The following is an excel assignment with which I'm having trouble. The balance sheet, income statement and SOCF in Screenshot #2 must be filled out using the information in screenshot #1 & #2. United States currency, etc.

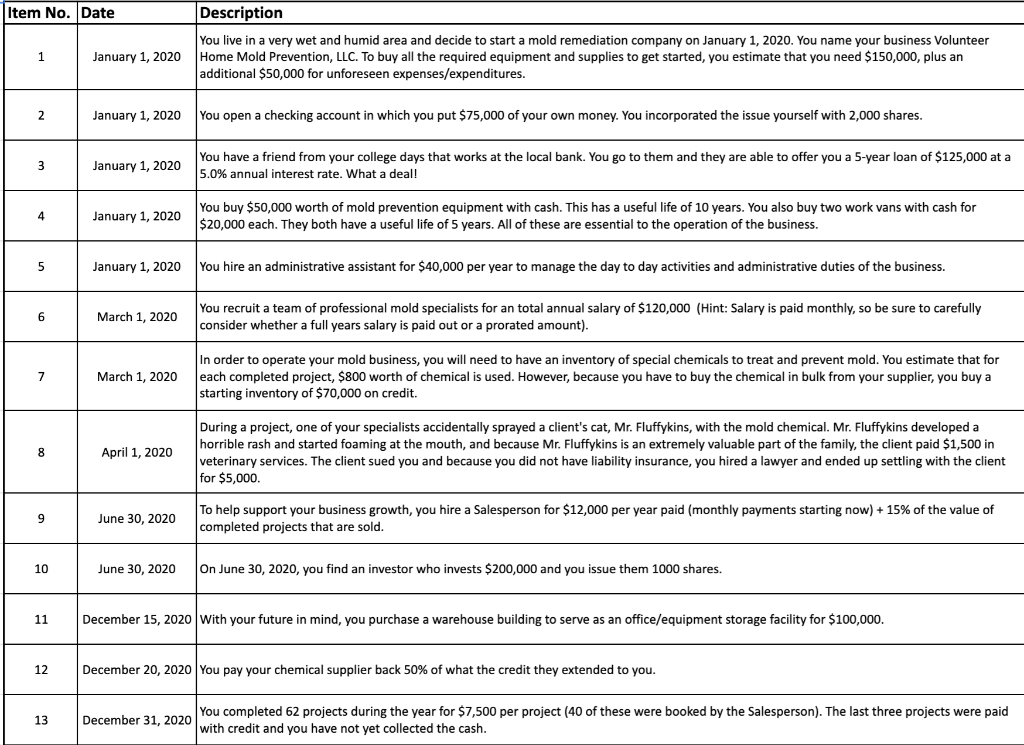

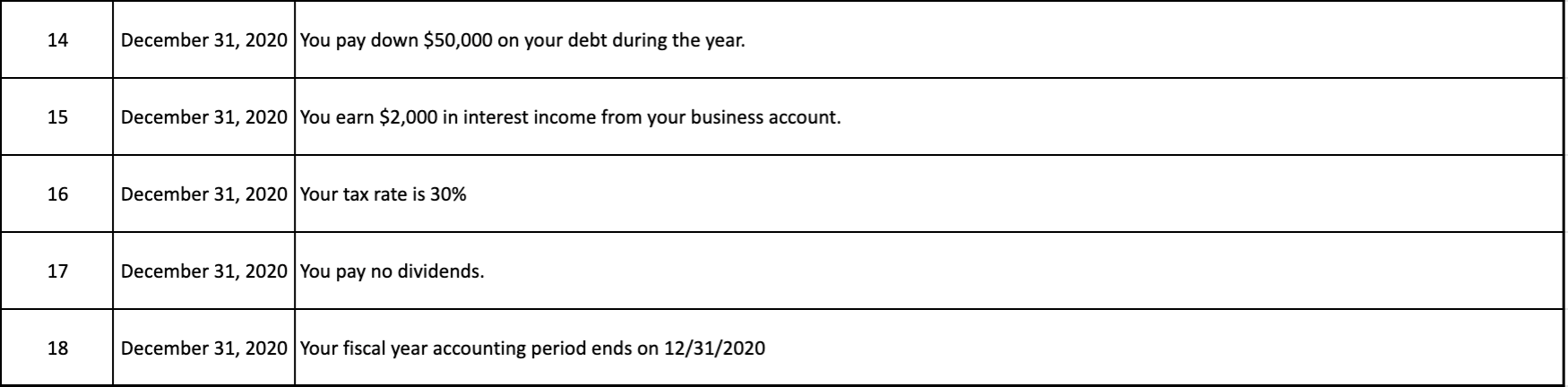

Screenshot #1 & #2

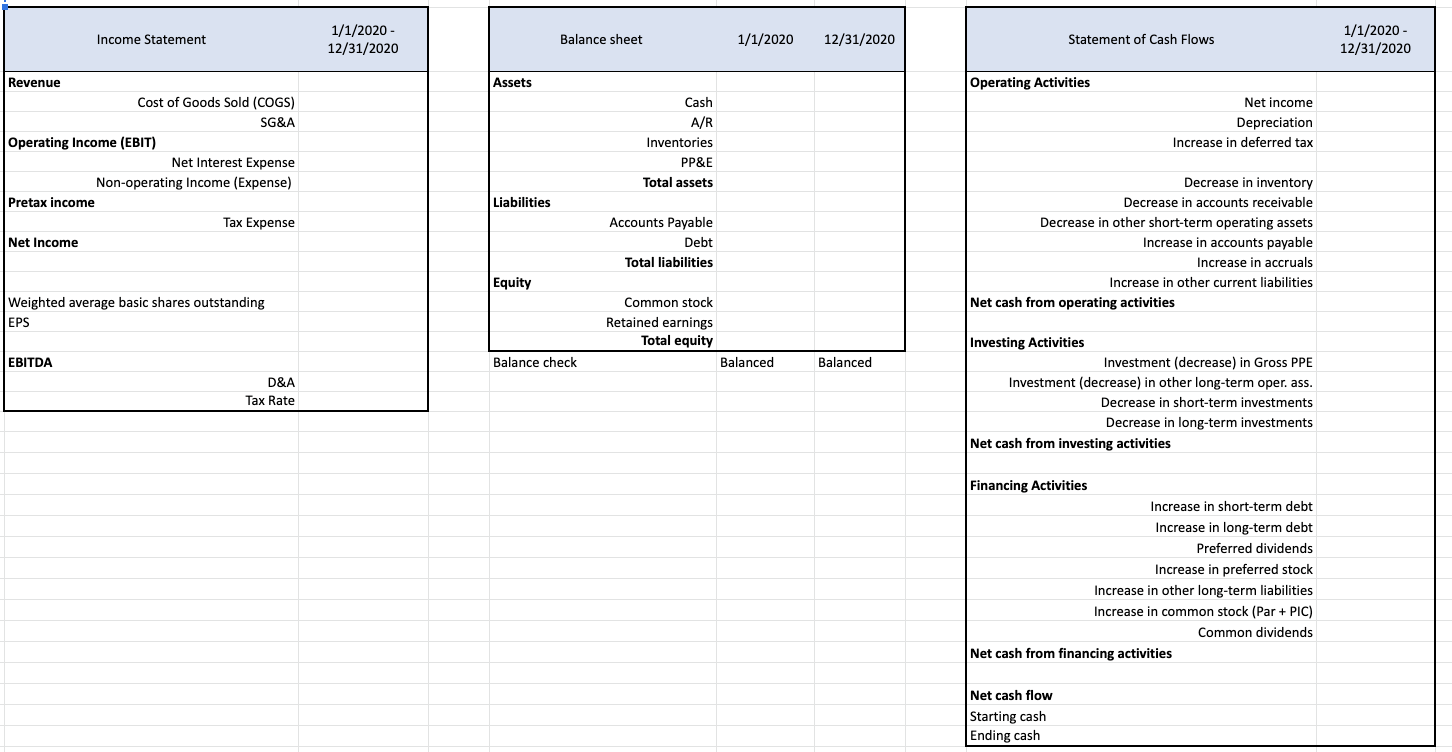

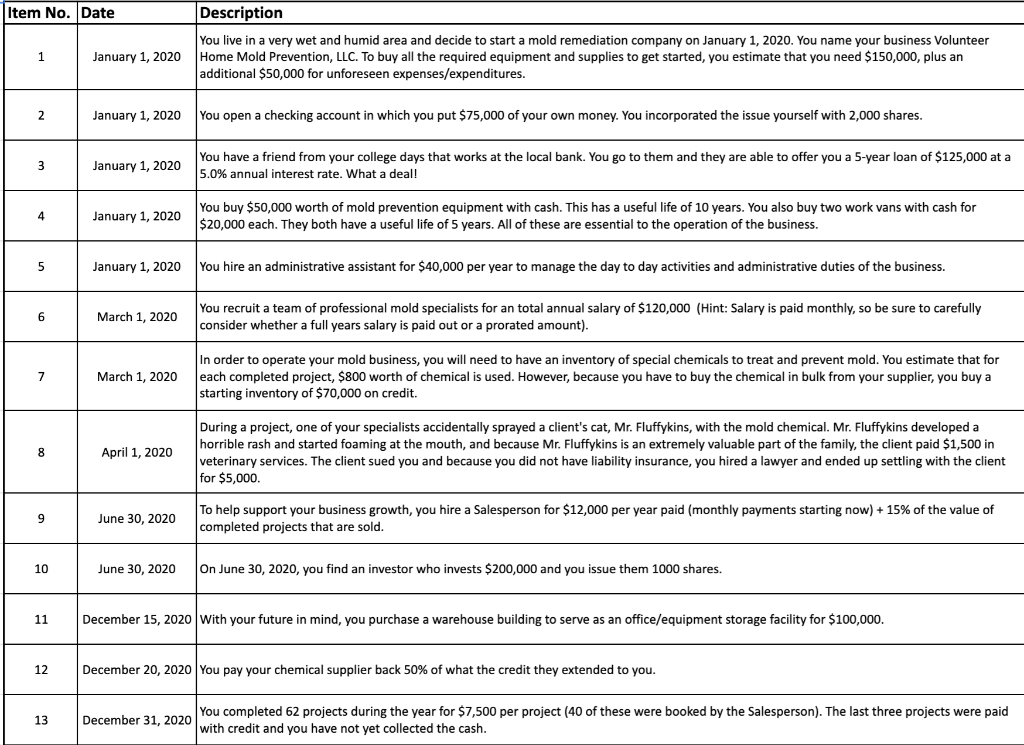

Screenshot #3

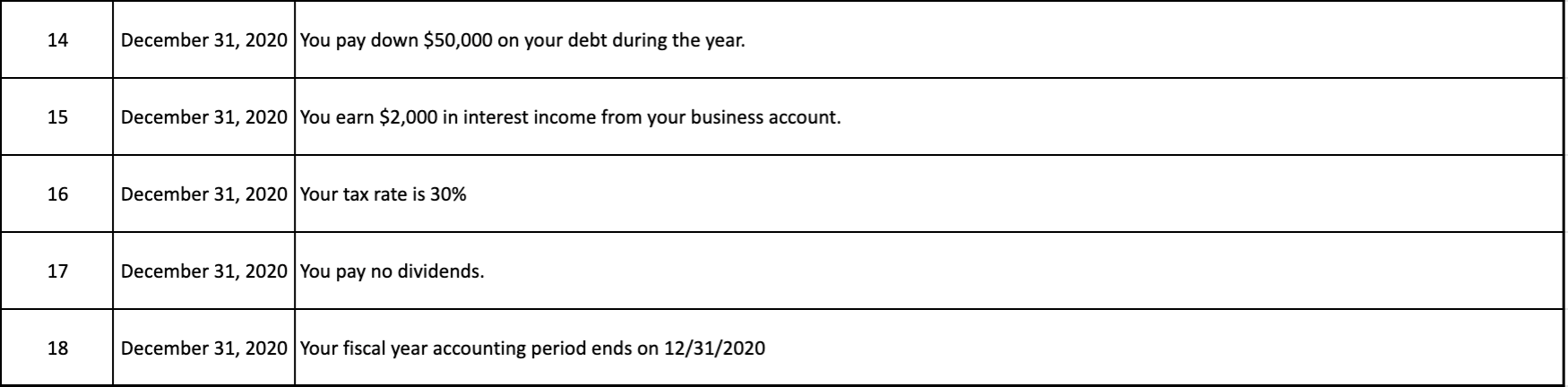

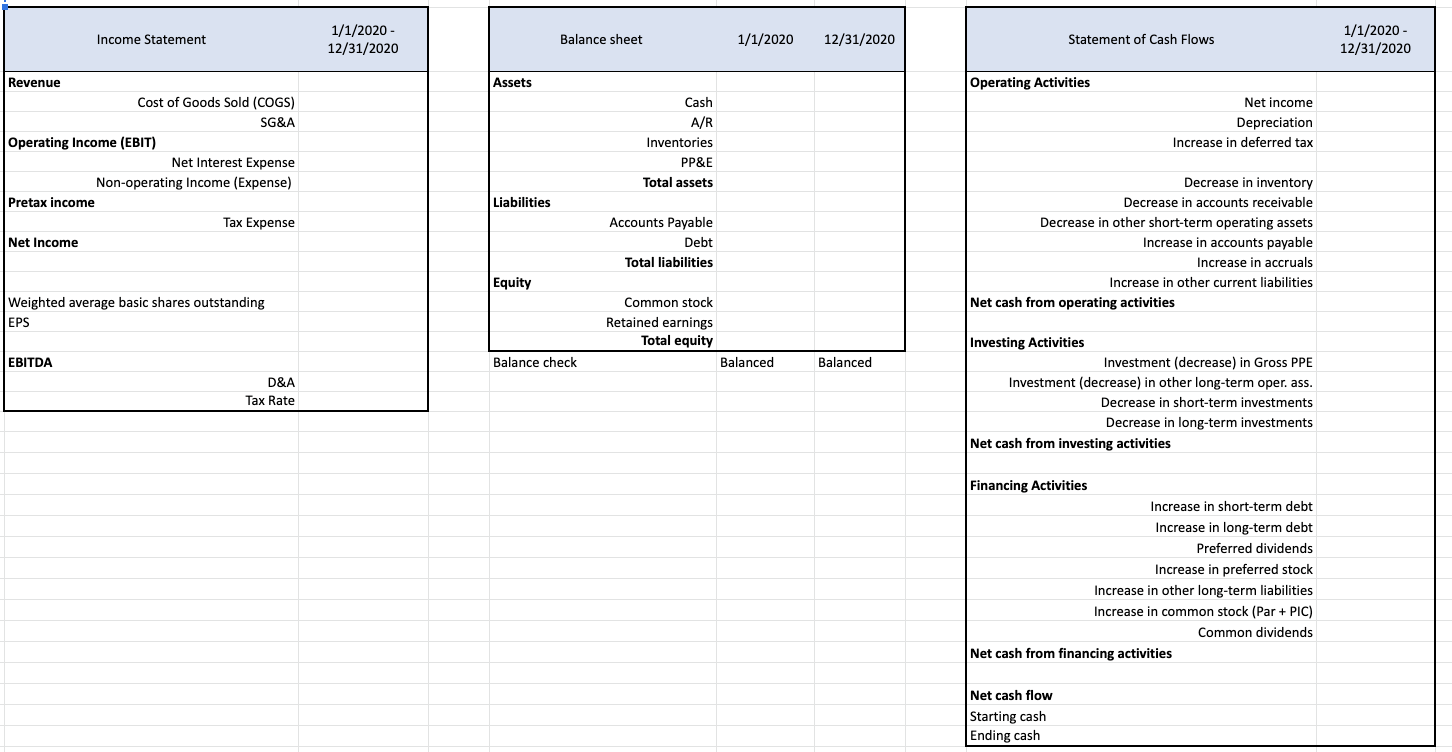

Item No. Date Description You live in a very wet and humid area and decide to start a mold remediation company on January 1, 2020. You name your business Volunteer Home Mold Prevention, LLC. To buy all the required equipment and supplies to get started, you estimate that you need $150,000, plus an additional $50,000 for unforeseen expenses/expenditures. 1 January 1, 2020 2 January 1, 2020 You open a checking account in which you put $75,000 of your own money. You incorporated the issue yourself with 2,000 shares. 3 January 1, 2020 You have a friend from your college days that works at the local bank. You go to them and they are able to offer you a 5-year loan of $125,000 at a 5.0% annual interest rate. What a deal! 4 January 1, 2020 You buy $50,000 worth of mold prevention equipment with cash. This has a useful life of 10 years. You also buy two work vans with cash for $20,000 each. They both have a useful life of 5 years. All of these are essential to the operation of the business. 5 January 1, 2020 You hire an administrative assistant for $40,000 per year to manage the day to day activities and administrative duties of the business. 