Answered step by step

Verified Expert Solution

Question

1 Approved Answer

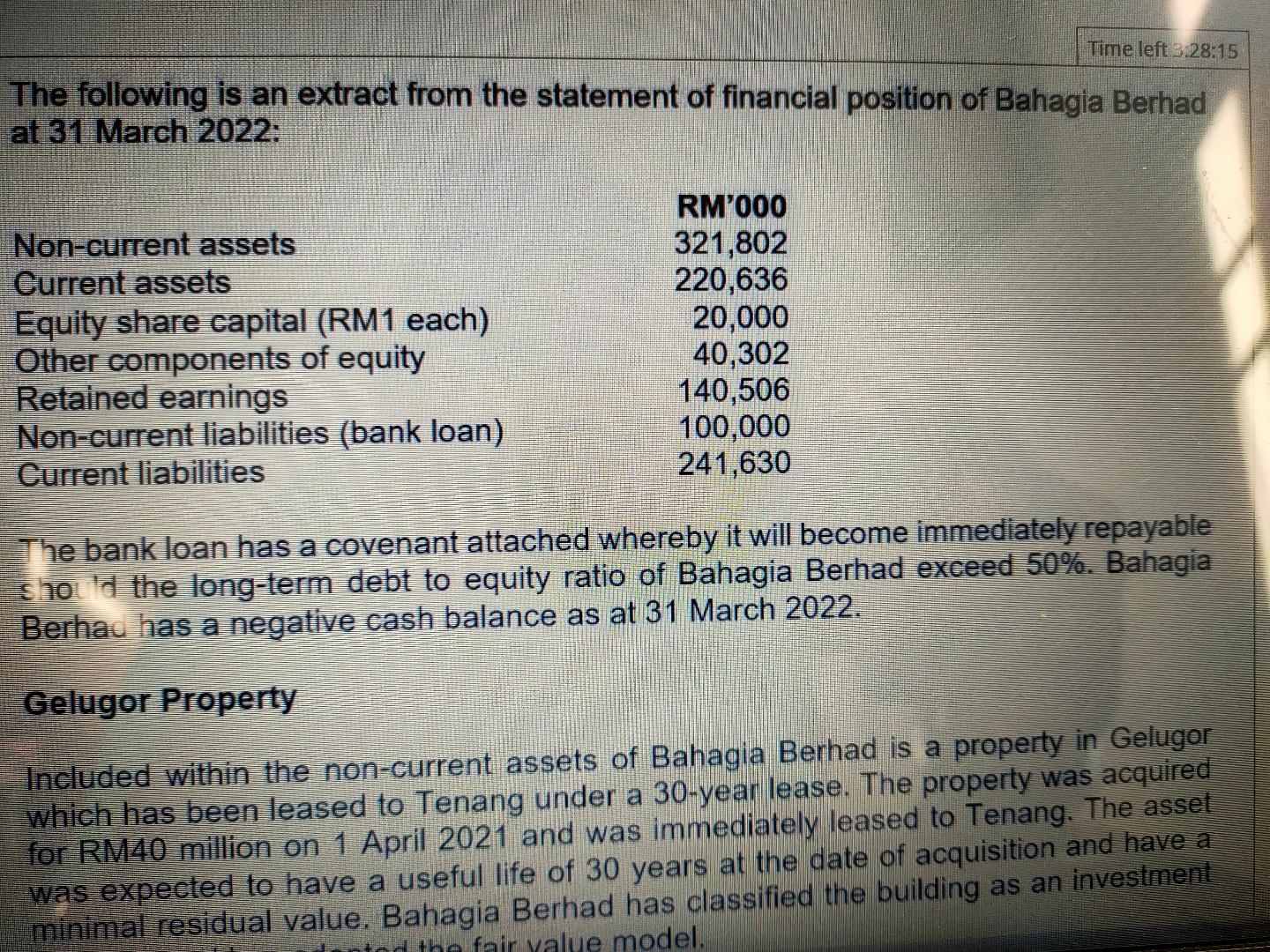

The following is an extract from the statement of financial position of Bahagia Berhad at 31 March 2022: The bank loan has a covenant attached

