Answered step by step

Verified Expert Solution

Question

1 Approved Answer

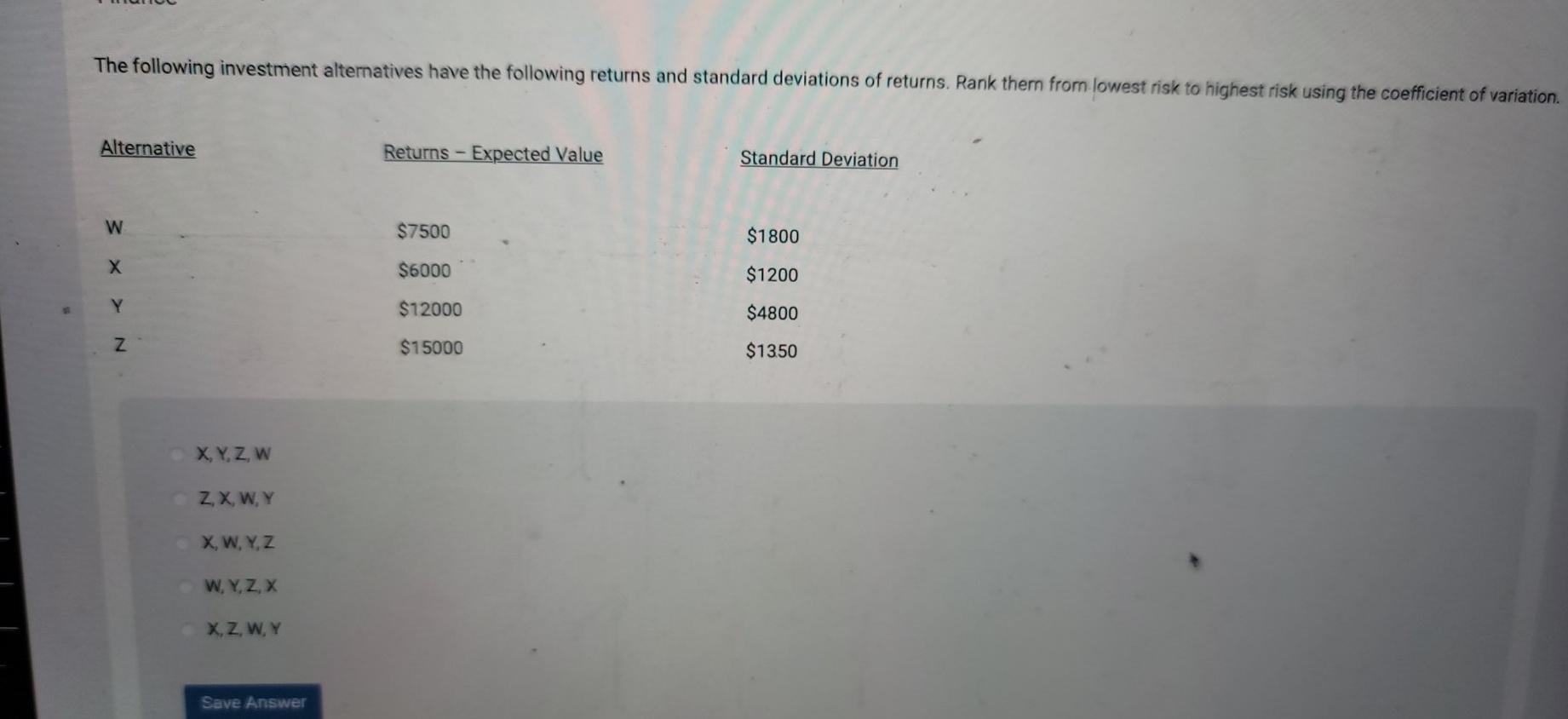

The following investment alternatives have the following returns and standard deviations of returns. Rank them from lowest risk to highest risk using the coefficient of

