Answered step by step

Verified Expert Solution

Question

1 Approved Answer

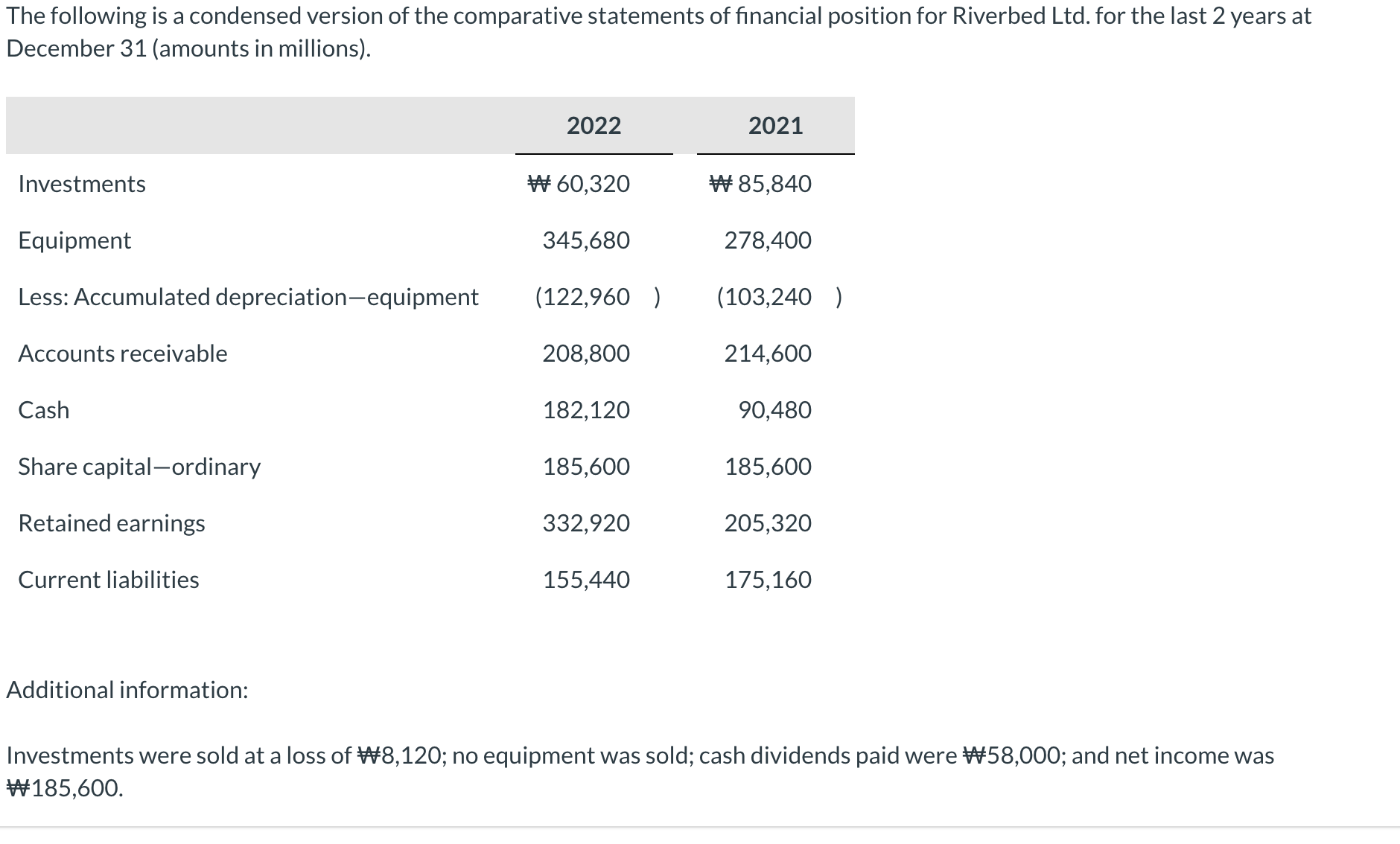

The following is a condensed version of the comparative statements of financial position for Riverbed Ltd. for the last 2 years at December 31