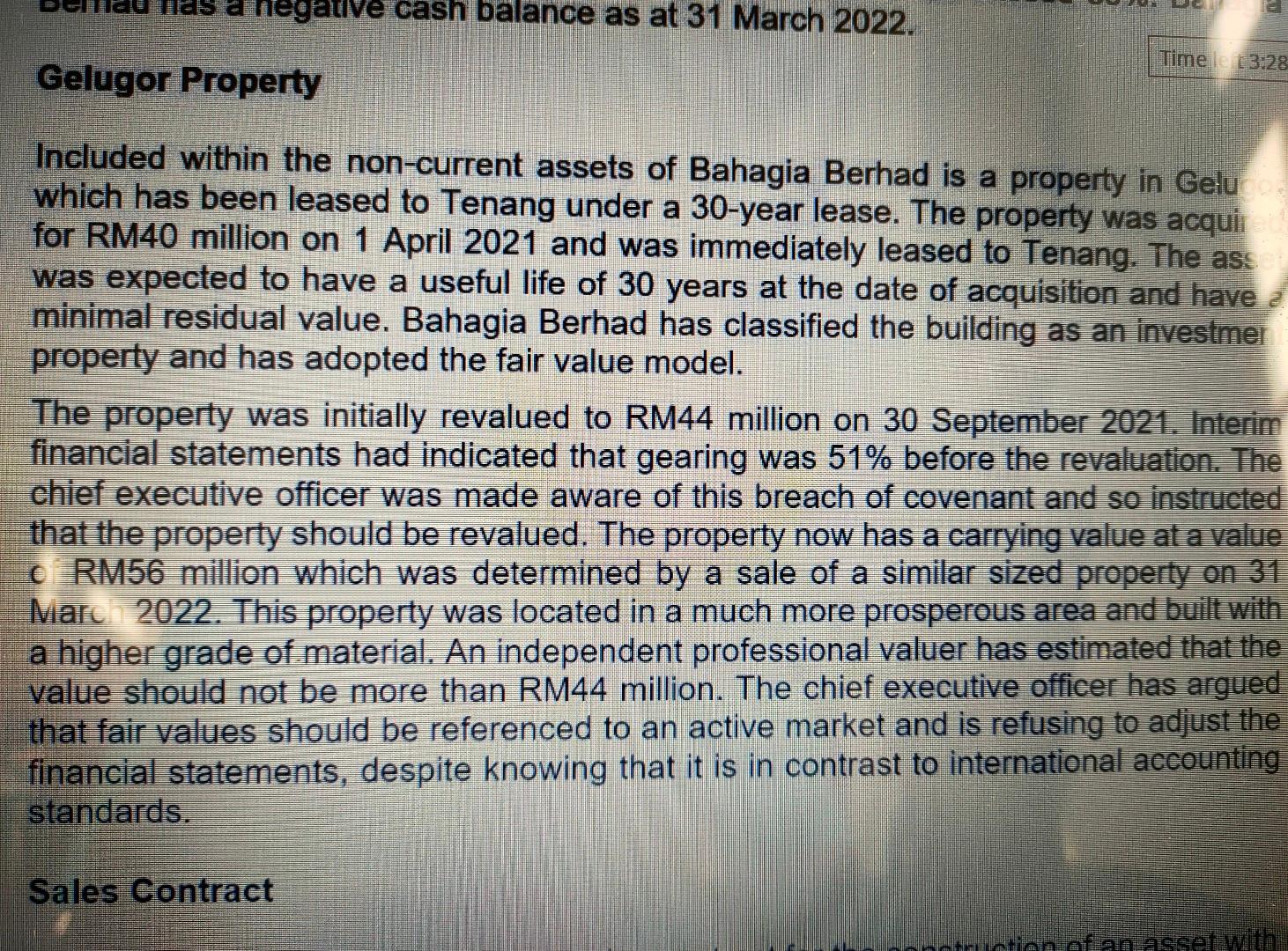

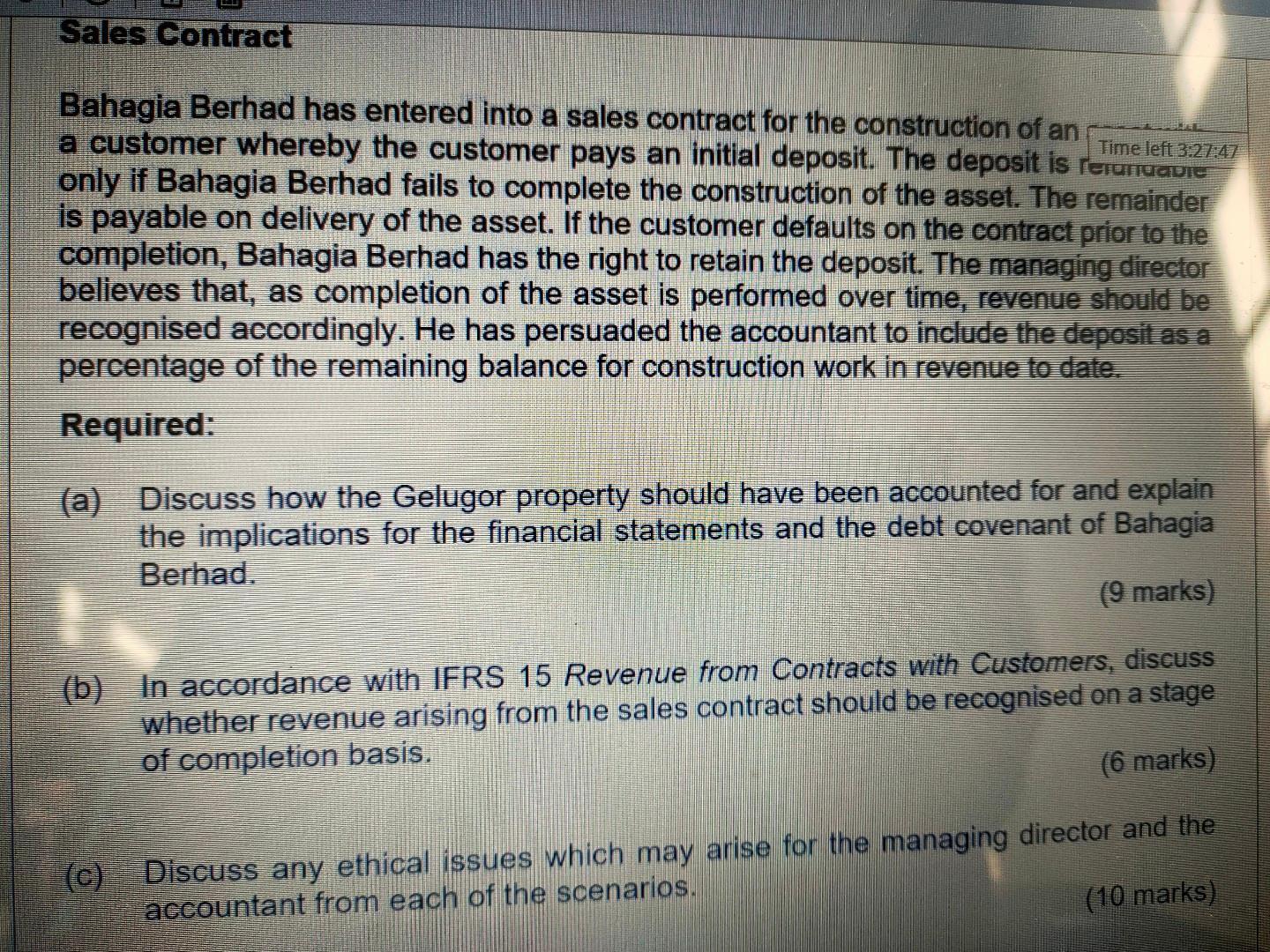

The following is an extract from the statement of financial position of Bahagia Berhad at 31 March 2022: The bank loan has a covenant attached whereby it will become immediately repayable sho the long-term debt to equity ratio of Bahagia Berhad exceed 50%. Bahagia Berhad has a negative cash balance as at 31 March 2022. eelugor Property Included within the non-current assets of Bahagia Berhad is a property in Gelugor which has been leased to Tenang under a 30 -year lease. The property was acquired for RM40 million on 1 April 2021 and was immediately leased to Tenang. The asset was expected to have a useful life of 30 years at the date of acquisition and have a minimal residual value. Bahagia Berhad has classified the building as an investment Gelugor Property Included within the non-current assets of Bahagia Berhad is a property in Gelu which has been leased to Tenang under a 30 -year lease. The property was acquil for RM40 million on 1 April 2021 and was immediately leased to Tenang. The as: was expected to have a useful life of 30 years at the date of acquisition and have minimal residual value. Bahagia Berhad has classified the building as an investmer property and has adopted the fair value model. The property was initially revalued to RM44 million on 30 September 2021. Interim financial statements had indicated that gearing was 51% before the revaluation. The chief executive officer was made aware of this breach of covenant and so instructed that the property should be revalued. The property now has a carrying value at a value - RM56 million which was determined by a sale of a similar sized property on 31 Marc 2022. This property was located in a much more prosperous area and built with a higher grade of material. An independent professional valuer has estimated that the value should not be more than RM44 million. The chief executive officer has argued that fair values should be referenced to an active market and is refusing to adjust the financial statements, despite knowing that it is in contrast to international accounting standards. Bahagia Berhad has entered into a sales contract