Question

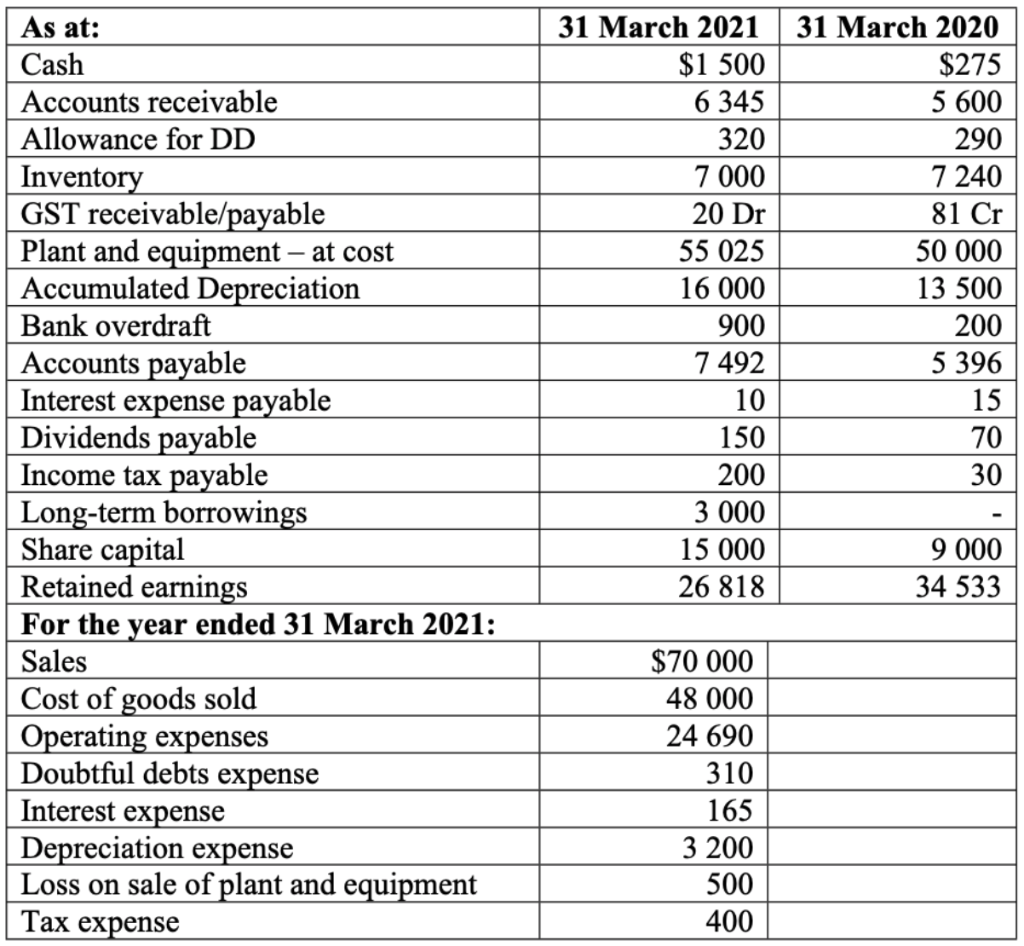

the following informational was extracted from the financial records of Lucy LTD additional information The entity classifies dividends paid and interest paid as cash flows

the following informational was extracted from the financial records of Lucy LTD

additional information

- The entity classifies dividends paid and interest paid as cash flows from financing activities

- an item of equipment was sold for $2000 cash

required:

(i) reconstruct and prepare general ledger accounts (for accounts recievable, allowance for doubtful debt, GST payable/recievable, inventory, plant and equipmant, accumulated depreciation, accounts payable, interest expense payable, dividends payable, income tax payable) and journal entries (for accounts recievable, accumulated depreication and accounts payable

(ii) prepare statement of cash flows for Lucy LTD in accordance with NZ IAS & statement of cash flows, for the year ended 31 march 2021, using the indirect method and direct method for each

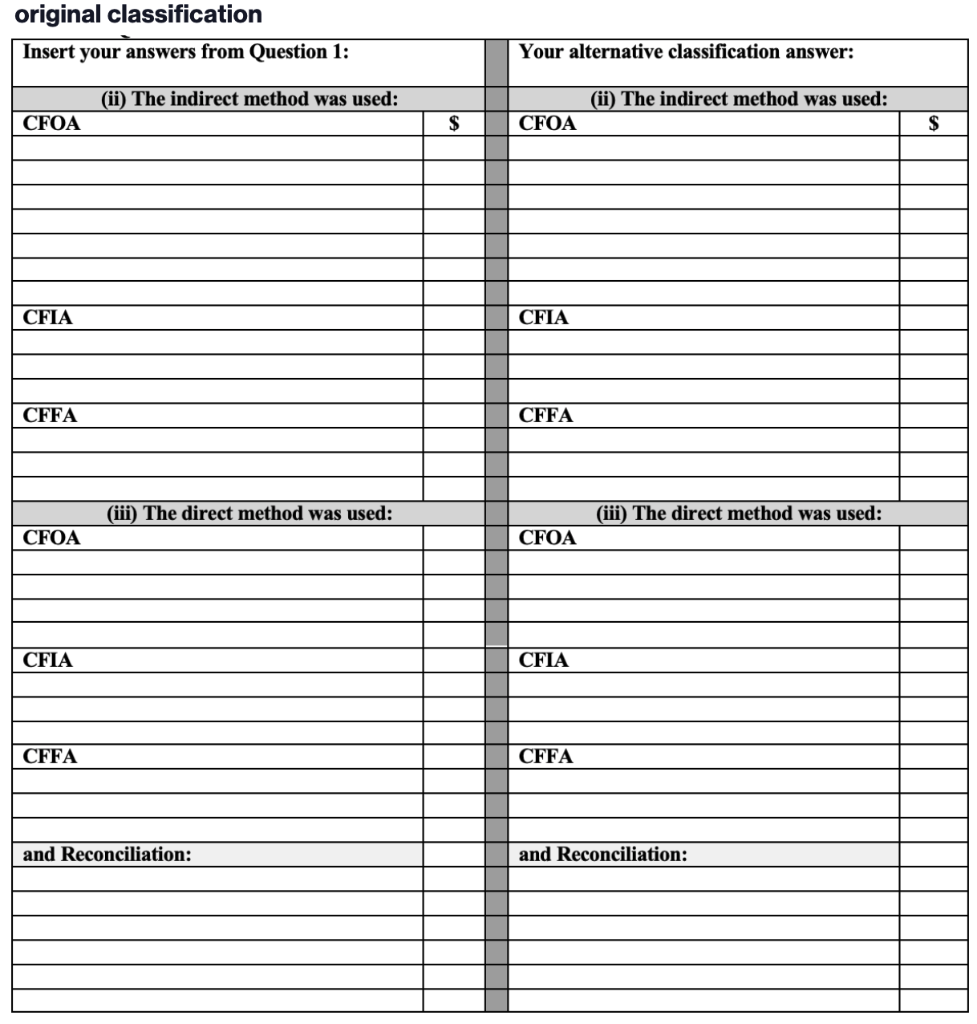

(iii) Lucy LTD classified interest expense paid, and dividends paid as cash flows from financing activities. What if Lucy LTD used the alternative classification for these two items?

Complete the table below to illustrate the effect of using a different classification, for these 2 items, on the statement of cash flows and note.

original classification

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started