Answered step by step

Verified Expert Solution

Question

1 Approved Answer

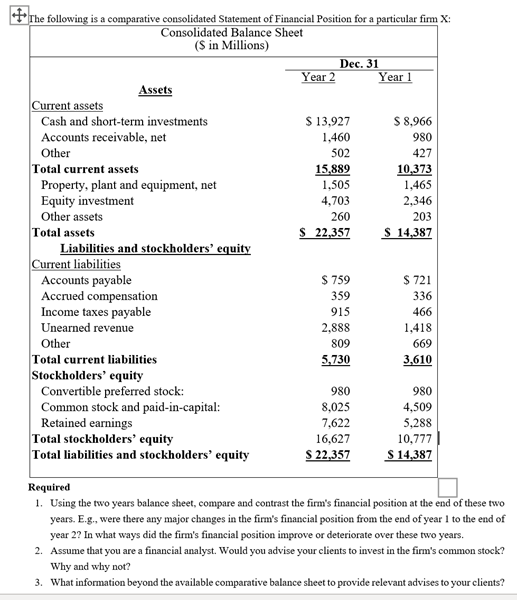

The following is a comparative consolidated Statement of Financial Position for a particular firm X: Consolidated Balance Sheet (S in Millions) Current assets Cash

The following is a comparative consolidated Statement of Financial Position for a particular firm X: Consolidated Balance Sheet (S in Millions) Current assets Cash and short-term investments Accounts receivable, net Assets Other Total current assets Property, plant and equipment, net Equity investment Other assets Total assets Liabilities and stockholders' equity Current liabilities Accounts payable Accrued compensation Income taxes payable Unearned revenue Other Total current liabilities Stockholders' equity Convertible preferred stock: Common stock and paid-in-capital: Retained earnings Total stockholders' equity Total liabilities and stockholders' equity Year 2 Dec. 31 $ 13,927 1,460 502 15,889 1,505 4,703 260 S 22,357 $ 759 359 915 2,888 809 5,730 980 8,025 7,622 16,627 $ 22,357 Year 1 $ 8,966 980 427 10,373 1,465 2,346 203 $ 14,387 $721 336 466 1,418 669 3,610 980 4,509 5,288 10,777 $ 14,387 Required 1. Using the two years balance sheet, compare and contrast the firm's financial position at the end of these two years. E.g., were there any major changes in the firm's financial position from the end of year 1 to the end of year 2? In what ways did the firm's financial position improve or deteriorate over these two years. 2. Assume that you are a financial analyst. Would you advise your clients to invest in the firm's common stock? Why and why not? 3. What information beyond the available comparative balance sheet to provide relevant advises to your clients?

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 Comparison of Financial Position From the comparative balance sheet provided we observe several significant changes in the firms financial position from the end of Year 1 to the end of Year 2 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started