Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following is from the 2024 annual report of Kaufman Chemicals, Incorporated: Statements of Comprehensive Income Years Ended December 31 2024 2023 2022 Net income

The following is from the 2024 annual report of Kaufman Chemicals, Incorporated:

| Statements of Comprehensive Income | Years Ended December 31 | ||

|---|---|---|---|

| 2024 | 2023 | 2022 | |

| Net income | $ 955 | $ 785 | $ 640 |

| Other comprehensive income: | |||

| Change in net unrealized gains on AFS investments, net of tax of $28, ($16), and $25 in 2024, 2023, and 2022, respectively | 38 | (26) | 32 |

| Other | (2) | (2) | 1 |

| Total comprehensive income | $ 991 | $ 757 | $ 673 |

Kaufman reports accumulated other comprehensive income in its balance sheet as a component of shareholders' equity as follows:

| ($ in millions) | 2024 | 2023 |

|---|---|---|

| Shareholders equity: | ||

| Common stock | $ 380 | $ 380 |

| Additional paid-in capital | 9,080 | 9,080 |

| Retained earnings | 8,160 | 7,604 |

| Accumulated other comprehensive income | 126 | 90 |

| Total shareholders equity | $ 17,746 | $ 17,154 |

Required:

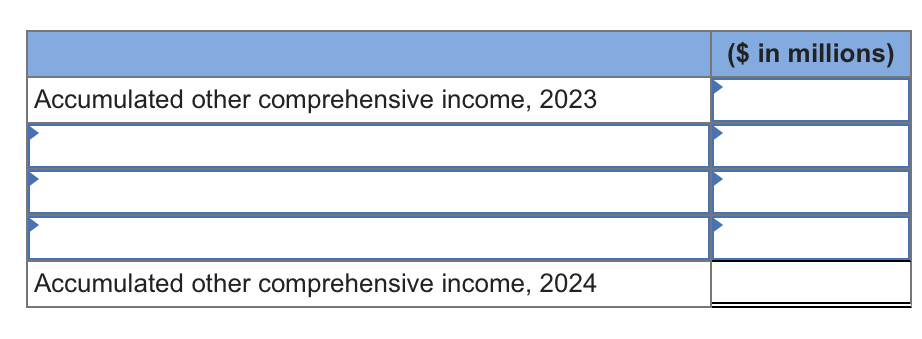

3. From the information provided, determine how Kaufman calculated the $126 million accumulated other comprehensive income in 2024.

Note: Negative amount should be indicated by a minus sign. Enter your answers in millions (i.e., 10,000,000 should be entered as 10).

\begin{tabular}{|l|l|} \hline Accumulated other comprehensive income, 2023 & \\ \hline & (\$ in millions) \\ \hline & \\ \hline Accumulated other comprehensive income, 2024 & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started