for the construction of an a customer whereby the customer pays an initial deposit. The deposit is remurume only if Bahagia Berhad fails to complete the construction of the asset. The remainder is payable on delivery of the asset. If the customer defaults on the contract prior to the completion, Bahagia Berhad has the right to retain the deposit. The managing director believes that, as completion of the asset is performed over time, revenue should be recognised accordingly. He has persuaded the accountant to include the deposit as a percentage of the remaining balance for construction work in revenue to date. Required: (a) Discuss how the Gelugor property should have been accounted for and explain the implications for the financial statements and the debt covenant of Bahagia Berhad. (9 marks) (b) In accordance with IFRS 15 Revenue from Contracts with Customers, discuss whether revenue arising from the sales contract should be recognised on a stage of completion basis. (6 marks) (c) Discuss any ethical issues which may arise for the managing director and the accountant from each of the scenarios. (10 marks) The following is an extract from the statement of financial position of Bahagia Berhad at 31 March 2022: The bank loan has a covenant attached whereby it will become immediately repayable sho the long-term debt to equity ratio of Bahagia Berhad exceed 50%. Bahagia Berhad has a negative cash balance as at 31 March 2022. eelugor Property Included within the non-current assets of Bahagia Berhad is a property in Gelugor which has been leased to Tenang under a 30 -year lease. The property was acquired for RM40 million on 1 April 2021 and was immediately leased to Tenang. The asset was expected to have a useful life of 30 years at the date of acquisition and have a minimal residual value. Bahagia Berhad has classified the building as an investment Gelugor Property Included within the non-current assets of Bahagia Berhad is a property in Gelu which has been leased to Tenang under a 30 -year lease. The property was acquil for RM40 million on 1 April 2021 and was immediately leased to Tenang. The as: was expected to have a useful life of 30 years at the date of acquisition and