Answered step by step

Verified Expert Solution

Question

1 Approved Answer

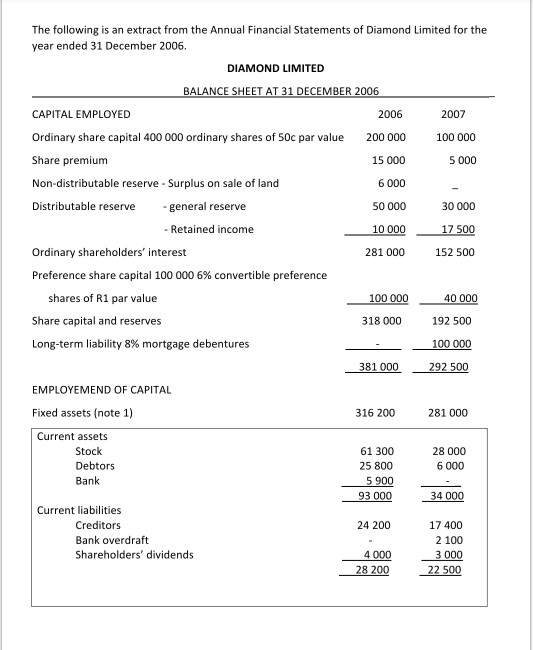

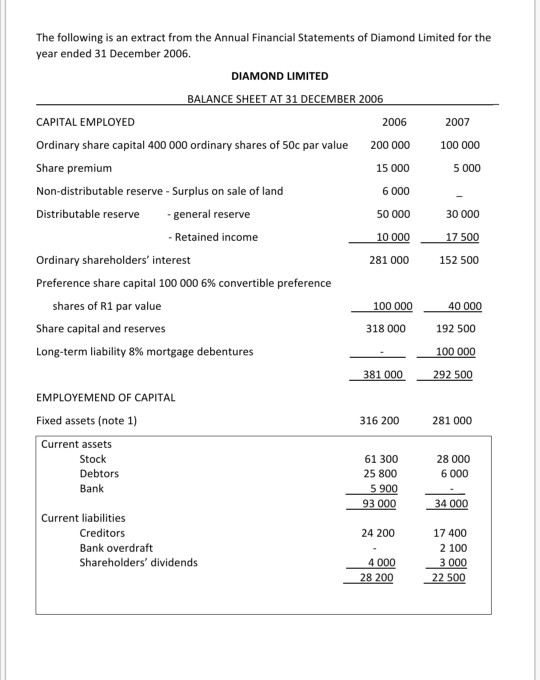

The following is an extract from the Annual Financial Statements of Diamond Limited for the year ended 31 December 2006 DIAMOND LIMITED BALANCE SHEET AT

