Answered step by step

Verified Expert Solution

Question

1 Approved Answer

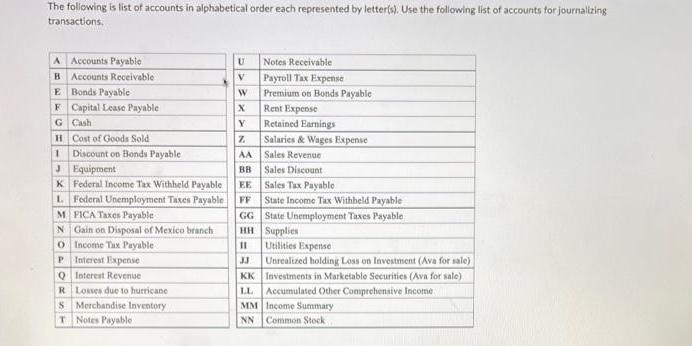

The following is list of accounts in alphabetical order each represented by letter(s). Use the following list of accounts for journalizing transactions. A Accounts

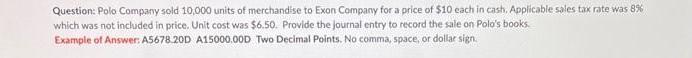

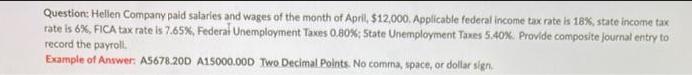

The following is list of accounts in alphabetical order each represented by letter(s). Use the following list of accounts for journalizing transactions. A Accounts Payable B Accounts Receivable E Bonds Payable F Capital Lease Payable G Cash H Cost of Goods Sold 1 Discount on Bonds Payable JEquipment K Federal Income Tax Withheld Payable L. Federal Unemployment Taxes Payable M FICA Taxes Payable N Gain on Disposal of Mexico branch O Income Tax Payable P Interest Expense Q Interest Revenue R Losses due to hurricane S Merchandise Inventory T Notes Payable U V W X Y Z AA BB Sales Discount Sales Tax Payable State Income Tax Withheld Payable GG State Unemployment Taxes Payable HH Supplies 11 33 EE FF Notes Receivable Payroll Tax Expense Premium on Bonds Payable Rent Expense Retained Earnings Salaries & Wages Expense Sales Revenue KK LL Utilities Expense Unrealized holding Loss on Investment (Ava for sale) Investments in Marketable Securities (Ava for sale) Accumulated Other Comprehensive Income MM Income Summary NN Common Stock Question: Polo Company sold 10,000 units of merchandise to Exon Company for a price of $10 each in cash, Applicable sales tax rate was 8% which was not included in price. Unit cost was $6.50. Provide the journal entry to record the sale on Polo's books. Example of Answer: A5678.20D A15000.00D Two Decimal Points. No comma, space, or dollar sign Question: Hellen Company paid salaries and wages of the month of April, $12,000. Applicable federal income tax rate is 18%, state income tax rate is 6%, FICA tax rate is 7.65%, Federal Unemployment Taxes 0.80%; State Unemployment Taxes 5.40%. Provide composite journal entry to record the payroll. Example of Answer: A5678.200 A15000.000 Two Decimal Points. No comma, space, or dollar sign.

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

The journal entry to record the sale on Polo Companys books Account Debit Credit AA Sales Revenue 10000000 G Cash 10000000 EE Sales Tax Payable 640000 S Merchandise Inventory 6500000 CC Cost of Goods Sold 6500000 AA Sales Revenue 10 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started