Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following investments are available to you: (a) a taxable bond with a coupon rate of 5% per year; (b) a tax-exempt bond with a

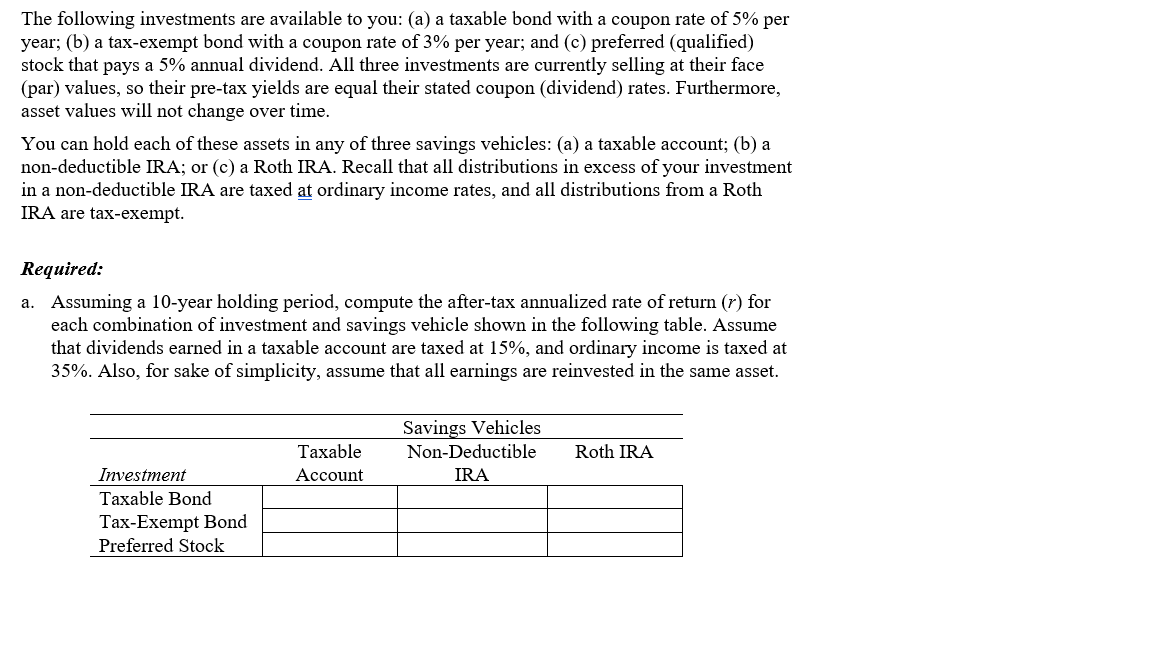

The following investments are available to you: (a) a taxable bond with a coupon rate of 5% per year; (b) a tax-exempt bond with a coupon rate of 3% per year; and (c) preferred (qualified) stock that pays a 5% annual dividend. All three investments are currently selling at their face (par) values, so their pre-tax yields are equal their stated coupon (dividend) rates. Furthermore, asset values will not change over time. You can hold each of these assets in any of three savings vehicles: (a) a taxable account; (b) a non-deductible IRA; or (c) a Roth IRA. Recall that all distributions in excess of your investment in a non-deductible IRA are taxed at ordinary income rates, and all distributions from a Roth IRA are tax-exempt. Required: a. Assuming a 10-year holding period, compute the after-tax annualized rate of return (r) for each combination of investment and savings vehicle shown in the following table. Assume that dividends earned in a taxable account are taxed at 15%, and ordinary income is taxed at 35%. Also, for sake of simplicity, assume that all earnings are reinvested in the same asset. The following investments are available to you: (a) a taxable bond with a coupon rate of 5% per year; (b) a tax-exempt bond with a coupon rate of 3% per year; and (c) preferred (qualified) stock that pays a 5% annual dividend. All three investments are currently selling at their face (par) values, so their pre-tax yields are equal their stated coupon (dividend) rates. Furthermore, asset values will not change over time. You can hold each of these assets in any of three savings vehicles: (a) a taxable account; (b) a non-deductible IRA; or (c) a Roth IRA. Recall that all distributions in excess of your investment in a non-deductible IRA are taxed at ordinary income rates, and all distributions from a Roth IRA are tax-exempt. Required: a. Assuming a 10-year holding period, compute the after-tax annualized rate of return (r) for each combination of investment and savings vehicle shown in the following table. Assume that dividends earned in a taxable account are taxed at 15%, and ordinary income is taxed at 35%. Also, for sake of simplicity, assume that all earnings are reinvested in the same asset

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started