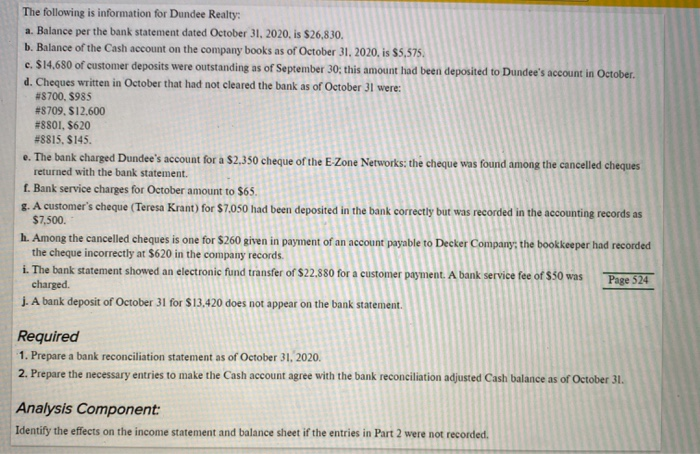

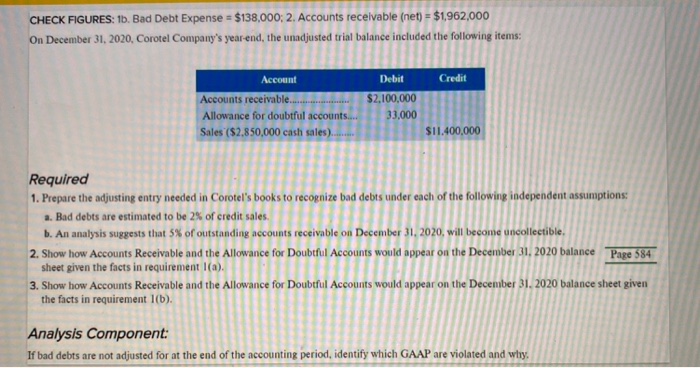

The following is information for Dundee Realty: a. Balance per the bank statement dated October 31, 2020, is $26,830 b. Balance of the Cash account on the company books as of October 31, 2020, is $5,575. c. $14.680 of customer deposits were outstanding as of September 30; this amount had been deposited to Dundee's account in October. d. Cheques written in October that had not cleared the bank as of October 31 were: #8700, 8985 #8709, $12.600 #8801, $620 #8815, $145. e. The bank charged Dundee's account for a $2,350 cheque of the B-Zone Networks: the cheque was found among the cancelled cheques returned with the bank statement. f. Bank service charges for October amount to $65. 8. A customer's cheque (Teresa Krant) for $7,050 had been deposited in the bank correctly but was recorded in the accounting records as $7,500 h. Among the cancelled cheques is one for $260 given in payment of an account payable to Decker Company: the bookkeeper had recorded the cheque incorrectly at $620 in the company records. i. The bank statement showed an electronic fund transfer of $22.880 for a customer payment. A bank service fee of $50 was Page 524 charged j. A bank deposit of October 31 for $13.420 does not appear on the bank statement. Required 1. Prepare a bank reconciliation statement as of October 31, 2020. 2. Prepare the necessary entries to make the Cash account agree with the bank reconciliation adjusted Cash balance as of October 31 Analysis Component: Identify the effects on the income statement and balance sheet if the entries in Part 2 were not recorded CHECK FIGURES: 15. Bad Debt Expense = $138,000; 2. Accounts receivable (net) = $1,962,000 On December 31, 2020, Corotel Company's year-end, the unadjusted trial balance included the following items: Credit Account Accounts receivable. Allowance for doubtful accounts.... Sales ($2,850,000 cash sales). Debit $2,100,000 33,000 $11.400,000 Required 1. Prepare the adjusting entry needed in Corotel's books to recognize bad debts under each of the following independent assumptions: a. Bad debts are estimated to be 2% of credit sales. b. An analysis suggests that 5% of outstanding accounts receivable on December 31, 2020, will become uncollectible 2. Show how Accounts Receivable and the Allowance for Doubtful Accounts would appear on the December 31, 2020 balance Page 584 sheet given the facts in requirement 1(a). 3. Show how Accounts Receivable and the Allowance for Doubtful Accounts would appear on the December 31, 2020 balance sheet given the facts in requirement 1(b). Analysis Component: If bad debts are not adjusted for at the end of the accounting period, identify which GAAP are violated and why