Answered step by step

Verified Expert Solution

Question

1 Approved Answer

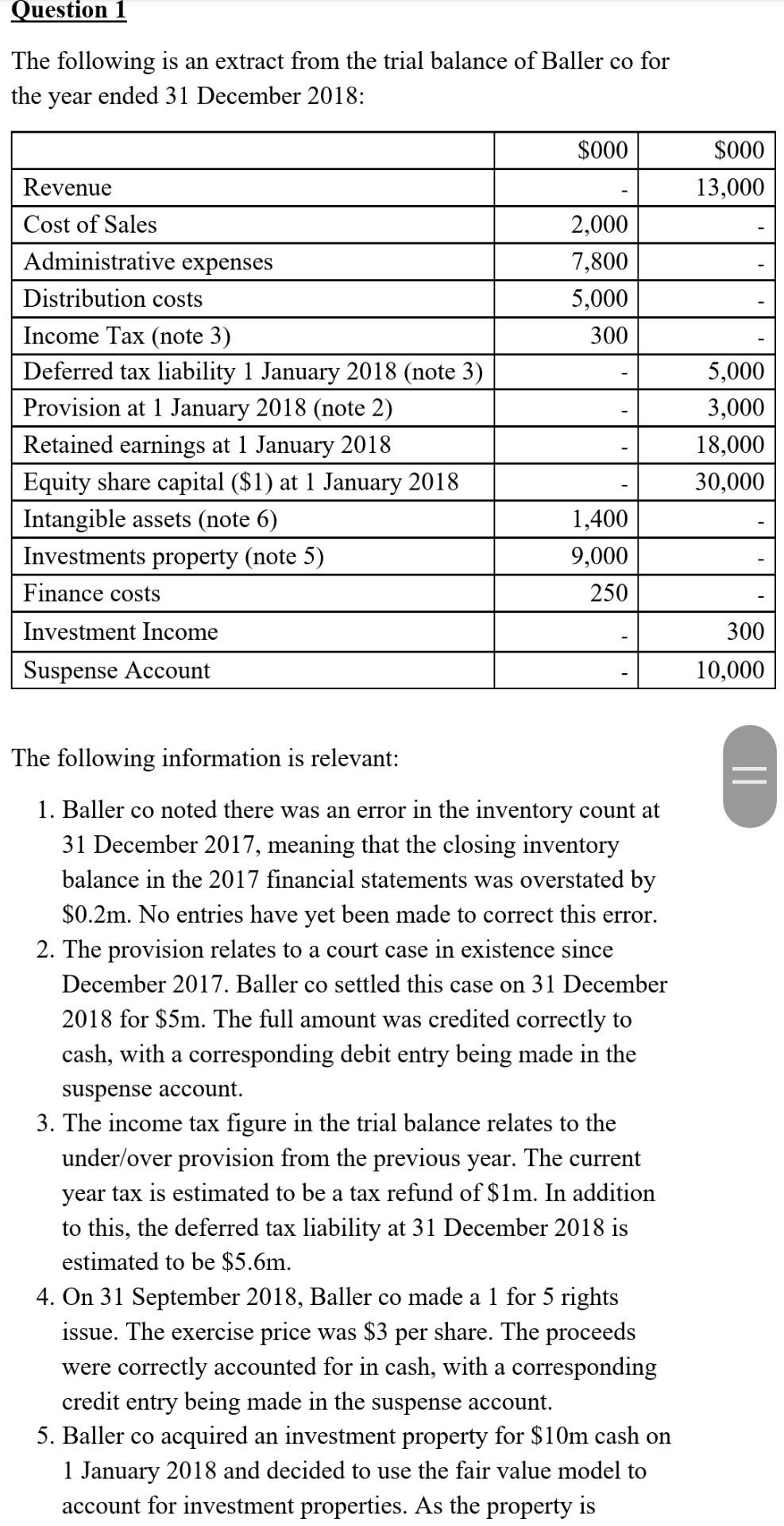

The following is an extract from the trial balance of Baller co for the year ended 31 December 2018: The following information is relevant: 1.

