Answered step by step

Verified Expert Solution

Question

1 Approved Answer

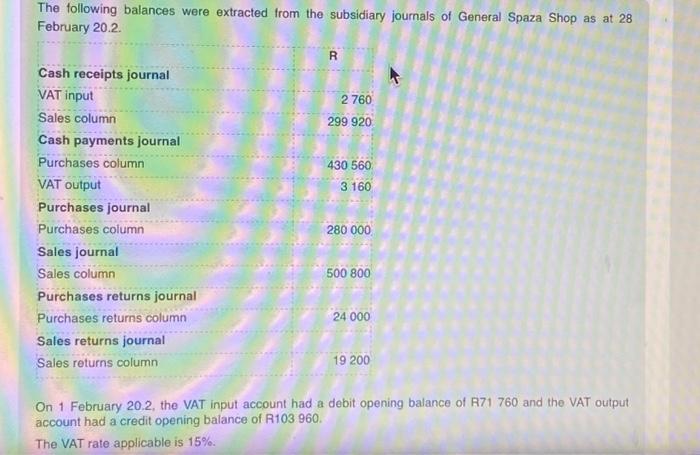

The following balances were extracted from the subsidiary journals of General Spaza Shop as at 28 February 20.2. Cash receipts journal VAT input Sales

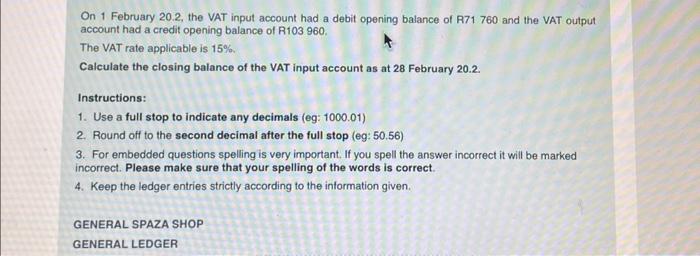

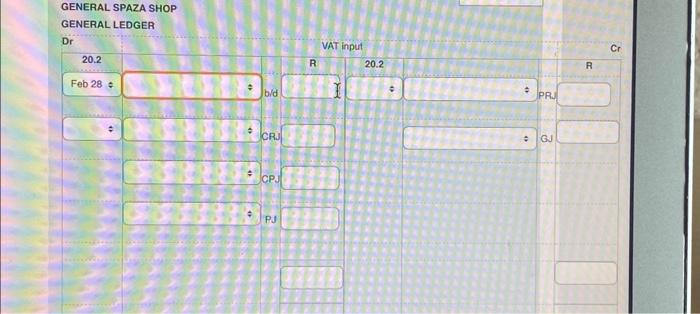

The following balances were extracted from the subsidiary journals of General Spaza Shop as at 28 February 20.2. Cash receipts journal VAT input Sales column Cash payments journal Purchases column VAT output Purchases journal Purchases column Sales journal Sales column Purchases returns journal Purchases returns column. Sales returns journal Sales returns column 2760 299 920 430 560 3 160 280 000 500 800 24 000 19 200 On 1 February 20.2, the VAT input account had a debit opening balance of R71 760 and the VAT output account had a credit opening balance of R103 960. The VAT rate applicable is 15%. On 1 February 20.2, the VAT input account had a debit opening balance of R71 760 and the VAT output account had a credit opening balance of R103 960. The VAT rate applicable is 15%. Calculate the closing balance of the VAT input account as at 28 February 20.2. Instructions: 1. Use a full stop to indicate any decimals (eg: 1000.01) 2. Round off to the second decimal after the full stop (eg: 50.56) 3. For embedded questions spelling is very important. If you spell the answer incorrect it will be marked incorrect. Please make sure that your spelling of the words is correct. 4. Keep the ledger entries strictly according to the information given. GENERAL SPAZA SHOP GENERAL LEDGER GENERAL SPAZA SHOP GENERAL LEDGER Dr 20.2 Feb 28 0 13 To b/d CRJ CPJ PJ R VAT input 20.2 # : PRJ GJ R Cr

Step by Step Solution

★★★★★

3.31 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Answer To calculate the closing balance of the VAT input account as at 28 Fe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started