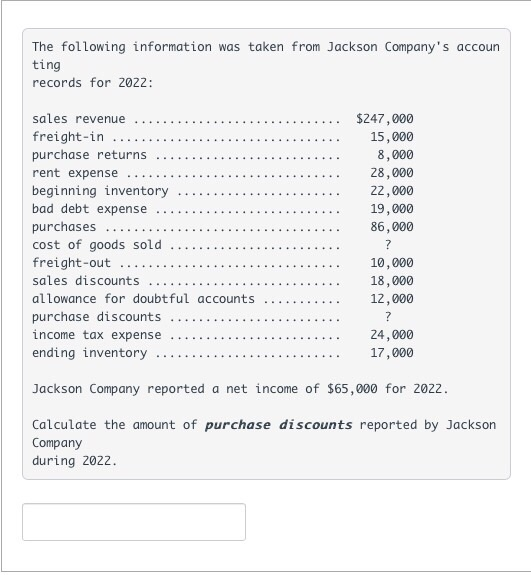

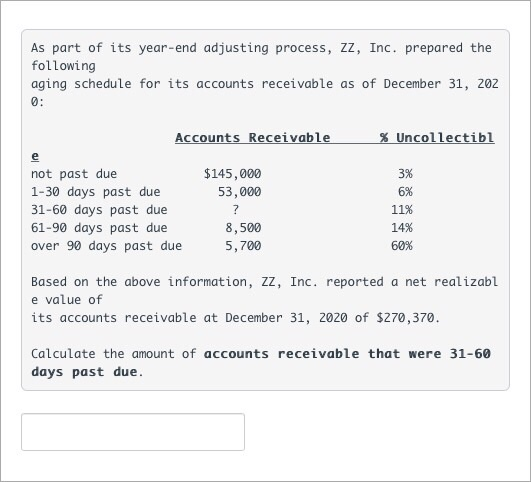

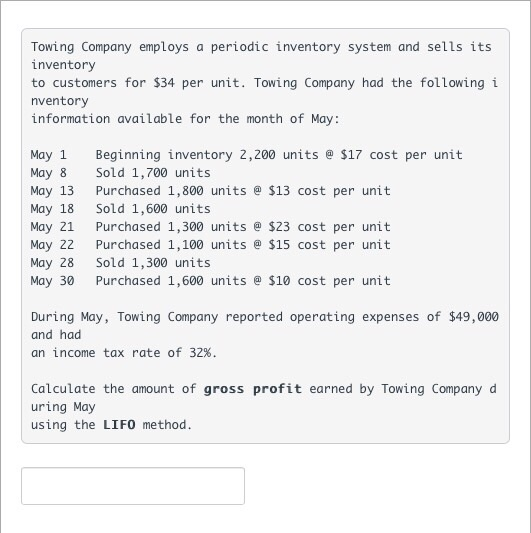

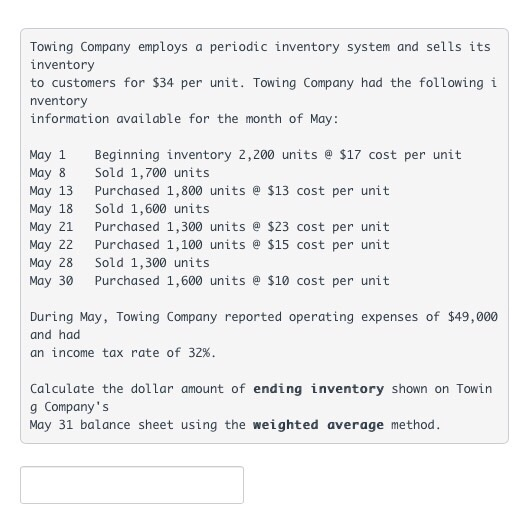

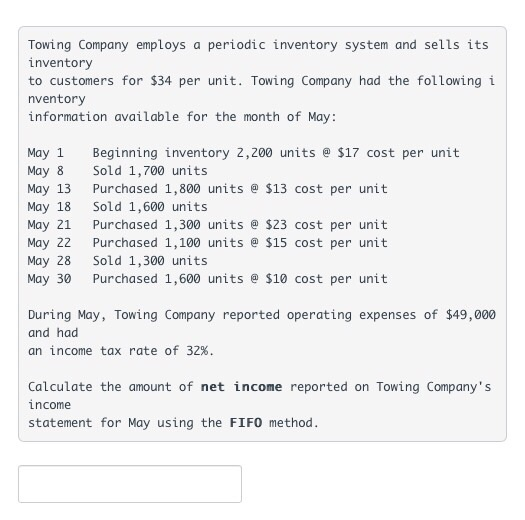

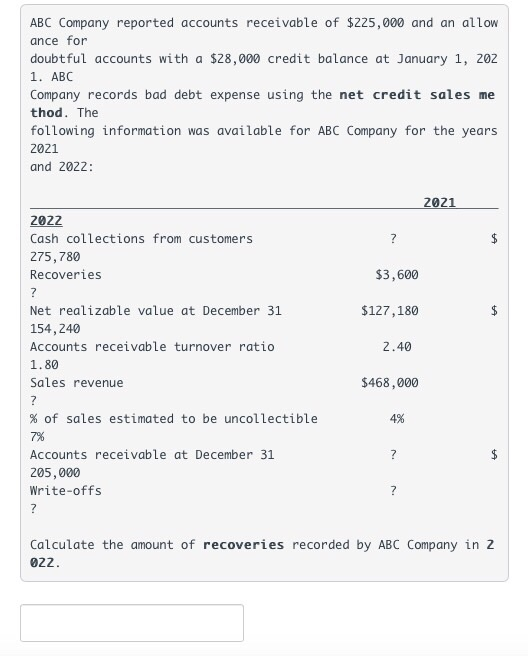

The following information was taken from Jackson Company's accoun ting records for 2022: 8,000 8 allowance for doubtful accounts .. . . . . .. 2 7 Jackson Company reported a net income of $65,000 for 20z2 Calculate the amount of purchase discounts reported by Jacksorn Company during 2022 As part of its year-end adjusting process, zz, Inc. prepared the following aging schedule for its accounts receivable as of December 31, 202 Accounts Re vable tib $145,000 53,000 not past due 1-30 days past due 31-60 days past due 61-90 days past due over 90 days past due 3% 6% 11% 14% 8,500 5,700 Based on the above information, ZZ, Inc. reported a net realizabl e value of its accounts receivable at December 31, 2020 of $270,370 Calculate the amount of accounts receivable that were 31-60 days past due Towing Company employs a periodic inventory system and sells its inventory to customers for $34 per unit. Towing Company had the following i nventory information available for the month of May: May 1 Beginning inventory 2,200 units $17 cost per unit May 8 Sold 1,700 unit:s May 13 Purchased 1,800 units $13 cost per unit May 18 Sold 1,600 unit:s May 21 Purchased 1,300 units $23 cost per unit May 22 Purchased 1,100 units $15 cost per unit May 28 Sold 1,300 units May 30 Purchased 1,600 units e $10 cost per unit During May, Towing Company reported operating expenses of $49,000 and had an income tax rate of 32% Calculate the amount of gross profit earned by Towing Company d uring May using the LIFO method Towing Company employs a periodic inventory system and sells its inventory to customers for $34 per unit. Towing Company had the following i nventory information available for the