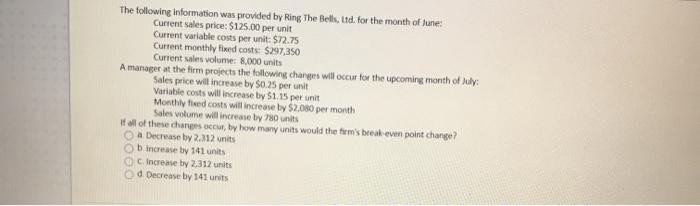

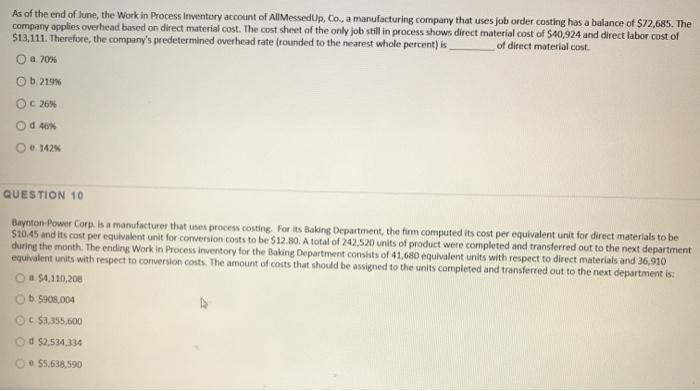

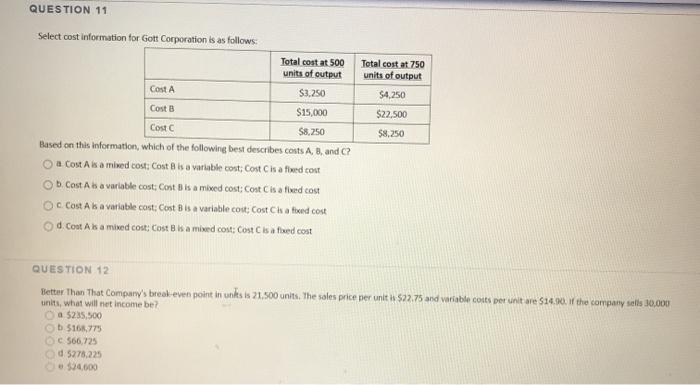

The following information was provided by Ring The Bells, Ltd. for the month of June Current sales price: $125.00 per unit Current variable costs per unit: $72.75 Current monthly feed costs: 5297,350 Current sales volume: 8.000 units A manager at the firm projects the following charges will occur for the upcoming month of July Sales price will increase by $0.25 per unit Variable costs will increase by $1.15 per unit Monthly feed costs will increase by $2.080 per month Sales volume will increase by 780 units It all of these changes occur, by how many units would the fron's break even point change? a Decrease by 2,312 units b Increase by 141 units Increase by 2312 units d Decrease by 141 units As of the end of June, the Work in Process Inventory account of AllMessed Up, Co., a manufacturing company that uses job order costing has a balance of $72,685. The company applies overhead based on direct material cost. The cost sheet of the only job still in process shows direct material cost of $40,924 and direct labor cost of $13,111. Therefore, the company's predetermined overhead rate (rounded to the nearest whole percent) is of direct material cost. O a 70% b.219% OC 26% Od 46 0 1425 QUESTION 10 Baynton Power Corp. is a manufacturer that uses process conting. For its Baking Department, the firm computed its cost per equivalent unit for direct materials to be $10.45 and its cost per equivalent unit for conversion costs to be $12.80 A total of 242,520 units of product were completed and transferred out to the next department during the month. The ending Work in Process inventory for the Baking Department consts of 41,680 equivalent units with respect to direct materials and 36,910 equivalent units with respect to conversion costs. The amount of costs that should be assigned to the units completed and transferred out to the next department is: O a $4,110,208 b. $908.004 OC $3,355,600 Od $2,534,334 $5,638,590 QUESTION 11 Select cost information for Gott Corporation is as follows: Total costat 500 units of output Total cost at 750 units of output $4,250 Cost A $3.250 Cost B $22,500 Costc $8,250 $15,000 $8,250 Based on this information, which of the following best describes costs A, B and C? a Cost A is a mixed cost: Cost Bis a variable cost; Cost Ch a fixed cout b. Cost Ab a variable cost; Cost is a mixed cost Cost Cialised cost Oc Cost Ab a variable cost; Cost B is a variable cout; Cost Cas a teed cost d.Cont As a mixed cost; Cost is a mixed cost; Cost is a faed cost QUESTION 12 Better Than That Company's break even point in unks is 21.500 units. The sales price per unit 522.75 and variable couts per unitare 519.00. If the company els 30,000 unit, what will not income be? a $235,500 ob 516,779 OC 566,725 05278.225