Answered step by step

Verified Expert Solution

Question

1 Approved Answer

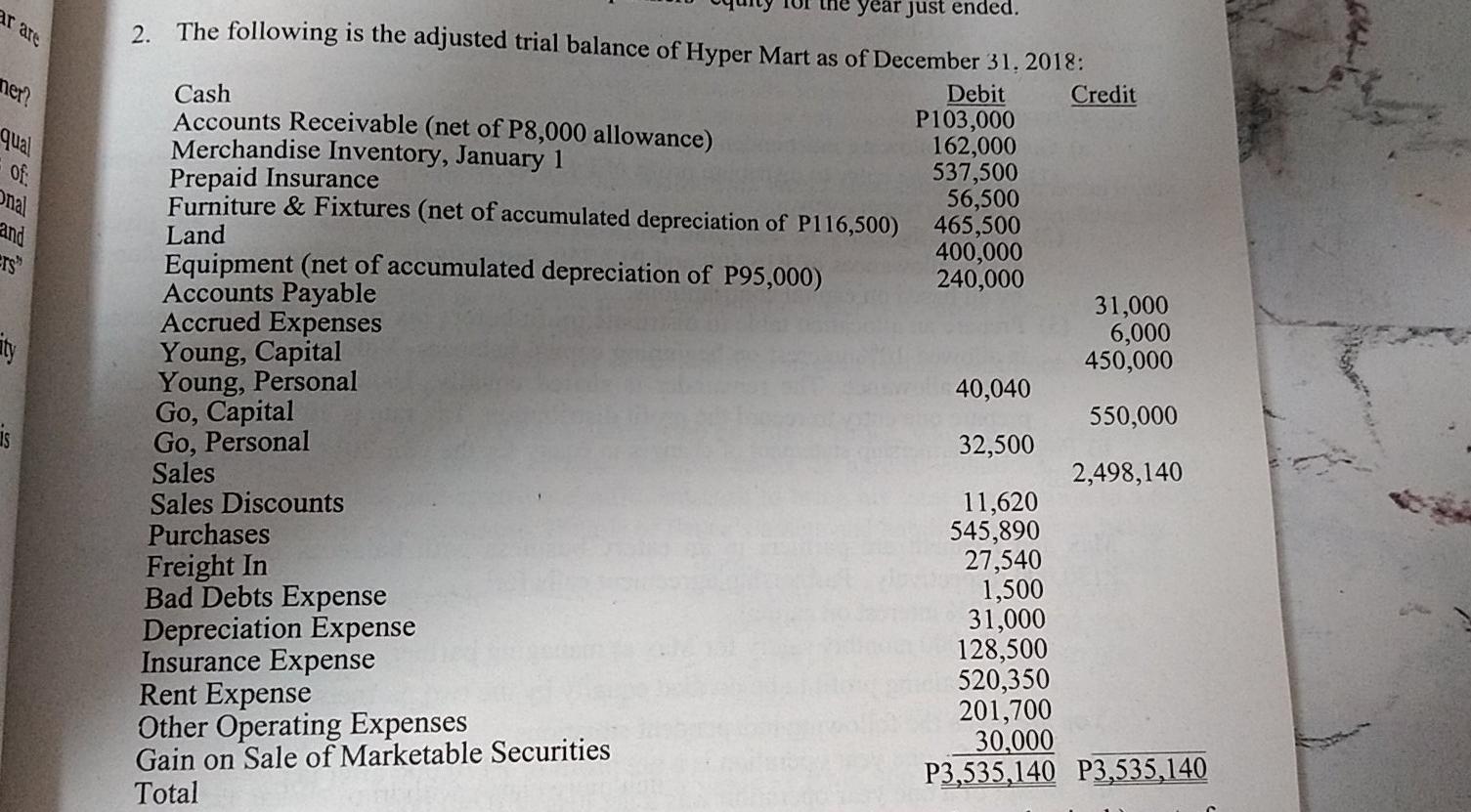

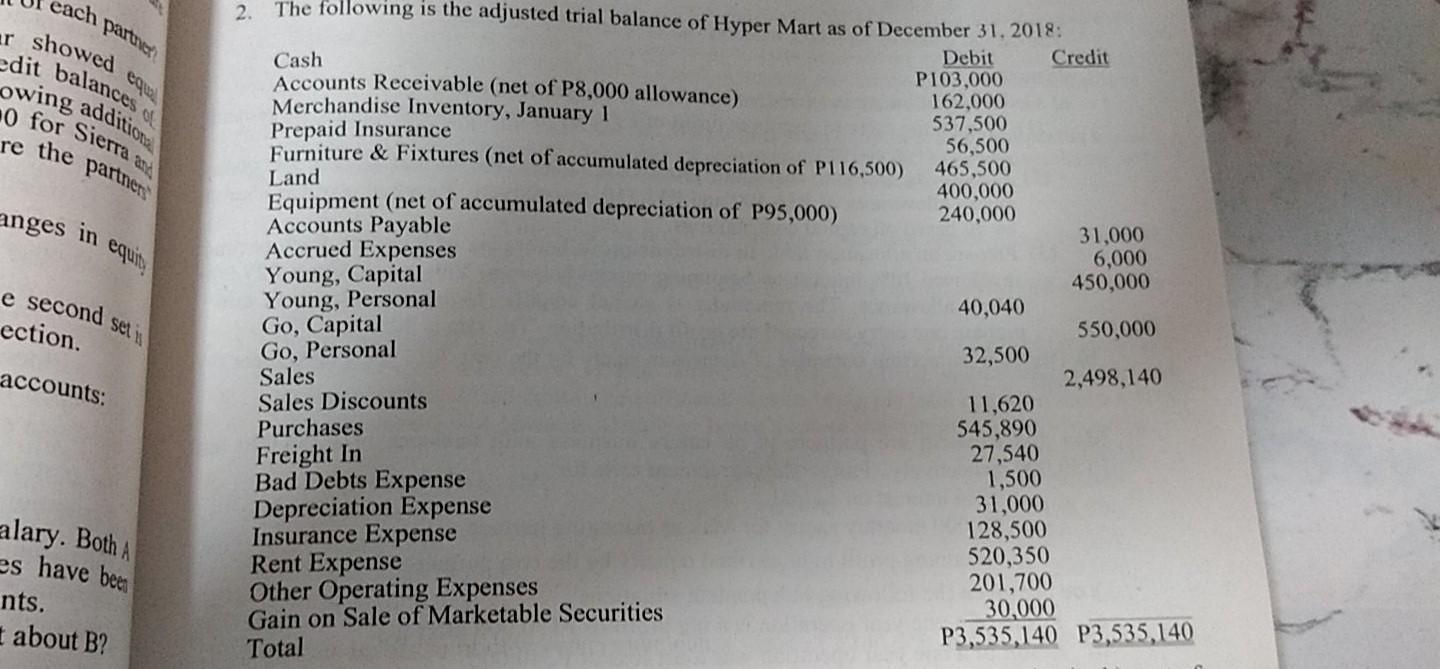

The following is the adjusted trial balance of Hyper Mart as of December 31,2018: Direction: 1. Three entries to close the nominal accounts a) net

The following is the adjusted trial balance of Hyper Mart as of December 31,2018:

Direction: 1. Three entries to close the nominal accounts a) net sales and gain, b) cost of sales with unsold good of P125, 000 at the year end, c) operating expenses. 2. Record 30% tax liability 3. Compute for share of each partner in the profit or loss. 4. Record the distribution of the profit or loss. 5. Prepare a Statement of Changed in Partner's Equity.

Corrections: Gain on Sale of MS is on credit side . Cash should be P 163,000.

ar are ner? qual of Onal and Ers ity year just ended. 2. The following is the adjusted trial balance of Hyper Mart as of December 31, 2018: Cash Debit Credit Accounts Receivable (net of P8,000 allowance) P103,000 Merchandise Inventory, January 1 162,000 Prepaid Insurance 537,500 Furniture & Fixtures (net of accumulated depreciation of P116,500) 56,500 Land 465,500 Equipment (net of accumulated depreciation of P95,000) 400,000 Accounts Payable 240,000 Accrued Expenses 31,000 6,000 Young, Capital 450,000 Young, Personal 