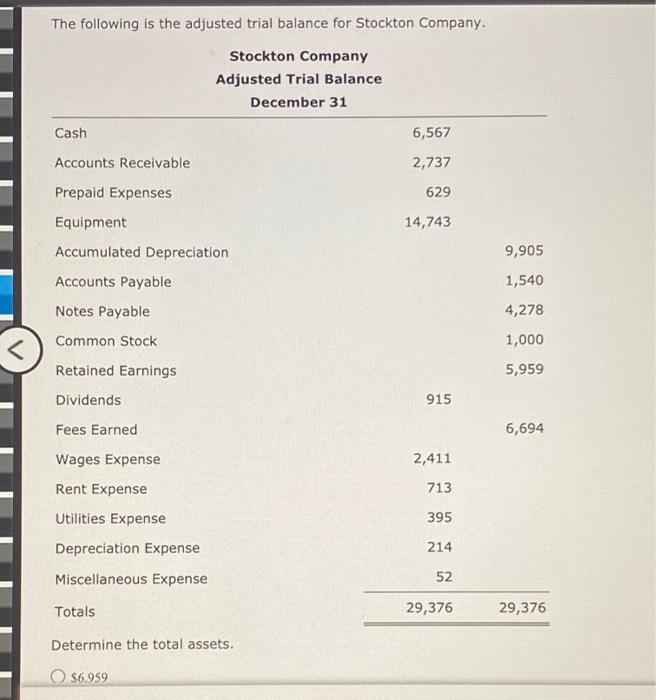

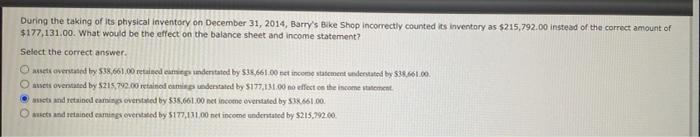

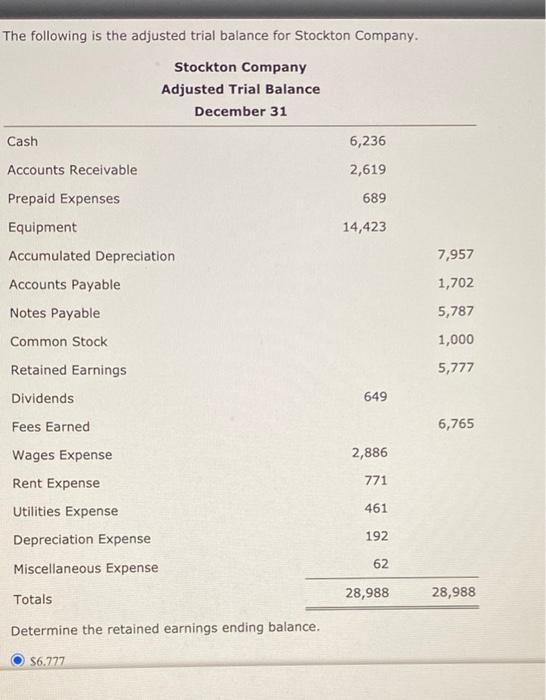

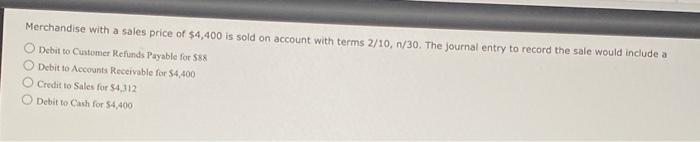

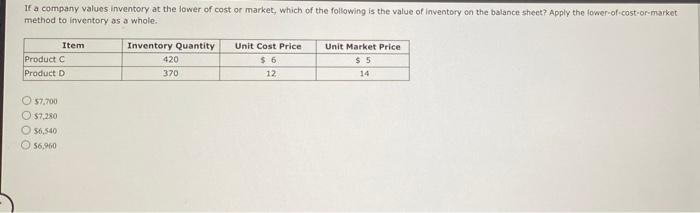

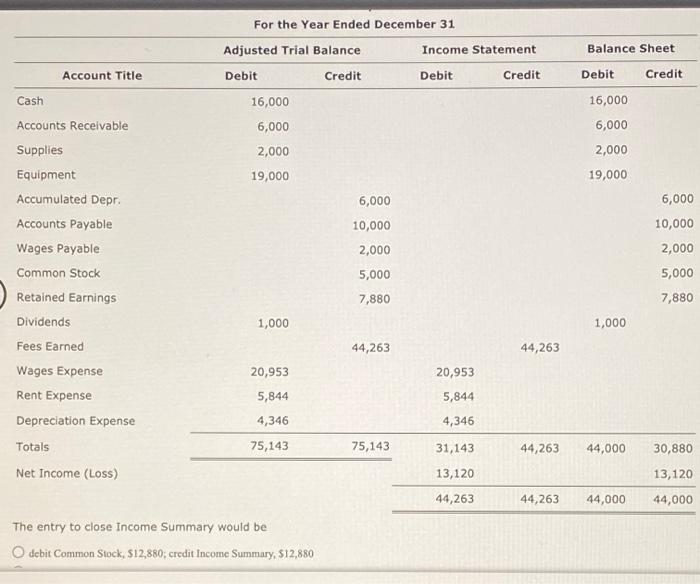

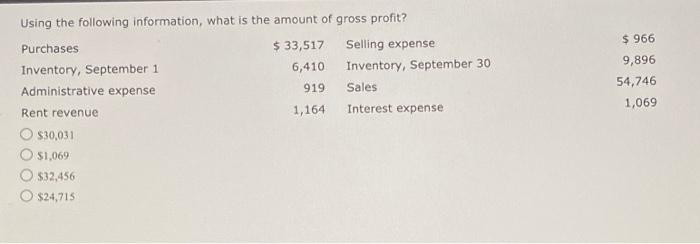

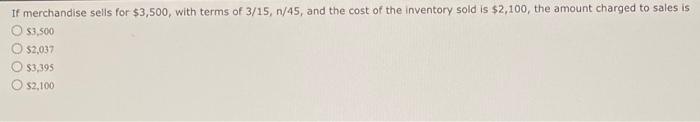

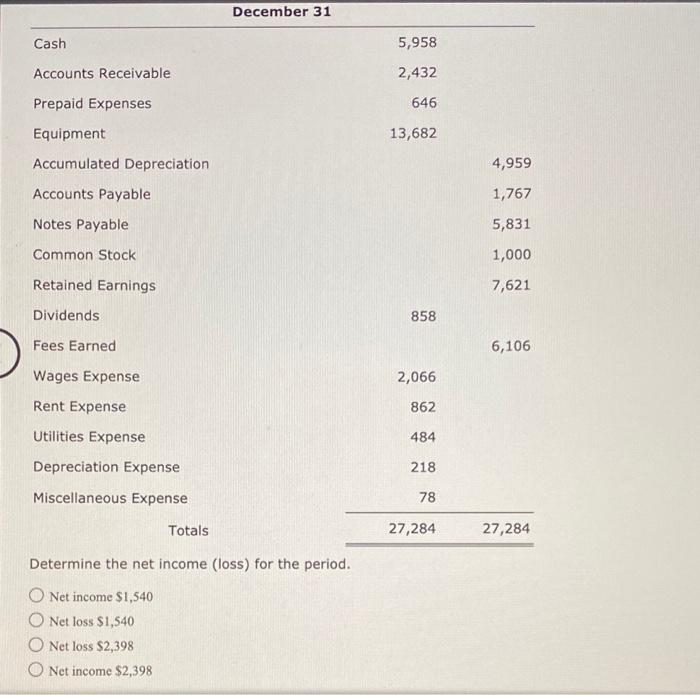

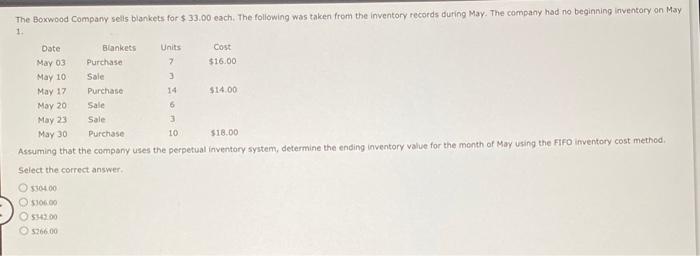

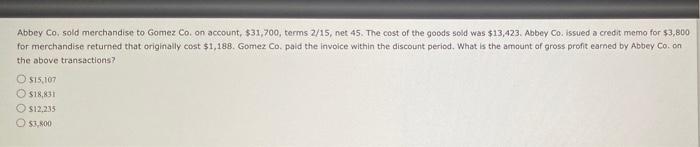

The following is the adjusted trial balance for Stockton Company. Stockton Company Adjusted Trial Balance December 31 Cash 6,567 Accounts Receivable 2,737 Prepaid Expenses 629 14,743 Equipment Accumulated Depreciation 9,905 Accounts Payable 1,540 4,278 Notes Payable Common Stock Retained Earnings 1,000 5,959 Dividends 915 6,694 Fees Earned Wages Expense 2,411 Rent Expense 713 Utilities Expense 395 Depreciation Expense 214 Miscellaneous Expense 52 Totals 29,376 29,376 Determine the total assets. O $6.959 During the taking of its physical inventory on December 31, 2014, Barry's Bike Shop incorrectly counted its inventory as $215,792.00 instead of the correct amount of $177,131.00. What would be the effect on the balance sheet and income statement? Select the correct answer net vented by 538,661.00 retained understated by $38.661.00 net income statement understated by 538.661.00 wet overstated by $215,792.00 retained indentated by $177,131.00 no effect on the income statement its and retained caring overed by $35.661.00 ed income overstated by SIX 661.00 iets and retained eaming evented by 5177,03100 net income understated by $215.792.00 The following is the adjusted trial balance for Stockton Company. Stockton Company Adjusted Trial Balance December 31 Cash 6,236 Accounts Receivable 2,619 