6 6 March 1, 2020 You recruit a team of professional mold specialists for an total annual salary of $120,000 (Hint: Salary is paid monthly, so be sure to carefully consider whether a full years salary is paid out or a prorated amount). 7 March 1, 2020 In order to operate your mold business, you will need to have an inventory of special chemicals to treat and prevent mold. You estimate that for each completed project, $800 worth of chemical is used. However, because you have to buy the chemical in bulk from your supplier, you buy a starting inventory of $70,000 on credit. 8 April 1, 2020 During a project, one of your specialists accidentally sprayed a client's cat, Mr. Fluffykins, with the mold chemical. Mr. Fluffykins developed a horrible rash and started foaming at the mouth, and because Mr. Fluffykins is an extremely valuable part of the family, the client paid $1,500 in veterinary services. The client sued you and because you did not have liability insurance, you hired a lawyer and ended up settling with the client for $5,000. 9 June 30, 2020 To help support your business growth, you hire a Salesperson for $12,000 per year paid (monthly payments starting now) + 15% of the value of completed projects that are sold. 10 June 30, 2020 On June 30, 2020, you find an investor who invests $200,000 and you issue them 1000 shares. 11 December 15, 2020 With your future in mind, you purchase a warehouse building to serve as an office/equipment storage facility for $100,000. 