Answered step by step

Verified Expert Solution

Question

1 Approved Answer

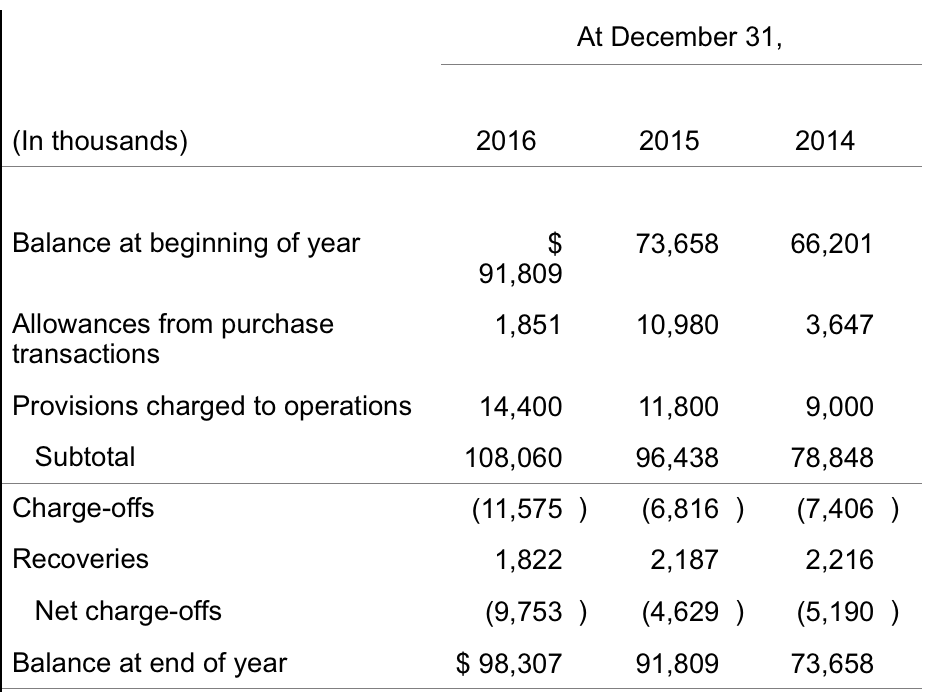

The following is a summary of the changes in the allowances for loan losses for three years: Lackey also reported (in thousands) in its comparative

The following is a summary of the changes in the allowances for loan losses for three years:

Lackey also reported (in thousands) in its comparative balance sheet Loans Receivable, net, of $6,869,911and $6,819,209 at December 31, 2016, and December 31, 2015, respectively.

1. How might a company with loan receivables be able to manage earnings in applying generally accepted accounting principles?

2. Is there any evidence in Lackey's disclosures above that are consistent with earnings management?

At December 31 (In thousands) 2016 2015 2014 Balance at beginning of year $73,658 66,201 91,809 1,851 Allowances from purchase transactions 10,980 3,647 11,800 96,438 (11,575 (6,816) (7,406) 2,187 Provisions charged to operations 14,400 9,000 Subtotal Charge-offs Recoveries 108,060 78,848 1,822 2,216 Net charge-offs Balance at end of year (9,753) (4,629 (5,190) $98,30791,80973,658Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started