Answered step by step

Verified Expert Solution

Question

1 Approved Answer

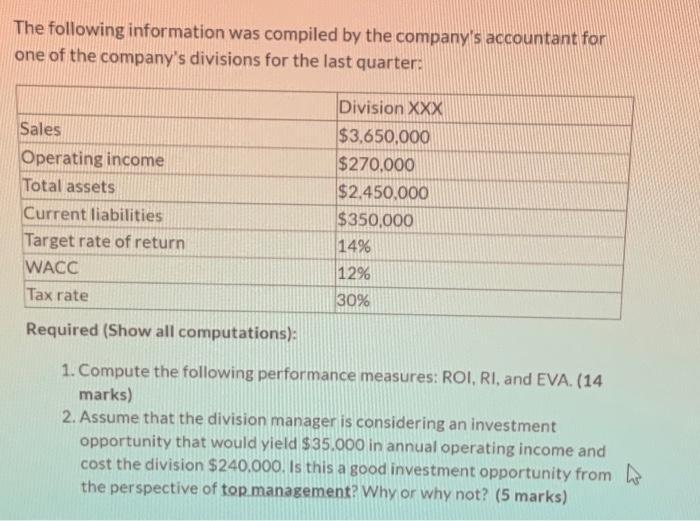

The following information was compiled by the company's accountant for one of the company's divisions for the last quarter: Division XXX $3,650,000 $270,000 $2,450,000

The following information was compiled by the company's accountant for one of the company's divisions for the last quarter: Division XXX $3,650,000 $270,000 $2,450,000 $350,000 Sales Operating income Total assets Current liabilities Target rate of return WACC Tax rate Required (Show all computations): 1. Compute the following performance measures: ROI, RI, and EVA. (14 marks) 2. Assume that the division manager is considering an investment opportunity that would yield $35.000 in annual operating income and cost the division $240.000. Is this a good investment opportunity from the perspective of top management? Why or why not? (5 marks) 14% 12% 30%

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

1 Compute the following performance measures ROI RI and EVA a Return on Investment ROI ROI Operating ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started