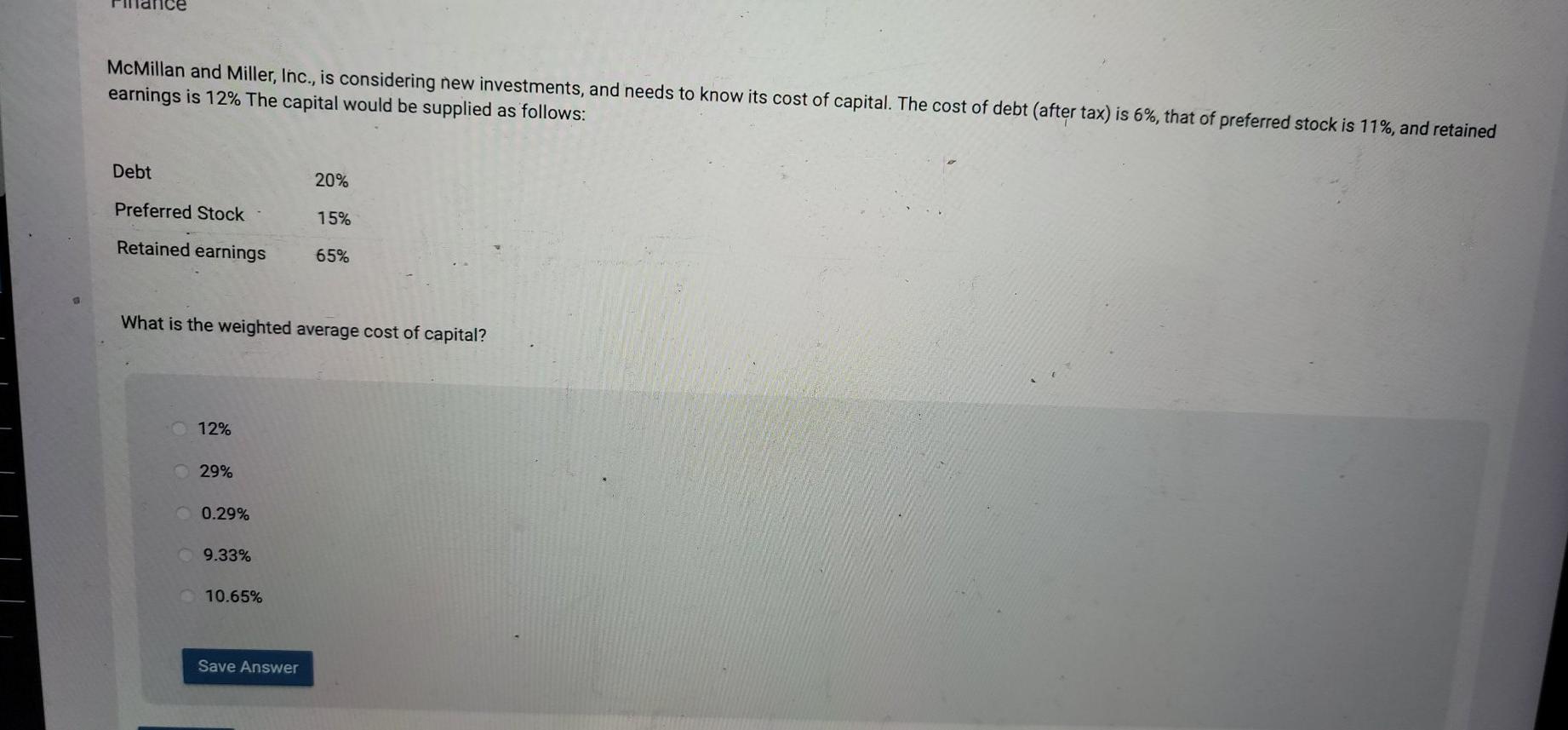

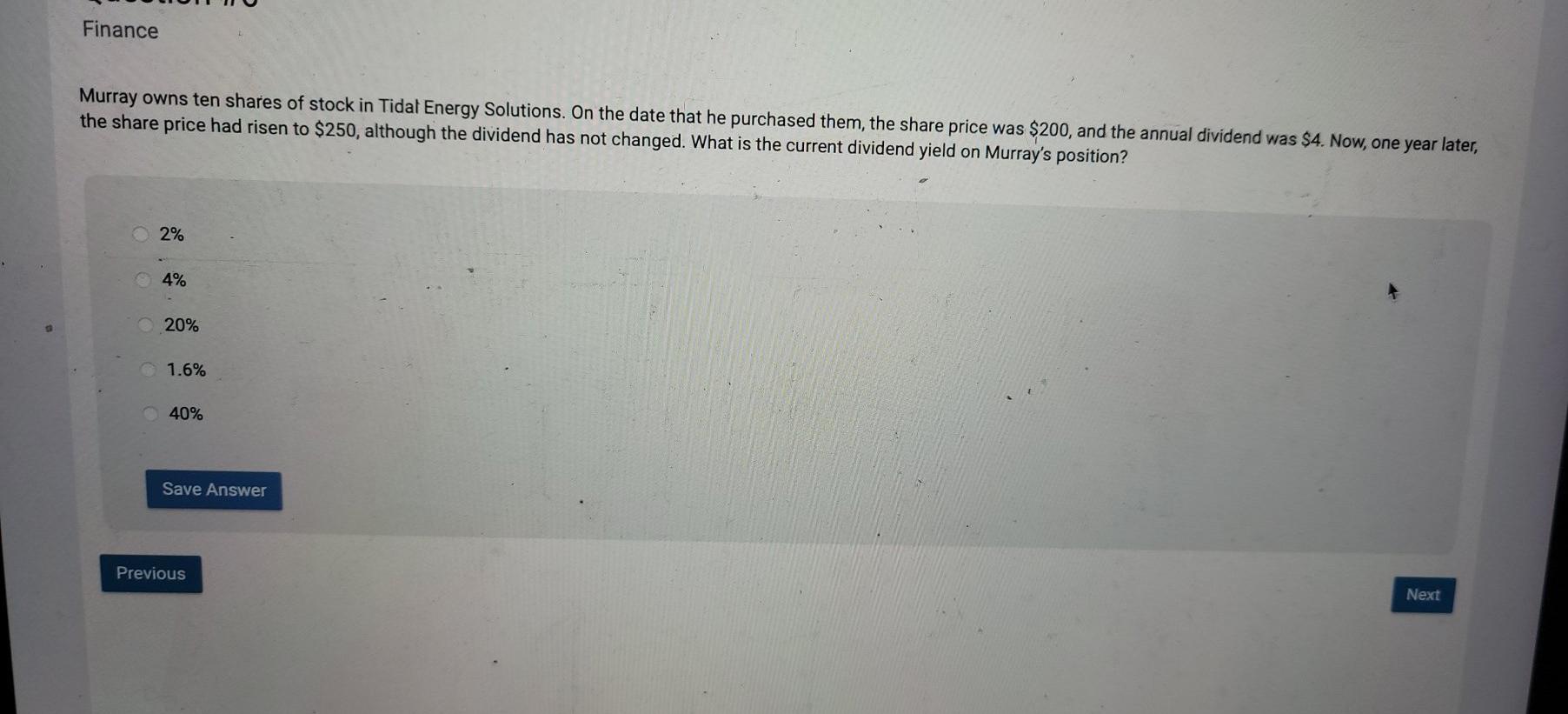

The following investment alternatives have the following returns and standard deviations of returns. Rank them from lowest risk to highest risk using the coefficient of variation Alternative Returns - Expected Value Standard Deviation $7500 $1800 $6000 $1200 Nxs $12000 $4800 $15000 $1350 X, Y, Z, W ZX, WY X, W, Y, Z WY, ZX X,Z, W.Y Save Answer McMillan and Miller, Inc., is considering new investments, and needs to know its cost of capital. The cost of debt (after tax) is 6%, that of preferred stock is 11%, and retained earnings is 12% The capital would be supplied as follows: Debt 20% Preferred Stock 15% Retained earnings 65% What is the weighted average cost of capital? 12% 29% 0.29% 9.33% 10.65% Save Answer Finance Murray owns ten shares of stock in Tidal Energy Solutions. On the date that he purchased them, the share price was $200, and the annual dividend was $4. Now, one year later, the share price had risen to $250, although the dividend has not changed. What is the current dividend yield on Murray's position? 2% 4% 20% 1.6% 40% Save Answer Previous Next

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started