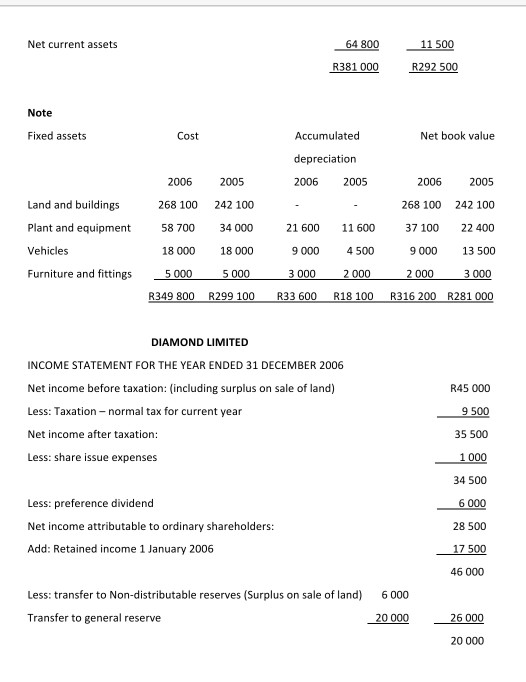

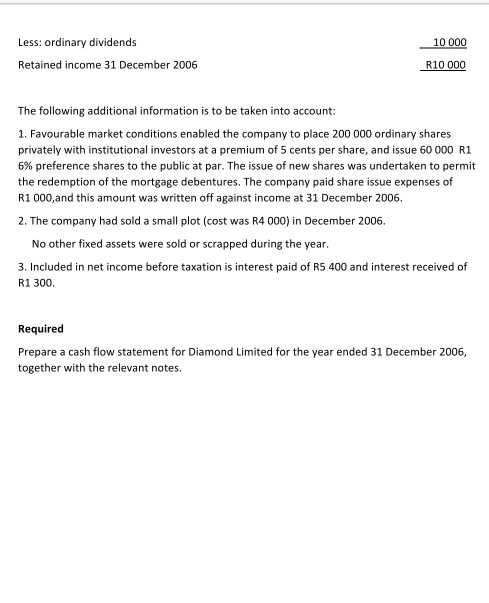

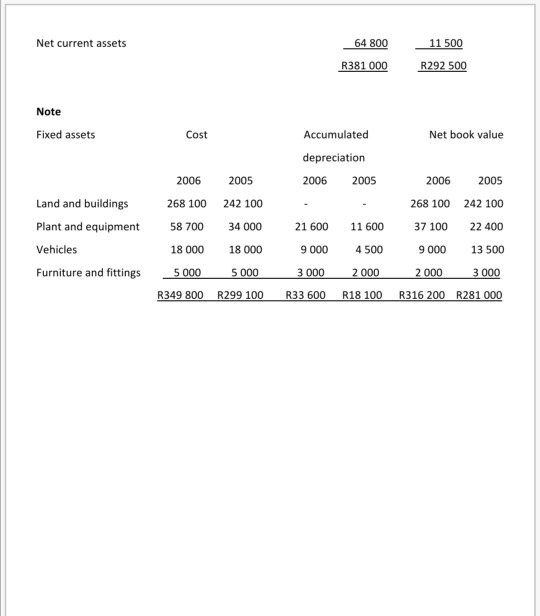

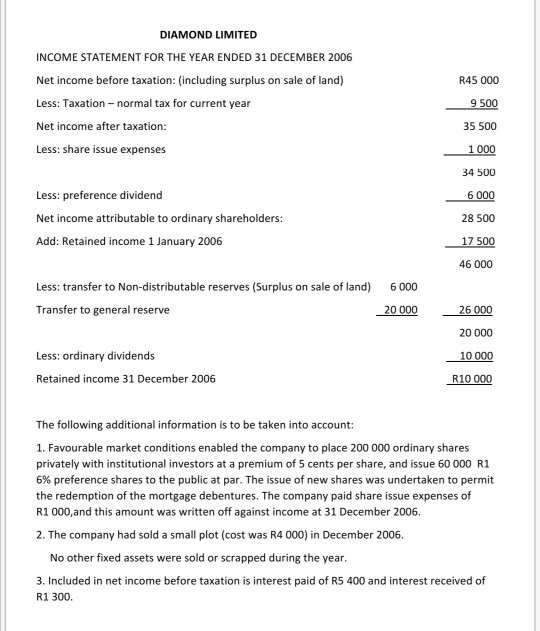

The following is an extract from the Annual Financial Statements of Diamond Limited for the year ended 31 December 2006 DIAMOND LIMITED BALANCE SHEET AT 31 DECEMBER 2006 CAPITAL EMPLOYED 2006 2007 Ordinary share capital 400 000 ordinary shares of Soc par value 200 000 100 000 Share premium 15 000 5 000 Non-distributable reserve - Surplus on sale of land 6 000 Distributable reserve general reserve 50 000 30 000 - Retained income 10 000 17 500 Ordinary shareholders' interest 281 000 152 500 Preference share capital 100 000 6% convertible preference shares of R1 par value 100 000 40 000 Share capital and reserves 318 000 192 500 Long-term liability 8% mortgage debentures 100 000 381 000 292 500 EMPLOYEMEND OF CAPITAL Fixed assets (note 1) 316 200 281 000 Current assets Stock Debtors Bank 28 000 6 000 61 300 25 800 5 900 93 000 34 000 24 200 Current liabilities Creditors Bank overdraft Shareholders' dividends 17 400 2 100 3000 22 500 4000 28 200 Net current assets 64 800 R381 000 11 500 R292 500 Note Fixed assets Cost Accumulated Net book value depreciation 2006 2005 Land and buildings Plant and equipment Vehicles Furniture and fittings 2006 2005 268 100 242 100 58 700 34 000 18000 18 000 5000 5000 R349 800 R299 100 21 600 9000 3 000 R33 600 11600 4500 2000 R18 100 2006 2005 268 100 242 100 37 100 22 400 9000 13 500 2 000 3000 R316 200 R281 000 DIAMOND LIMITED INCOME STATEMENT FOR THE YEAR ENDED 31 DECEMBER 2006 Net income before taxation: (including surplus on sale of land) Less: Taxation - normal tax for current year R45 000 Net income after taxation: Less: share issue expenses 9 500 35 500 1 000 34 500 6 000 28 500 17 500 Less: preference dividend Net income attributable to ordinary shareholders: Add: Retained income 1 January 2006 46 000 Less: transfer to Non-distributable reserves (Surplus on sale of land) 6000 20 000 Transfer to general reserve 26000 20 000 Less: ordinary dividends 10 000 R10 000 Retained income 31 December 2006 The following additional information is to be taken into account: 1. Favourable market conditions enabled the company to place 200 000 ordinary shares privately with institutional investors at a premium of 5 cents per share, and issue 60 000 R1 6% preference shares to the public at par. The issue of new shares was undertaken to permit the redemption of the mortgage debentures. The company paid share issue expenses of R1 000, and this amount was written off against income at 31 December 2006 2. The company had sold a small plot (cost was R4 000) in December 2006 No other fixed assets were sold or scrapped during the year. 3. Included in net income before taxation is interest paid of Rs 400 and interest received of R1 300. Required Prepare a cash flow statement for Diamond Limited for the year ended 31 December 2006, together with the relevant notes

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started