as $3,450 972 58 351 33 575 523 What was the cash balance per books of Dove Company prior to beginning the bank reconciliation? Will Company's independent accountant discovered that the ending inventory for 20x2 had been overstated by the company by $2,000. Before the correction, what was the effect in the 20x2 statement of earnings because of the overstatement of the ending inventory? Multiple Choice Pretax profit was overstated and the cost of goods sold was understated by $2,000. Pretax profit was understated by $2,000. Pretax profit understated by $2,000. Cost of goods sold was overstated by $2,000. Seinerfeld Company had its merchandise inventory warehouse destroyed by a fire. Thankfully, the owner had the accounting records at home to prepare financial statements after counting the inventory earlier in the day. The company used the periodic inventory system. In the shock of being notified of the fire, the owner spilled his dinner on the statement of earnings he had just completed. However, the following information was readable: Sales, $200,000; Beginning Inventory, $20,000; Purchases, $130,000; Total Operating Expenses (not including taxes), $40,000; and Profit Before Taxes, $20,000. There were no sales returns, purchases returns, sales discounts nor purchases discounts. Compute the amount of the ending inventory on hand before the fire. Multiple Choice $-0 O $30,000 O $10,000 O O $20,000 Smithers Amusement Machines has cost of goods sold of $100,000 and ending inventory of $150,000. If Smithers had no purchases and no returns during the period, what was the cost of its beginning inventory? Multiple Choice $150,000 $100,000 $250,000 O $50,000 O School Supplies Company made the following journal entries (1) to write off an account judged to be uncollectible and (2) to record bad debt expense for 20X1: CR DR 1,000 1,000 Allowance for doubtful accounts Trade receivables Bad debt expense Allowance for doubtful accounts 3,000 3,000 As a result of the first entry only, the book value (net realizable value) of trade receivables was A; as a result of the second entry only, the book value (net realizable value) of trade receivable was B: B 2 Increased Decreased Unchanged Unchanged Decreased Decreased Unchanged Decreased 3 14