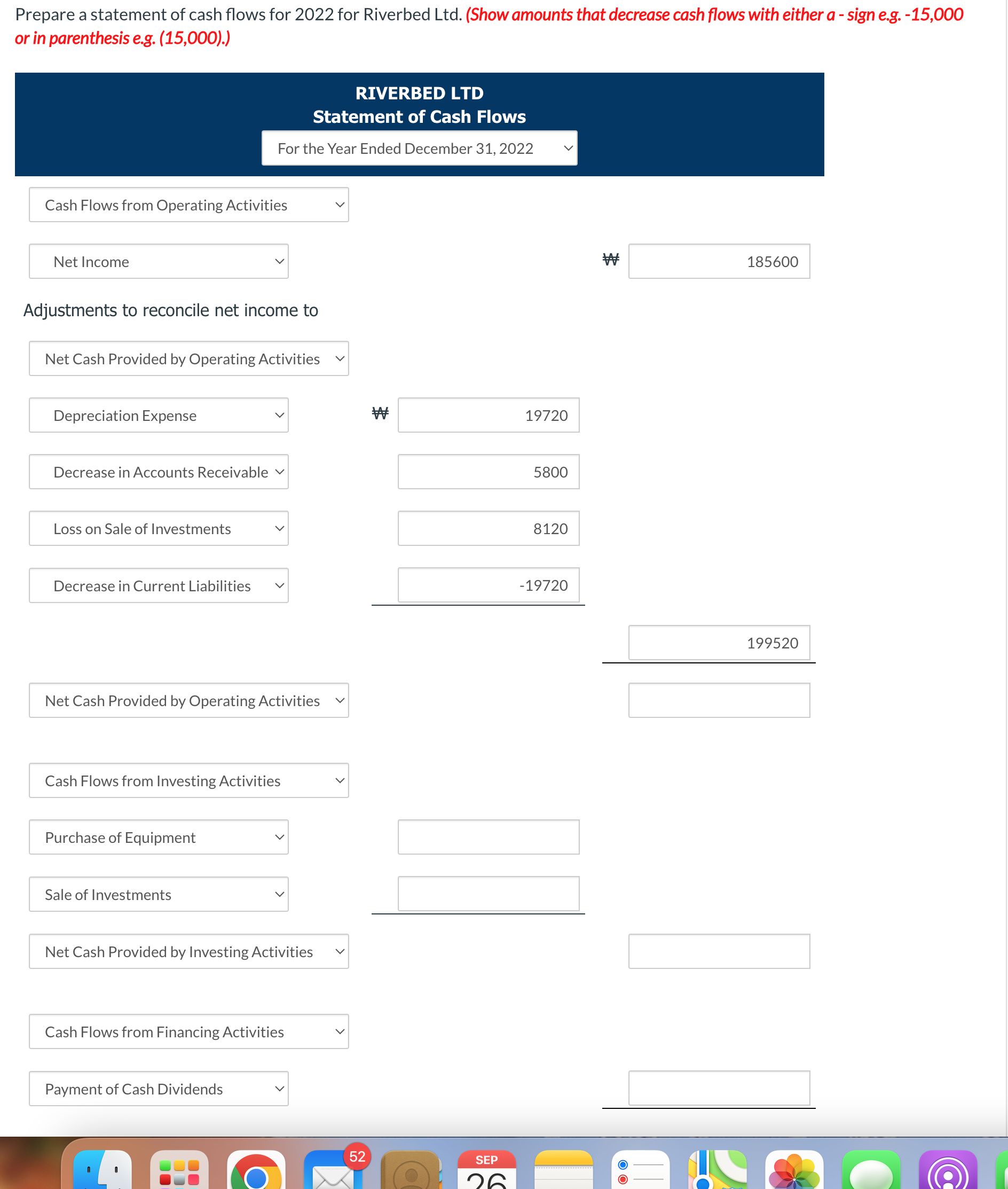

The following is a condensed version of the comparative statements of financial position for Riverbed Ltd. for the last 2 years at December 31 (amounts in millions). Investments Equipment Less: Accumulated depreciation-equipment Accounts receivable Cash Share capital-ordinary Retained earnings Current liabilities Additional information: 2022 #60,320 345,680 (122,960 ) 208,800 182,120 185,600 332,920 155,440 2021 #85,840 278,400 (103,240 ) 214,600 90,480 185,600 205,320 175,160 Investments were sold at a loss of #8,120; no equipment was sold; cash dividends paid were #58,000; and net income was #185,600. Prepare a statement of cash flows for 2022 for Riverbed Ltd. (Show amounts that decrease cash flows with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).) Cash Flows from Operating Activities Net Income Adjustments to reconcile net income to Net Cash Provided by Operating Activities Depreciation Expense Decrease in Accounts Receivable Loss on Sale of Investments RIVERBED LTD Statement of Cash Flows For the Year Ended December 31, 2022 Decrease in Current Liabilities Net Cash Provided by Operating Activities Cash Flows from Investing Activities Purchase of Equipment Sale of Investments Net Cash Provided by Investing Activities Cash Flows from Financing Activities Payment of Cash Dividends 52 # SEP 26 19720 5800 8120 -19720 $ O O 185600 199520

Step by Step Solution

★★★★★

3.20 Rating (142 Votes )

There are 3 Steps involved in it

Step: 1

The cash flow statement is a financial statement which is used to show the inflow and outflow of cas...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started