Answered step by step

Verified Expert Solution

Question

1 Approved Answer

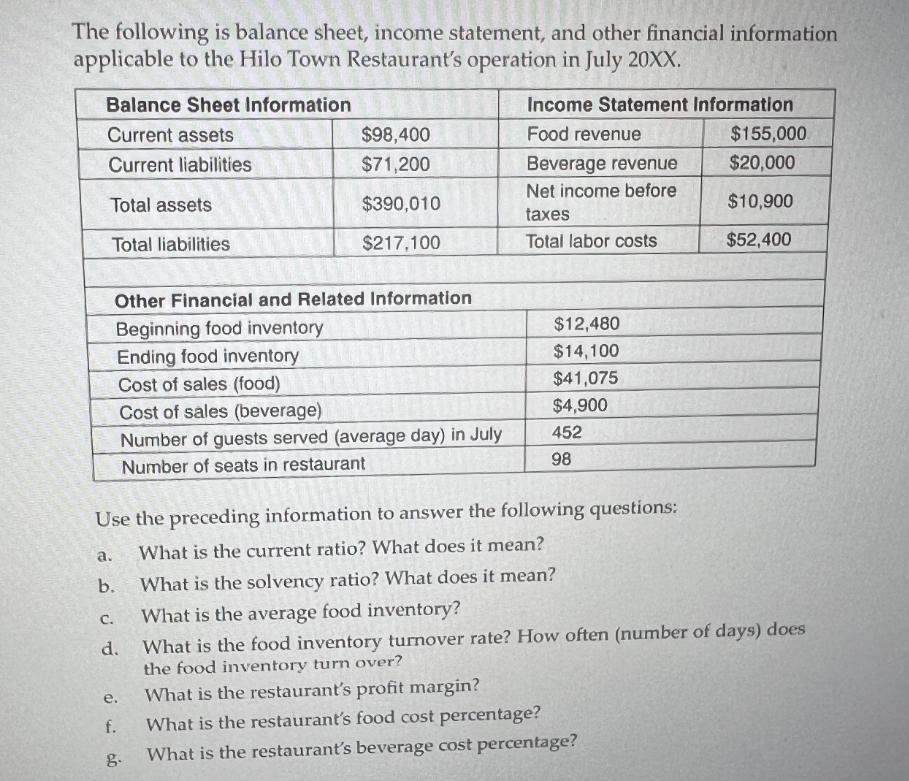

The following is balance sheet, income statement, and other financial information applicable to the Hilo Town Restaurant's operation in July 20XX. Balance Sheet Information

The following is balance sheet, income statement, and other financial information applicable to the Hilo Town Restaurant's operation in July 20XX. Balance Sheet Information Income Statement Information Current assets $98,400 Food revenue $155,000 Current liabilities $71,200 Beverage revenue $20,000 Net income before Total assets $390,010 $10,900 taxes Total liabilities $217,100 Total labor costs $52,400 Other Financial and Related Information Beginning food inventory Ending food inventory Cost of sales (food) Cost of sales (beverage) Number of guests served (average day) in July Number of seats in restaurant $12,480 $14,100 $41,075 $4,900 452 98 Use the preceding information to answer the following questions: a. What is the current ratio? What does it mean? b. What is the solvency ratio? What does it mean? C. What is the average food inventory? d. What is the food inventory turnover rate? How often (number of days) does the food inventory turn over? e. What is the restaurant's profit margin? f. 918 g. What is the restaurant's food cost percentage? What is the restaurant's beverage cost percentage?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a The current ratio is calculated by dividing current assets by current liabilities Current Ratio Current Assets Current Liabilities Current Ratio 71200 98400 Current Ratio 0723 The current ratio meas...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663e66104cdaa_956943.pdf

180 KBs PDF File

663e66104cdaa_956943.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started