12 December 20, 2020 You pay your chemical supplier back 50% of what the credit they extended to you. 13 December 31, 2020 You completed 62 projects during the year for $7,500 per project (40 of these were booked by the Salesperson). The last three projects were paid with credit and you have not yet collected the cash. 14 December 31, 2020 You pay down $50,000 on your debt during the year. 15 December 31, 2020 You earn $2,000 in interest income from your business account. 16 December 31, 2020 Your tax rate is 30% 17 December 31, 2020 You pay no dividends. 18 December 31, 2020 Your fiscal year accounting period ends on 12/31/2020 Income Statement 1/1/2020- 12/31/2020 Balance sheet 1/1/2020 12/31/2020 Statement of Cash Flows 1/1/2020 - 12/31/2020 Assets Operating Activities Revenue Cost of Goods Sold (COGS) SG&A Operating Income (EBIT) Net Interest Expense Non-operating Income (Expense) Pretax income Tax Expense Net Income Cash A/R Inventories PP&E Total assets Net income Depreciation Increase in deferred tax Liabilities Accounts Payable Debt Total liabilities Decrease in inventory Decrease in accounts receivable Decrease in other short-term operating assets Increase in accounts payable Increase in accruals Increase in other current liabilities Net cash from operating activities Equity Weighted average basic shares outstanding EPS Common stock Retained earnings Total equity EBITDA Balance check Balanced Balanced D&A Tax Rate Investing Activities Investment (decrease) in Gross PPE Investment (decrease) in other long-term oper. ass. Decrease in short-term investments Decrease in long-term investments Net cash from investing activities Financing Activities Increase in