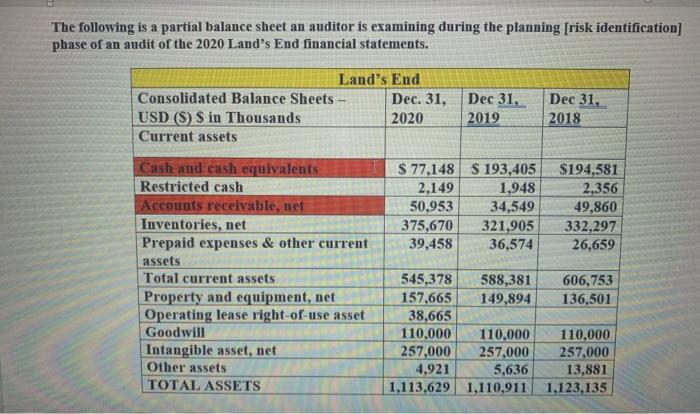

Question: The following is a partial balance sheet an auditor is examining during the planning (risk identification] phase of an audit of the 2020 Land's End

![during the planning (risk identification] phase of an audit of the 2020](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66ee460d9376f_53366ee460d374e6.jpg)

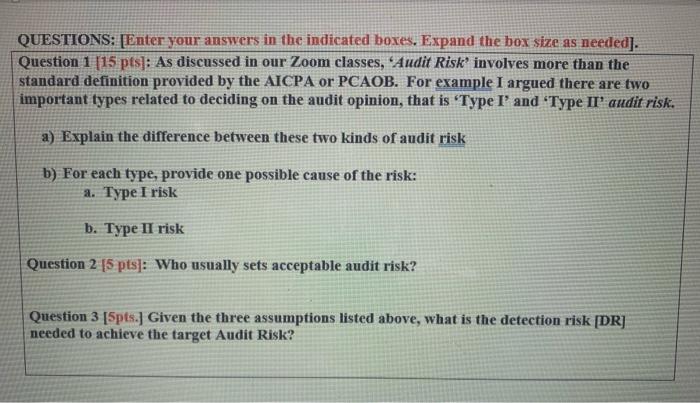

The following is a partial balance sheet an auditor is examining during the planning (risk identification] phase of an audit of the 2020 Land's End financial statements. Land's End Consolidated Balance Sheets - Dec. 31, USD (S) S in Thousands 2020 Current assets Dec 31, 2019 Dec 31, 2018 S 77,148 $ 193,405 2,149 1,948 50,953 34,549 375,670 321,905 39,458 36,574 $194,581 2,356 49,860 332,297 26,659 Cush and cash equivalents Restricted cash Accounts receivable, net Inventories, net Prepaid expenses & other current assets Total current assets Property and equipment, net Operating lease right-ofuse asset Goodwill Intangible asset, net Other assets TOTAL ASSETS 545,378 588,381 606,753 157,665 149,894 136,501 38,665 110,000 110,000 110,000 257,000 257,000 257,000 4,921 5,636 13,881 1,113,629 1,110,911 1,123,135 Planning Phase Assumptions: Assumptions 1: The target [maximum) for acceptable audit risk (AAR) is 0.07 or 7% risk Assumption 2: The estimated risk of material misstatement [RMM) at this point in the audit is 0.21 Assumption 3: Tolerable error [tolerable misstatement for each account within the statement of financial position [balance sheet] has been set at $ 90,000,000 for $ 90,000 in $ 1,000s). Accounts of interest: As indicated in the above balance sheet, the audit manager has highlighted two accounts for you to analyze and discuss: Cash & Cash Equivalents Accounts Receivable, Net Your answers should be based completely on the evidence indicated in the balance sheet. QUESTIONS: [Enter your answers in the indicated boxes. Expand the box size as needed]. Question 1 (15 pts]: As discussed in our Zoom classes, Audit Risk involves more than the standard definition provided by the AICPA or PCAOB. For example I argued there are two important types related to deciding on the audit opinion, that is Type I' and 'Type II' audit risk. a) Explain the difference between these two kinds of audit risk b) For each type, provide one possible cause of the risk: a. Type I risk b. Type II risk Question 2 [5 pts]: Who usually sets acceptable audit risk? Question 3 [5pts.] Given the three assumptions listed above, what is the detection risk [DR] needed to achieve the target Audit Risk? The following is a partial balance sheet an auditor is examining during the planning (risk identification] phase of an audit of the 2020 Land's End financial statements. Land's End Consolidated Balance Sheets - Dec. 31, USD (S) S in Thousands 2020 Current assets Dec 31, 2019 Dec 31, 2018 S 77,148 $ 193,405 2,149 1,948 50,953 34,549 375,670 321,905 39,458 36,574 $194,581 2,356 49,860 332,297 26,659 Cush and cash equivalents Restricted cash Accounts receivable, net Inventories, net Prepaid expenses & other current assets Total current assets Property and equipment, net Operating lease right-ofuse asset Goodwill Intangible asset, net Other assets TOTAL ASSETS 545,378 588,381 606,753 157,665 149,894 136,501 38,665 110,000 110,000 110,000 257,000 257,000 257,000 4,921 5,636 13,881 1,113,629 1,110,911 1,123,135 Planning Phase Assumptions: Assumptions 1: The target [maximum) for acceptable audit risk (AAR) is 0.07 or 7% risk Assumption 2: The estimated risk of material misstatement [RMM) at this point in the audit is 0.21 Assumption 3: Tolerable error [tolerable misstatement for each account within the statement of financial position [balance sheet] has been set at $ 90,000,000 for $ 90,000 in $ 1,000s). Accounts of interest: As indicated in the above balance sheet, the audit manager has highlighted two accounts for you to analyze and discuss: Cash & Cash Equivalents Accounts Receivable, Net Your answers should be based completely on the evidence indicated in the balance sheet. QUESTIONS: [Enter your answers in the indicated boxes. Expand the box size as needed]. Question 1 (15 pts]: As discussed in our Zoom classes, Audit Risk involves more than the standard definition provided by the AICPA or PCAOB. For example I argued there are two important types related to deciding on the audit opinion, that is Type I' and 'Type II' audit risk. a) Explain the difference between these two kinds of audit risk b) For each type, provide one possible cause of the risk: a. Type I risk b. Type II risk Question 2 [5 pts]: Who usually sets acceptable audit risk? Question 3 [5pts.] Given the three assumptions listed above, what is the detection risk [DR] needed to achieve the target Audit Risk

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts