Answered step by step

Verified Expert Solution

Question

1 Approved Answer

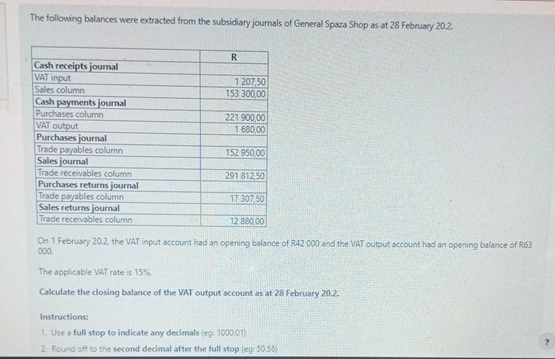

The following balances were extracted from the subsidiary journals of General Spaza Shop as at 28 February 20.2. Cash receipts journal VAT input Sales

The following balances were extracted from the subsidiary journals of General Spaza Shop as at 28 February 20.2. Cash receipts journal VAT input Sales column Cash payments journal Purchases column VAT output Purchases journal Trade payables column R 1207,50 153 300,00 221 900,00 1 68000 152 950,00 Sales journal Trade receivables column 291 812,50 Purchases returns journal Trade payables column 17 307 50 Sales returns journal Trade receivables column 12 880,00 On 1 February 20.2, the VAT input account had an opening balance of R42 000 and the VAT output account had an opening balance of R63 000. The applicable VAT rate is 15%. Calculate the closing balance of the VAT output account as at 28 February 20.2. Instructions: 1. Use a full stop to indicate any decimals (eg: 1000.01) 2. Round off to the second decimal after the full stop (eg: 50.56)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the closing balance of the VAT output account at 28 Feb...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663e661c335f7_956942.pdf

180 KBs PDF File

663e661c335f7_956942.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started