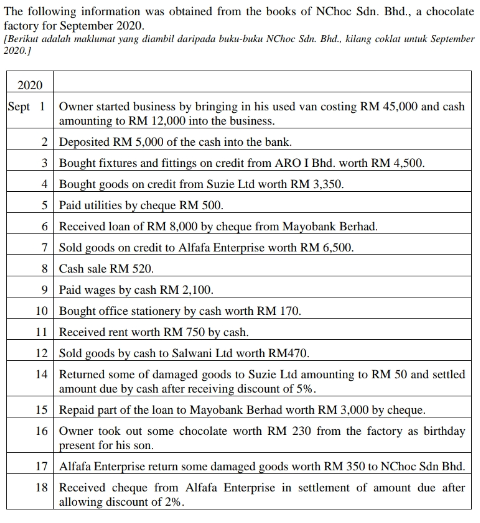

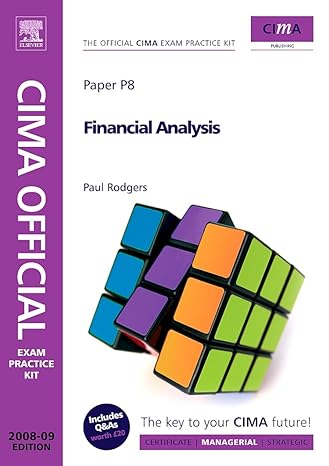

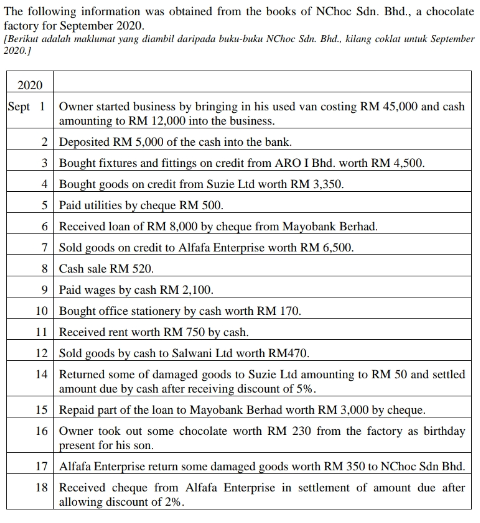

The following information was obtained from the books of NChoc Sdn. Bhd., a chocolate factory for September 2020. (Berikut adalah maklumat yang diambil daripada buku-buku NChoc Sdn. Bhd., kilang coklat untuk September 2020.) Sept 1 2020 Owner started business by bringing in his used van costing RM 45,000 and cash amounting to RM 12,000 into the business. 2 Deposited RM 5,000 of the cash into the bank. 3. Bought fixtures and fittings on credit from ARO I Bhd. worth RM 4,500. 4 Bought goods on credit from Suzie Ltd worth RM 3,350. 5 Paid utilities by cheque RM 500. 6 Received loan of RM 8,000 by cheque from Mayobank Berhad, 7 Sold goods on credit to Alfafa Enterprise worth RM 6,500. 8 Cash sale RM 520. 9 Paid wages by cash RM 2,100. 10 Bought office stationery by cash worth RM 170. 11 Received rent worth RM 750 by cash. 12 Sold goods by cash to Salwani Lid worth RM470. 14 Returned some of damaged goods to Suzie Ltd amounting to RM 50 and settled amount due by cash after receiving discount of 5%. 15 Repaid part of the loan to Mayobank Berhad worth RM 3,000 by cheque. 16 Owner took out some chocolate worth RM 230 from the factory as birthday present for his son. 17 Alfafa Enterprise return some damaged goods worth RM 350 to NChoc Sdn Bhd. 18 Received cheque from Alfafa Enterprise in settlement of amount due after allowing discount of 2%. d) Prepare Statement of Profit or Loss and Other Comprehensive Income for the year ended 30 September 2020. (Sediakan Penyata Untung atau Rugi dan Pendapatan Komprehensif Lain bagi tahun berakhir 30 September 2020.) The following information was obtained from the books of NChoc Sdn. Bhd., a chocolate factory for September 2020. (Berikut adalah maklumat yang diambil daripada buku-buku NChoc Sdn. Bhd., kilang coklat untuk September 2020.) Sept 1 2020 Owner started business by bringing in his used van costing RM 45,000 and cash amounting to RM 12,000 into the business. 2 Deposited RM 5,000 of the cash into the bank. 3. Bought fixtures and fittings on credit from ARO I Bhd. worth RM 4,500. 4 Bought goods on credit from Suzie Ltd worth RM 3,350. 5 Paid utilities by cheque RM 500. 6 Received loan of RM 8,000 by cheque from Mayobank Berhad, 7 Sold goods on credit to Alfafa Enterprise worth RM 6,500. 8 Cash sale RM 520. 9 Paid wages by cash RM 2,100. 10 Bought office stationery by cash worth RM 170. 11 Received rent worth RM 750 by cash. 12 Sold goods by cash to Salwani Lid worth RM470. 14 Returned some of damaged goods to Suzie Ltd amounting to RM 50 and settled amount due by cash after receiving discount of 5%. 15 Repaid part of the loan to Mayobank Berhad worth RM 3,000 by cheque. 16 Owner took out some chocolate worth RM 230 from the factory as birthday present for his son. 17 Alfafa Enterprise return some damaged goods worth RM 350 to NChoc Sdn Bhd. 18 Received cheque from Alfafa Enterprise in settlement of amount due after allowing discount of 2%. d) Prepare Statement of Profit or Loss and Other Comprehensive Income for the year ended 30 September 2020. (Sediakan Penyata Untung atau Rugi dan Pendapatan Komprehensif Lain bagi tahun berakhir 30 September 2020.)