Prepaid Expenses 689 14,423 Equipment Accumulated Depreciation 7,957 Accounts Payable 1,702 Notes Payable 5,787 Common Stock 1,000 5,777 Retained Earnings Dividends Fees Earned 649 6,765 Wages Expense 2,886 Rent Expense 771 Utilities Expense 461 192 Depreciation Expense Miscellaneous Expense 62 Totals 28,988 28,988 Determine the retained earnings ending balance. 56.777 Merchandise with a sales price of $4,400 is sold on account with terms 2/10, 1/30. The journal entry to record the sale would include a Debit to Customer Refunds Payable for 588 Debit to Accounts Receivable for $4,400 Credit to Sales for 54 312 Debit to Cach for 54,400 If a company values inventory at the lower of cost or market, which of the following is the value of inventory on the balance sheet? Apply the lower-of-cost-or-market method to inventory as a whole. Item Product Product D Inventory Quantity 420 370 Unit Cost Price $6 12 Unit Market Price $ 5 14 57,700 $7.280 56.540 56,960 Balance Sheet Account Title For the Year Ended December 31 Adjusted Trial Balance Income Statement Debit Credit Debit Credit 16,000 6,000 Debit Credit 16,000 6,000 2,000 2,000 19,000 19,000 6,000 6,000 10,000 10,000 2,000 Cash Accounts Receivable Supplies Equipment Accumulated Depr. Accounts Payable Wages Payable Common Stock Retained Earnings Dividends Fees Earned Wages Expense Rent Expense Depreciation Expense Totals Net Income (Loss) 2,000 5,000 7,880 5,000 7,880 1,000 1,000 44,263 44,263 20,953 20,953 5,844 5,844 4,346 4,346 75,143 75,143 31,143 44,263 44,000 30,880 13,120 13,120 44,263 44,263 44,000 44,000 The entry to close Income Summary would be Odebit Common Stock, 512,880; credit fncome Summary, 512,880 $ 966 Using the following information, what is the amount of gross