short-term debt Increase in long-term debt Preferred dividends Increase in preferred stock Increase in other long-term liabilities Increase in common stock (Par + PIC) Common dividends Net cash from financing activities Net cash flow Starting cash Ending cash Item No. Date Description You live in a very wet and humid area and decide to start a mold remediation company on January 1, 2020. You name your business Volunteer Home Mold Prevention, LLC. To buy all the required equipment and supplies to get started, you estimate that you need $150,000, plus an additional $50,000 for unforeseen expenses/expenditures. 1 January 1, 2020 2 January 1, 2020 You open a checking account in which you put $75,000 of your own money. You incorporated the issue yourself with 2,000 shares. 3 January 1, 2020 You have a friend from your college days that works at the local bank. You go to them and they are able to offer you a 5-year loan of $125,000 at a 5.0% annual interest rate. What a deal! 4 January 1, 2020 You buy $50,000 worth of mold prevention equipment with cash. This has a useful life of 10 years. You also buy two work vans with cash for $20,000 each. They both have a useful life of 5 years. All of these are essential to the operation of the business. 5 January 1, 2020 You hire an administrative assistant for $40,000 per year to manage the day to day activities and administrative duties of the business. 6 6 March 1, 2020 You recruit a team of professional mold specialists for an total annual salary of $120,000 (Hint: Salary is paid monthly, so be sure to carefully consider whether a full years salary is paid out or a prorated amount). 