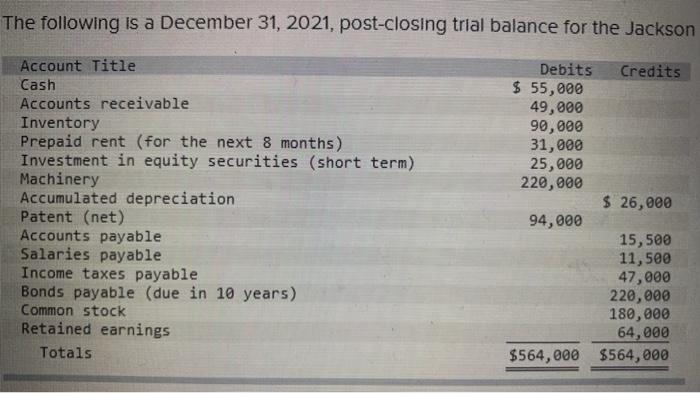

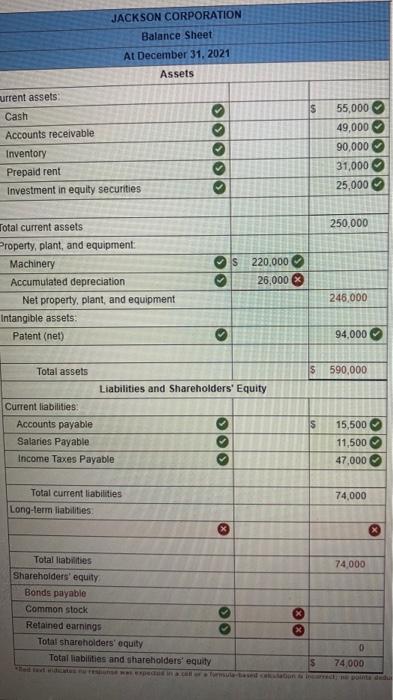

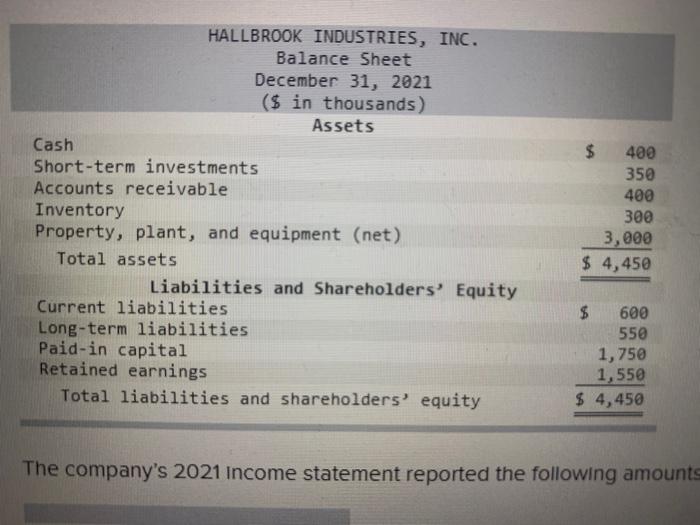

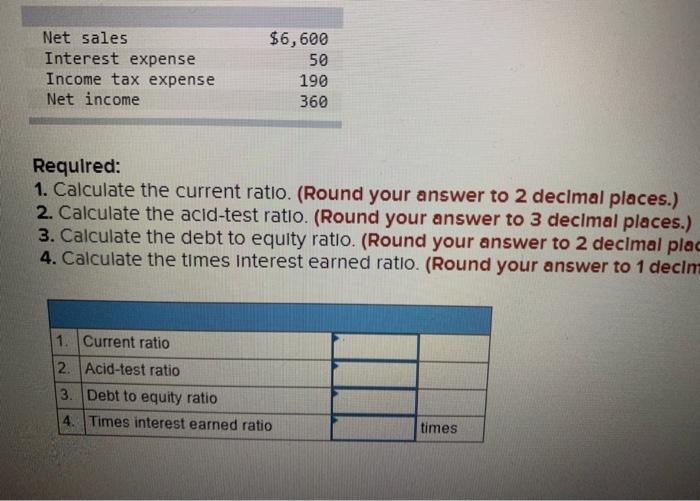

The following is a December 31, 2021, post-closing trial balance for the Jackson Account Title Cash Accounts receivable Inventory Prepaid rent (for the next 8 months) Investment in equity securities (short term) Machinery Accumulated depreciation Patent (net) Accounts payable Salaries payable Income taxes payable Bonds payable (due in 10 years) Common stock Retained earnings Totals Debits Credits $ 55,000 49,000 90,000 31,000 25,000 220,000 $ 26,000 94,000 15,500 11,500 47,000 220,000 180,000 64,000 $564,000 $564,000 JACKSON CORPORATION Balance Sheet At December 31, 2021 Assets current assets Cash Accounts receivable Inventory Prepaid rent Investment in equity securities $ 55,000 49,000 90,000 31,000 25,000 250,000 Total current assets Property, plant, and equipment Machinery Accumulated depreciation Net property, plant, and equipment Intangible assets Patent (net) 220,000 26.000 X 246,000 S 94,000 $ 590,000 Total assets Liabilities and Shareholders' Equity Current liabilities Accounts payable Salaries Payable Income Taxes Payable S 00 15,500 11,500 47,000 Total current liabilities Long-term liabilities: 74,000 74,000 Total liabilities Shareholders' equity Bonds payable Common stock Retained earnings Total shareholders' equity Total liabilities and shareholders' equity 0 74,000 HALLBROOK INDUSTRIES, INC. Balance Sheet December 31, 2021 ($ in thousands) Assets Cash Short-term investments Accounts receivable Inventory Property, plant, and equipment (net) Total assets Liabilities and Shareholders' Equity Current liabilities Long-term liabilities Paid-in capital Retained earnings Total liabilities and shareholders' equity $ 400 350 400 300 3,000 $ 4,450 $ 600 550 1,750 1,550 $ 4,450 The company's 2021 Income statement reported the following amounts $6,600 50 Net sales Interest expense Income tax expense Net income 190 360 Required: 1. Calculate the current ratio. (Round your answer to 2 decimal places.) 2. Calculate the acid-test ratio. (Round your answer to 3 decimal places.) 3. Calculate the debt to equity ratio. (Round your answer to 2 decimal plac 4. Calculate the times Interest earned ratio. (Round your answer to 1 decim 1. Current ratio 2. Acid-test ratio 3. Debt to equity ratio 4. Times interest earned ratio times