month of May: May 1 Beginning inventory 2,200 units $17 cost per unit May 8 Sold 1,700 units May 13 Purchased 1,800 units e $13 cost per unit May 18 Sold 1,600 units May 21 Purchased 1,300 units e $23 cost per unit May 22 Purchased 1,100 units e $15 cost per unit May 28 Sold 1,300 units May 30 Purchased 1,600 units $10 cost per unit During May, Towing Company reported operating expenses of $49,000 and had an income tax rate of 32%. Calculate the dollar amount of ending inventory shown on Towin g Company's May 31 balance sheet using the weighted average method. Towing Company employs a periodic inventory system and sells its inventory to customers for $34 per unit. Towing Company had the following i nventory information available for the month of May: May1 Beginning inventory 2,200 units $17 cost per unit May 8 Sold 1,700 units May 13 Purchased 1,800 units $13 cost per unit May 18 Sold 1,600 units May 21 Purchased 1,300 units $23 cost per unit May 22 Purchased 1,100 units $15 cost per unit May 28 Sold 1,300 units May 30 Purchased 1,600 units $10 cost per unit During May, Towing Company reported operating expenses of $49,000 and had an income tax rate of 32%. Calculate the amount of net income reported on Towing Company's income statement for May using the FIFO method. ABC Company reported accounts receivable of $225,000 and an allow ance for doubtful accounts with a $28,000 credit balance at January 1, 202 1. ABC Company records bad debt expense using the net credit sales me thod. The following information was available for ABC Company for the years 2021 and 2022 2022 Cash collections from customers 275,780 Recoveries $3,600 Net realizable value at December 31 154,240 Accounts receivable turnover ratio 1.80 Sales revenue $127,180 $468,000 % of sales estimated to be uncollectible 7% Accounts receivable at December 31 205,000 Write-offs 4% Calculate the amount of recoveries recorded by ABC Company in 2 022