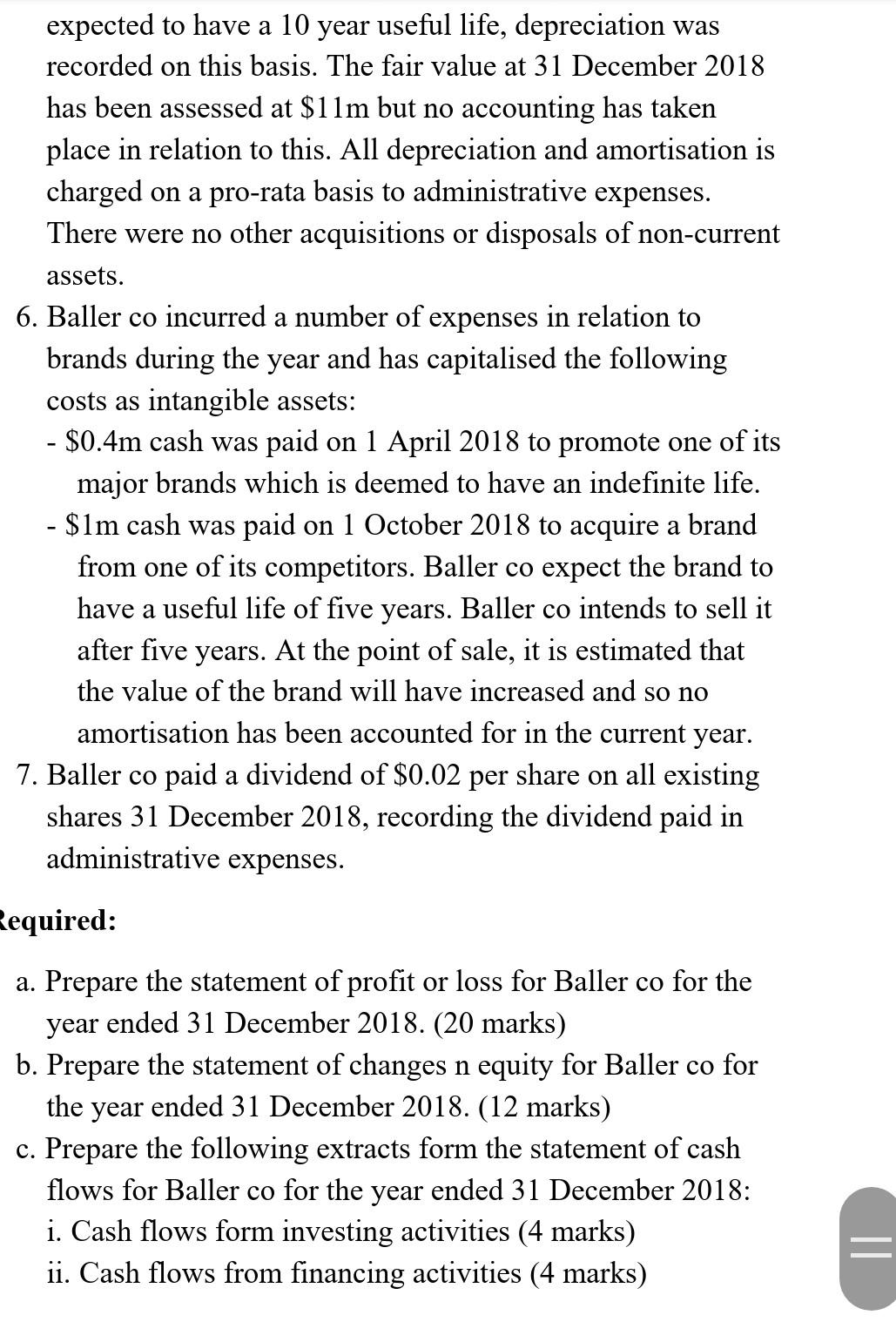

The following is an extract from the trial balance of Baller co for the year ended 31 December 2018: The following information is relevant: 1. Baller co noted there was an error in the inventory count at 31 December 2017, meaning that the closing inventory balance in the 2017 financial statements was overstated by $0.2m. No entries have yet been made to correct this error. 2. The provision relates to a court case in existence since December 2017. Baller co settled this case on 31 December 2018 for $5m. The full amount was credited correctly to cash, with a corresponding debit entry being made in the suspense account. 3. The income tax figure in the trial balance relates to the under/over provision from the previous year. The current year tax is estimated to be a tax refund of $1m. In addition to this, the deferred tax liability at 31 December 2018 is estimated to be $5.6m. 4. On 31 September 2018, Baller co made a 1 for 5 rights issue. The exercise price was $3 per share. The proceeds were correctly accounted for in cash, with a corresponding credit entry being made in the suspense account. 5. Baller co acquired an investment property for $10m cash on 1 January 2018 and decided to use the fair value model to account for investment properties. As the property is expected to have a 10 year useful life, depreciation was recorded on this basis. The fair value at 31 December 2018 has been assessed at $11m but no accounting has taken place in relation to this. All depreciation and amortisation is charged on a pro-rata basis to administrative expenses. There were no other acquisitions or disposals of non-current assets. 6. Baller co incurred a number of expenses in relation to brands during the year and has capitalised the following costs as intangible assets: - $0.4m cash was paid on 1 April 2018 to promote one of its major brands which is deemed to have an indefinite life. - $1m cash was paid on 1 October 2018 to acquire a brand from one of its competitors. Baller co expect the brand to have a useful life of five years. Baller co intends to sell it after five years. At the point of sale, it is estimated that the value of the brand will have increased and so no amortisation has been accounted for in the current year. 7. Baller co paid a dividend of $0.02 per share on all existing shares 31 December 2018, recording the dividend paid in administrative expenses. iequired: a. Prepare the statement of profit or loss for Baller co for the year ended 31 December 2018. (20 marks) b. Prepare the statement of changes n equity for Baller co for the year ended 31 December 2018. (12 marks) c. Prepare the following extracts form the statement of cash flows for Baller co for the year ended 31 December 2018: i. Cash flows form investing activities (4 marks) ii. Cash flows from financing activities (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started