7 March 1, 2020 In order to operate your mold business, you will need to have an inventory of special chemicals to treat and prevent mold. You estimate that for each completed project, $800 worth of chemical is used. However, because you have to buy the chemical in bulk from your supplier, you buy a starting inventory of $70,000 on credit. 8 April 1, 2020 During a project, one of your specialists accidentally sprayed a client's cat, Mr. Fluffykins, with the mold chemical. Mr. Fluffykins developed a horrible rash and started foaming at the mouth, and because Mr. Fluffykins is an extremely valuable part of the family, the client paid $1,500 in veterinary services. The client sued you and because you did not have liability insurance, you hired a lawyer and ended up settling with the client for $5,000. 9 June 30, 2020 To help support your business growth, you hire a Salesperson for $12,000 per year paid (monthly payments starting now) + 15% of the value of completed projects that are sold. 10 June 30, 2020 On June 30, 2020, you find an investor who invests $200,000 and you issue them 1000 shares. 11 December 15, 2020 With your future in mind, you purchase a warehouse building to serve as an office/equipment storage facility for $100,000. 12 December 20, 2020 You pay your chemical supplier back 50% of what the credit they extended to you. 13 December 31, 2020 You completed 62 projects during the year for $7,500 per project (40 of these were booked by the Salesperson). The last three projects were paid with credit and you have not yet collected the cash. 14 December 31, 2020 You pay down $50,000 on your debt during the year. 15 December 31, 2020 You earn $2,000 in interest income from your business account. 