40,040 Go, Capital 550,000 Go, Personal 32,500 Sales 2,498,140 Sales Discounts 11,620 Purchases 545,890 Freight In 27,540 Bad Debts Expense 1,500 Depreciation Expense 31,000 Insurance Expense 128,500 Rent Expense 520,350 201,700 Other Operating Expenses 30,000 Gain on Sale of Marketable Securities Total P3,535,140 P3,535,140 is 0 for Sierra 24 each partner r showed dit balances owing addition re the partner anges in equit: set e second ection. accounts: 2. The following is the adjusted trial balance of Hyper Mart as of December 31, 2018: Cash Debit Credit Accounts Receivable (net of P8,000 allowance) P103,000 Merchandise Inventory, January 1 162,000 Prepaid Insurance 537,500 Furniture & Fixtures (net of accumulated depreciation of P116,500) 56,500 Land 465,500 Equipment (net of accumulated depreciation of P95,000) 400,000 Accounts Payable 240,000 Accrued Expenses 31,000 6,000 Young, Capital 450,000 Young, Personal 40,040 Go, Capital 550,000 Go, Personal 32,500 Sales 2,498,140 Sales Discounts 11,620 Purchases 545,890 Freight In 27,540 Bad Debts Expense 1,500 Depreciation Expense 31,000 Insurance Expense 128,500 Rent Expense 520,350 Other Operating Expenses 201,700 Gain on Sale of Marketable Securities 30,000 Total P3,535,140 P3,535,140 alary. Both A es have been nts. about BStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started