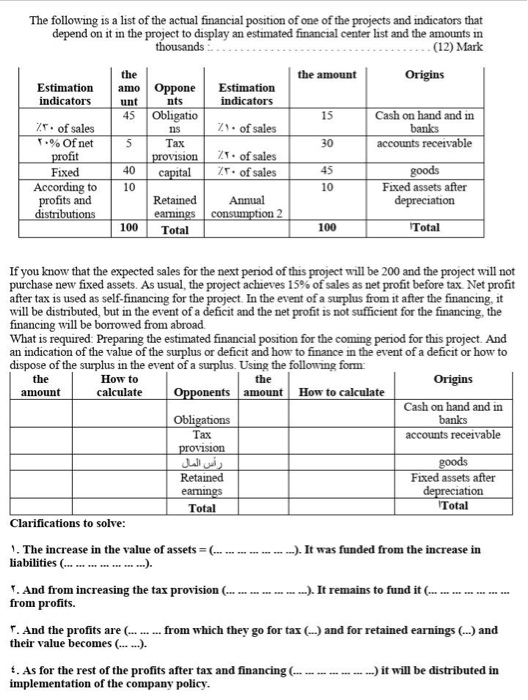

The following is a list of the actual financial position of one of the projects and indicators that depend on it in the project to display an estimated financial center list and the amounts in thousands (12) Mark the amount Origins Estimation indicators the amo unt Estimation indicators 45 15 Oppone nts Obligatio ns Tax provision capital 71. of sales Cash on hand and in banks accounts receivable Zr. of sales T.% Of net profit Fixed According to profits and distributions S of sales Zr. of sales 40 10 goods Fixed assets after depreciation Retained earings Total Annual consumption 2 100 100 Total If you know that the expected sales for the next period of this project will be 200 and the project will not purchase new fixed assets. As usual, the project achieves 15% of sales as net profit before tax. Net profit after tax is used as self-financing for the project. In the event of a surplus from it after the financing, it will be distributed, but in the event of a deficit and the net profit is not sufficient for the financing the financing will be borrowed from abroad What is required: Preparing the estimated financial position for the coming period for this project. And an indication of the value of the surplus or deficit and how to finance in the event of a deficit or how to dispose of the surplus in the event of a surplus. Using the following form the How to 1 the Origins amount calculate Opponents amount How to calcu Cash on hand and in Obligations banks Tax accounts receivable provision goods Retained eamings Total Fixed assets after depreciation Total Clarifications to solve: ). It was funded from the increase in 1. The increase in the value of assets =(... liabilities (...........). 1. And from increasing the tax provision (---------). It remains to fund it........... from profits. 7. And the profits are .......... from which they go for tax their value becomes (.....). ) and for retained earnings (...) and ..) it will be distributed in 1. As for the rest of the profits after tax and financing . implementation of the company policy. The following is a list of the actual financial position of one of the projects and indicators that depend on it in the project to display an estimated financial center list and the amounts in thousands (12) Mark the amount Origins Estimation indicators the amo unt Estimation indicators 45 15 Oppone nts Obligatio ns Tax provision capital 71. of sales Cash on hand and in banks accounts receivable Zr. of sales T.% Of net profit Fixed According to profits and distributions S of sales Zr. of sales 40 10 goods Fixed assets after depreciation Retained earings Total Annual consumption 2 100 100 Total If you know that the expected sales for the next period of this project will be 200 and the project will not purchase new fixed assets. As usual, the project achieves 15% of sales as net profit before tax. Net profit after tax is used as self-financing for the project. In the event of a surplus from it after the financing, it will be distributed, but in the event of a deficit and the net profit is not sufficient for the financing the financing will be borrowed from abroad What is required: Preparing the estimated financial position for the coming period for this project. And an indication of the value of the surplus or deficit and how to finance in the event of a deficit or how to dispose of the surplus in the event of a surplus. Using the following form the How to 1 the Origins amount calculate Opponents amount How to calcu Cash on hand and in Obligations banks Tax accounts receivable provision goods Retained eamings Total Fixed assets after depreciation Total Clarifications to solve: ). It was funded from the increase in 1. The increase in the value of assets =(... liabilities (...........). 1. And from increasing the tax provision (---------). It remains to fund it........... from profits. 7. And the profits are .......... from which they go for tax their value becomes (.....). ) and for retained earnings (...) and ..) it will be distributed in 1. As for the rest of the profits after tax and financing . implementation of the company policy