16 December 31, 2020 Your tax rate is 30% 17 December 31, 2020 You pay no dividends. 18 December 31, 2020 Your fiscal year accounting period ends on 12/31/2020 Income Statement 1/1/2020- 12/31/2020 Balance sheet 1/1/2020 12/31/2020 Statement of Cash Flows 1/1/2020 - 12/31/2020 Assets Operating Activities Revenue Cost of Goods Sold (COGS) SG&A Operating Income (EBIT) Net Interest Expense Non-operating Income (Expense) Pretax income Tax Expense Net Income Cash A/R Inventories PP&E Total assets Net income Depreciation Increase in deferred tax Liabilities Accounts Payable Debt Total liabilities Decrease in inventory Decrease in accounts receivable Decrease in other short-term operating assets Increase in accounts payable Increase in accruals Increase in other current liabilities Net cash from operating activities Equity Weighted average basic shares outstanding EPS Common stock Retained earnings Total equity EBITDA Balance check Balanced Balanced D&A Tax Rate Investing Activities Investment (decrease) in Gross PPE Investment (decrease) in other long-term oper. ass. Decrease in short-term investments Decrease in long-term investments Net cash from investing activities Financing Activities Increase in short-term debt Increase in long-term debt Preferred dividends Increase in preferred stock Increase in other long-term liabilities Increase in common stock (Par + PIC) Common dividends Net cash from financing activities Net cash flow Starting cash Ending cash