Answered step by step

Verified Expert Solution

Question

1 Approved Answer

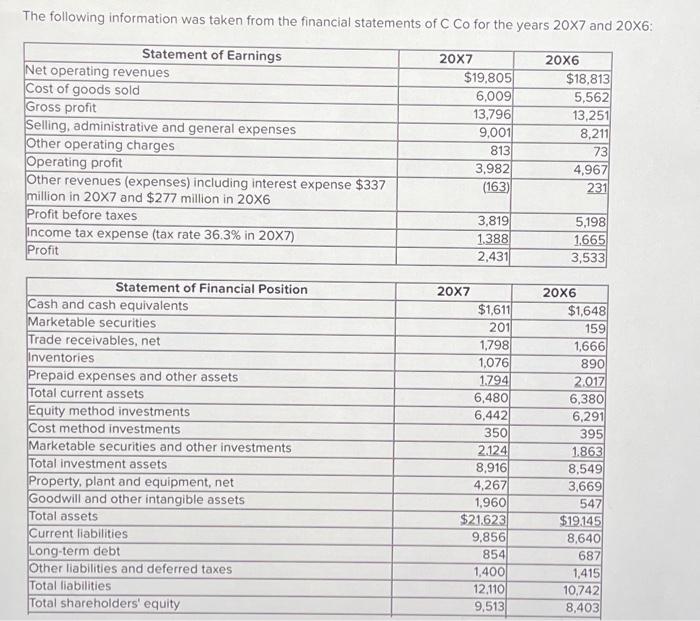

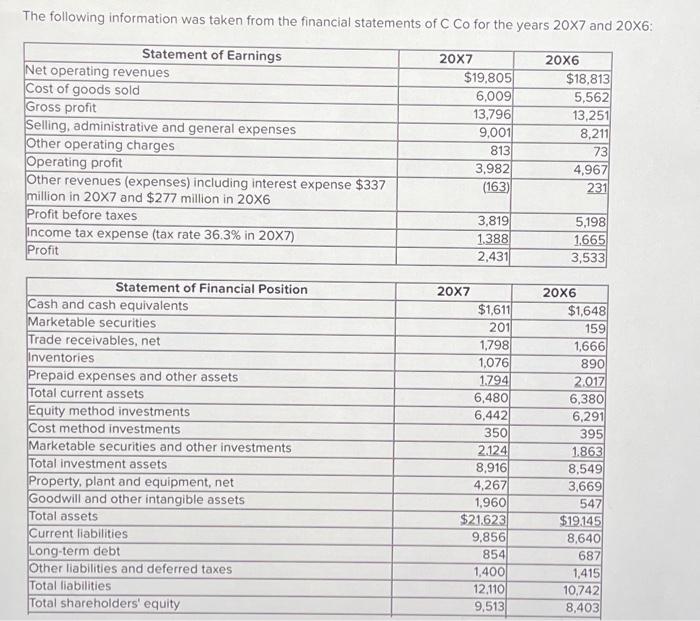

The following information was taken from the financial statements of C Co for the years 20X7 and 20X6: Statement of Earnings Net operating revenues Cost

The following information was taken from the financial statements of C Co for the years 20X7 and 20X6: Statement of Earnings Net operating revenues Cost of goods sold Gross profit Selling, administrative and general expenses Other operating charges Operating profit Other revenues (expenses) including interest expense $337 million in 20X7 and $277 million in 20X6 Profit before taxes Income tax expense (tax rate 36.3% in 20X7) Profit Statement of Financial Position Cash and cash equivalents Marketable securities Trade receivables, net Inventories Prepaid expenses and other assets Total current assets Equity method investments Cost method investments Marketable securities and other investments Total investment assets Property, plant and equipment, net Goodwill and other intangible assets Total assets Current liabilities Long-term debt Other liabilities and deferred taxes Total liabilities Total shareholders' equity 20X7 $19,805 6,009 13,796 9,001 813 20X7 3,982 (163) 3,819 1,388 2,431 $1,611 201 1,798 1,076 1,794 6,480 6,442 350 2,124 8,916 4,267 1,960 $21,623 9,856 854 1,400 12,110 9,513 20X6 $18,813 5,562 13,251 8,211 73 4,967 231 5,198 1,665 3,533 20X6 $1,648 159 1,666 890 2,017 6,380 6,291 395 1,863 8,549 3,669 547 $19,145 8,640 687 1,415 10,742 8,403

Calculate C Co's return on equity for 20X7

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started