have minimal residual value. Bahagia Berhad has classified the building as an investmer property and has adopted the fair value model. The property was initially revalued to RM44 million on 30 September 2021. Interim financial statements had indicated that gearing was 51% before the revaluation. The chief executive officer was made aware of this breach of covenant and so instructed that the property should be revalued. The property now has a carrying value at a value - RM56 million which was determined by a sale of a similar sized property on 31 Marc 2022. This property was located in a much more prosperous area and built with a higher grade of material. An independent professional valuer has estimated that the value should not be more than RM44 million. The chief executive officer has argued that fair values should be referenced to an active market and is refusing to adjust the financial statements, despite knowing that it is in contrast to international accounting standards. Bahagia Berhad has entered into a sales contract for the construction of an a customer whereby the customer pays an initial deposit. The deposit is remurume only if Bahagia Berhad fails to complete the construction of the asset. The remainder is payable on delivery of the asset. If the customer defaults on the contract prior to the completion, Bahagia Berhad has the right to retain the deposit. The managing director believes that, as completion of the asset is performed over time, revenue should be recognised accordingly. He has persuaded the accountant to include the deposit as a percentage of the remaining balance for construction work in revenue to date. Required: (a) Discuss how the Gelugor property should have been accounted for and explain the implications for the financial statements and the debt covenant of Bahagia Berhad. (9 marks) (b) In accordance with IFRS 15 Revenue from Contracts with Customers, discuss whether revenue arising from the sales contract should be recognised on a stage of completion basis. (6 marks) (c) Discuss any ethical issues which may arise for the managing director and the accountant from each of the scenarios. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started