profit? Purchases $ 33,517 Selling expense Inventory, September 1 6,410 Inventory, September 30 Administrative expense 919 Sales Rent revenue 1,164 Interest expense O $30,031 $1,069 $32,456 O $24,715 9,896 54,746 1,069 If merchandise sells for $3,500, with terms of 3/15, n/45, and the cost of the inventory sold is $2,100, the amount charged to sales is $3,500 $2,037 53.395 O $2,100 December 31 Cash 5,958 Accounts Receivable 2,432 646 Prepaid Expenses Equipment 13,682 Accumulated Depreciation 4,959 Accounts Payable 1,767 Notes Payable 5,831 Common Stock 1,000 Retained Earnings 7,621 Dividends 858 Fees Earned 6,106 Wages Expense 2,066 Rent Expense 862 Utilities Expense 484 Depreciation Expense 218 Miscellaneous Expense 78 Totals 27,284 27,284 Determine the net income (loss) for the period. O Net income $1,540 Net loss $1,540 O Net loss $2,398 Net income $2,398 The Boxwood Company sells blankets for $ 33.00 each. The following was taken from the inventory records during May. The company had no beginning inventory on May 1 Date Blankets Units Cost May 03 Purchase 7 $16.00 May 10 Sale 3 May 17 Purchase 14 $14.00 May 20 Sale 5 May 23 Sale 3 May 30 Purchase 10 $18.00 Assuming that the company uses the perpetual inventory system, determine the ending inventory value for the month of May using the FIFO inventory cost method Select the correct answer $34.00 $106.00 554200 5266.00 Abbey Co, sold merchandise to Gomez Co, on account, $31,700, terms 2/15, net 45. The cost of the goods sold was $13,423. Abbey Co. issued a credit memo for $3,800 for merchandise returned that originally cost $1,188. Gomez Co. paid the invoice within the discount period. What is the amount of gross profit earned by Abbey Coon the above transactions? OS15.107 $18,831 S12.235 53.800